Oil giant BP plc (LON:BP) (NYSE:BP) announced that it can now estimate its remaining material liabilities in connection with the catastrophic 2010 Deepwater Horizon spill.

The company expects an after-tax non-operating charge of around $2.5 billion, which will be reported in its second-quarter 2016 results. With this, BP is estimated to incur a total cumulative pre-tax charge relating to the incident of $61.6 billion or $44.0 billion after tax. This includes an additional pre-tax non-operating charge of $5.2 billion relating to the spill.

The company mentioned that any additional outstanding claims related to the incident, which have not been covered within the aforesaid charge, will not have a substantial impact on its financial performance. The company intends to manage the remaining claims in the ordinary course of business.

In sync with the financial framework laid out in the previous quarters, BP plans to continue using funds generated from divestments to fulfill the commitments pertaining to Deepwater Horizon.

The aforesaid charge is inclusive of cost of settling all outstanding business and economic loss claims under the 2012 Plaintiffs’ Steering Committee (PSC) settlement. All the payments are expected to be made by 2019.

A year ago, BP agreed to settle the remaining federal, state and local government claims associated with Deepwater Horizon. BP has progressed significantly with the matter since then.

In Feb 2016, the U.S. federal district court assessed that there were over 85,000 valid opt-out and excluded economic loss plaintiffs. Most these claims have already been settled or dismissed as an order of the court confirmed. The aforesaid charge to be paid by BP includes an estimate of the cost of these remaining claims, which will likely be paid by the end of 2016.

In June, BP announced a $175 million settlement of claims from a class of post-explosion ADS purchasers in the MDL 2185 securities litigation. These claims are payable during 2016–2017. This company added that this cost is also included in the above mentioned charge.

In Oct 2015, the U.S. and five Gulf states reached a $20.8 billion civil claims settlement with BP regarding Deepwater Horizon. Notably, this is the largest settlement with a single entity in the DOJ history.

In Jul 2015, BP agreed to shell out a $18.7 billion settlement to federal, state, five Gulf Coast states including Alabama, Florida, Louisiana, Mississippi, and Texas, and more than 400 local government entities. The payment was to be made over an 18-year period.

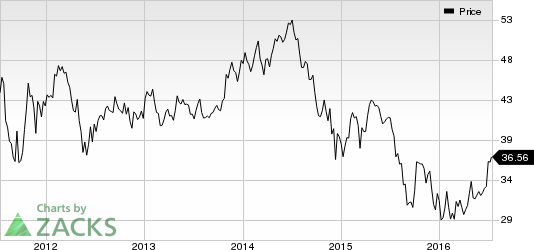

Currently, BP carries a Zacks Rank #2 (Buy). Other well-ranked players from the energy sector are Chevron Corp (NYSE:CVX) , Murphy USA Inc. (NYSE:MUSA) and ReneSola Ltd. (NYSE:SOL) . All of these stocks sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

MURPHY USA INC (MUSA): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

RENESOLA LT-ADR (SOL): Free Stock Analysis Report

Original post

Zacks Investment Research