The gas armageddon doesn't look likely to leave Europe anytime soon, with its effects trickling into related markets. Brent crude updated three-year highs on the spot market on Monday morning, and futures markets already took those highs on Friday. Investors expect energy costs to remain elevated in the coming months or even quarters, and the chances are high for continued gains.

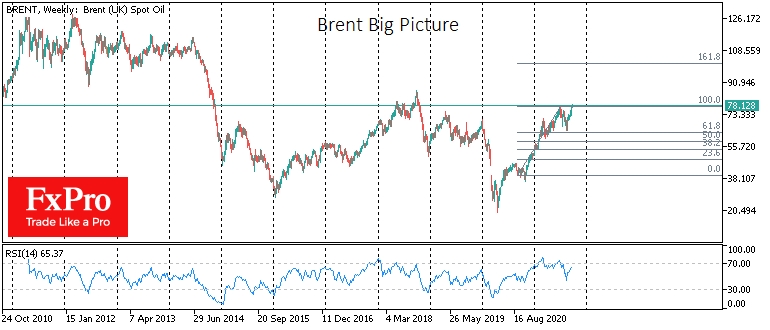

The value of Brent has surpassed $78. This grade traded higher for less than a month from late September 2018 after a drone attack on Saudi Arabian refining capacity. Excluding this man-made force majeure, prices are now at their highest levels since 2014, when oversupply halved the price in less than six months.

Volatility remains a major hallmark of oil prices, so forecasts of a rise to $100-110 by the end of winter do not look unduly bullish. By comparison, gas prices in Europe remain near historic highs and have gained new momentum in recent days.

The cost of coal, the dirtiest fossil energy source, is highest since 2008, as companies are forced to go back to it due to shortages from other sources.

Europe has had very weak winds in the past six weeks, drastically reducing the flow from wind turbines. Some also point to a "Russian footprint," causing inadequate gas supplies by Gazprom (OTC:OGZPY), which has almost no booked extra capacity to supply gas via Ukraine above contract. Europe probably has missed chances to fully fill its gas storage capacity this winter because of the upcoming cold season. However, 100% filling is no more than an additional lay of insurance against force majeure.

Part of the energy storm has been triggered by Europe itself, where major companies such as BP (NYSE:BP), Shell (NYSE:RDSa), Enel (OTC:ENLAY) are drastically reducing investments in traditional energy sources and laying off coal in their strategies, followed by oil and, even later, gas.

Praiseworthy long-term plans have triggered short-term secondary effects. In the long-term, energy price hikes will further encourage European policymakers' confidence in the need for broad diversification of energy sources and investment in alternative energy.

However, even a long-term decline in consumption does not mean that oil and gas prices will be low. For the price of oil and gas, the biggest risk is production volumes. A rise in oil prices above $80 and the subsequent move higher will strengthen the proponents' position of more active quota increases and reduce the discipline of the cartel agreements, as already happened in 2018 and 2014.

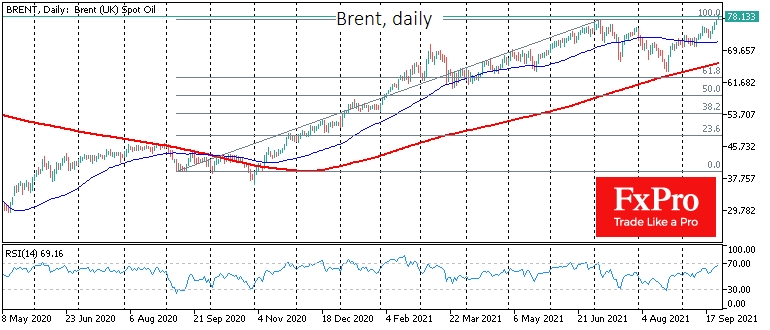

From a speculative point of view, oil has room to rise as the bulls recharged their guns during the July-August correction. The latest correction has taken about 38% of the rally from lows near $40 in September-October 2020 to highs above $77 in early August 2021. A renewal of the recent highs' points to upside targets of 161% from the rally mentioned above to levels near $100.