: Japan's cash-strapped government is turning to wildly popular music group AKB48 to help it sell government bonds, as interest in the low-yield paper wanes, reports said Friday.

The all-female pop group will headline a summer campaign for "reconstruction bonds" aimed at financing projects in regions hammered by last year's quake-tsunami disaster, the Wall Street Journal said, citing an unnamed source.

AKB48, one of the world's highest-grossing acts with more than $200 million in CD and DVD sales last year, are a phenomenon in Japan and across Asia, with members appearing in commercials for everything from chocolate to mobile phones.

The debt campaign will see AKB48 -- comprising about 90 performers, ranging in age from early teens to mid-20s -- joined by sumo wrestling's champion Hakuho and female football star Homare Sawa, Japan's Jiji press agency reported. See a more "colorful" version of this story from the Telegraph.

Buying government paper is being portrayed as a patriotic thing to do. These types of campaigns to push JGBs to Japan's population have been common in recent years. But with some 95% of bonds owned domestically and a rapidly aging population, selling long-term paper at yields of 90bp will become increasingly difficult - no matter how many girl bands or sumo wrestlers the government hires.

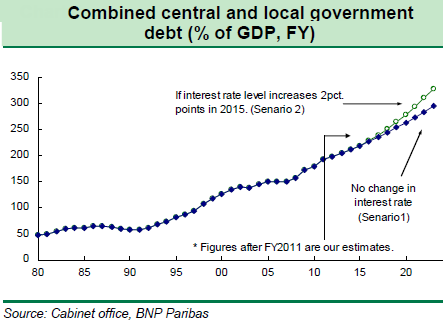

Some would argue that the central bank (BoJ) with its unlimited supply of yen can always step in and buy the government's massive amounts of rolling and new debt. That is Japan's Debt to GDP ratio can grow indefinitely. The rating agencies have simply been wrong to sound the alarm. And because Japan has been in a deflationary environment, printing more yen will do the nation some good.

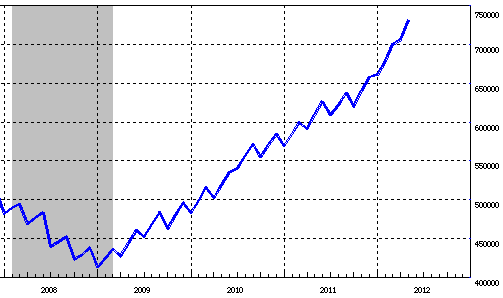

In fact BoJ has been doing just that. The central bank has been engaged in a "perpetual QE" since the 2008 financial crisis. And that program has been accelerated this year, keeping long-term rates low.

Apparently that's not enough, as the governmental needs to sell more paper - above and beyond what the central bank, insurance firms, banks, pensions, and corporations have been buying. Clearly there is the reconstruction effort, after which the needs to sell large amounts of JGBs should subside.

Or maybe not. Debt to GDP ratio is expected to continue climbing at its current pace, exceeding 250% within the next few years. And that's assuming no change in interest rates. Should rates increase, the ratio's growth will begin to accelerate because the government would need to cover ever larger interest expenses.

But for now BoJ will simply buy whatever the amounts the girl band campaigns are unable to sell. Deflation will be tamed, the yen will be weakened, the debt to GDP ratio growth will be ignored, and all will be well...

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

BOJ Will Buy The JGBs That Girl Bands And Sumo Wrestlers Haven't Sold

Published 05/27/2012, 12:30 AM

Updated 07/09/2023, 06:31 AM

BOJ Will Buy The JGBs That Girl Bands And Sumo Wrestlers Haven't Sold

AFP

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.