A bearish signal behind silver’s recent surge that has accurately predicted market downturns before? Brace yourself for the possibility of a major decline.

In my analysis yesterday, I was forecasting silver prices for July 2023, and basically, this prediction was not bullish. Yes, I am very bullish on silver in the long run, but silver’s recent strength appeared fake as it was not accompanied by significant volume.

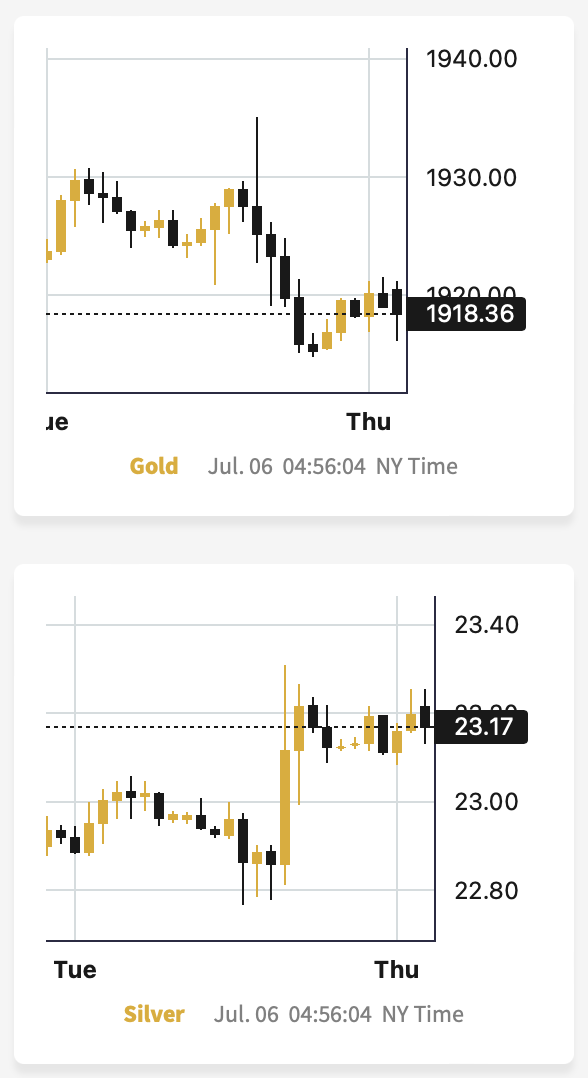

In yesterday’s session, silver did show relative strength compared to gold (chart courtesy of GoldPriceForecast.com)

The problem with this rally in silver is that silver’s very short-term outperformance of gold is a bearish sign – as simple as that. We’ve seen it on multiple occasions, and this signal proved to be reliable. Of course, there are no certainties in any market, but this is one of the more reliable indicators.

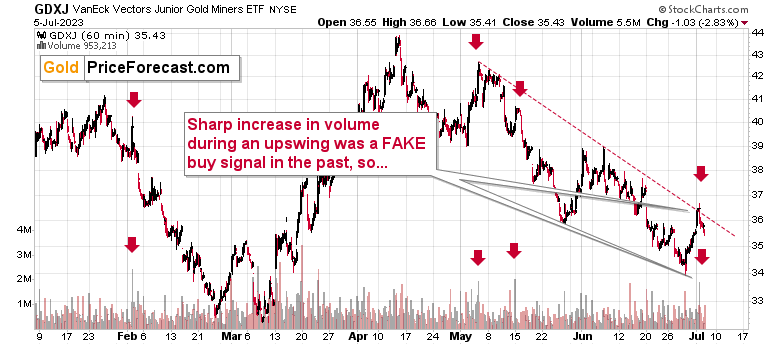

That’s not the only bearish indication that we see right now. If you look at mining stocks’ short-term chart, you’ll see that it just reversed its course after touching its declining resistance line.

That’s not that surprising, given the volume readings that I had mentioned previously. I emphasized that sharp upswings that were accompanied by huge volume spikes in hourly terms (the above chart is based on hourly candlesticks) preceded bigger declines in all three out of three recent cases.

Therefore, the recent rally – as I had written – was not bullish but rather a regular pause within a bigger decline.

In fact, please note that those sharp high-hourly-volume upswings were followed by really significant short-term declines, so what we saw yesterday is probably small compared to what’s next, even though it was a near 3% decline.

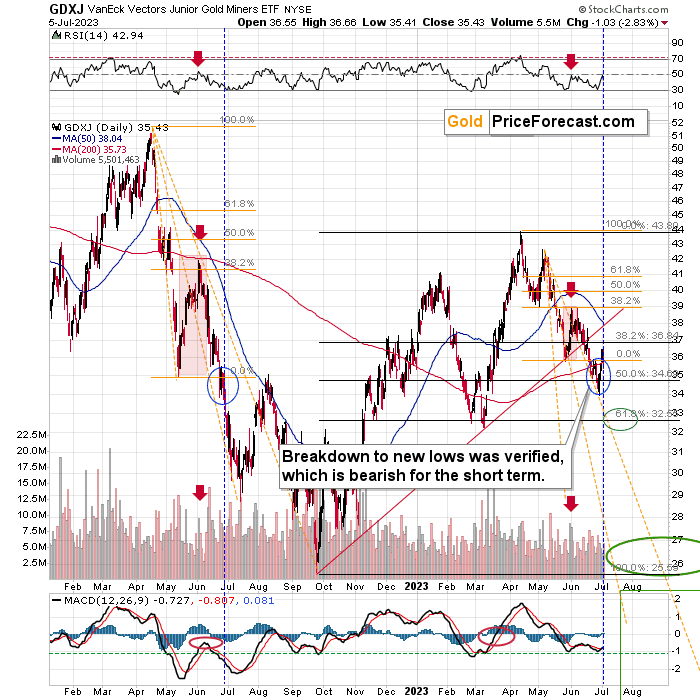

That also makes sense in light of the analogy to what happened last year in June. We saw a very brief rally after RSI moved to the 30 level, but that wasn’t necessarily the end of the decline.

Instead, it was just a comeback after the breakdown below the previous (May 2022 / May 2023) lows. So, are we about to see another sharp decline in the miners? That’s what yesterday’s price action in the GDXJ and silver’s brief outperformance are telling us right now.

All in all, we might see a bigger (possibly tradable – allowing us to cash in profits from the short positions) rebound as early as this (or next) week, but it doesn’t seem like the recent upswing was the start of it.