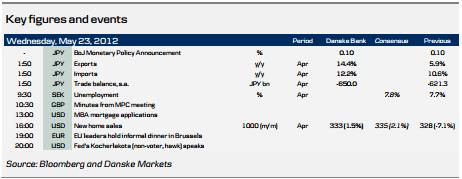

- BoJ keeps monetary policy unchanged.

- Rising concerns about Greece leaving the euro once again weigh on sentiment as former Greek President Papademos said that “Greece is considering preparations to leave the euro”.

- Germany to launch 2-year bond today with zero coupon.

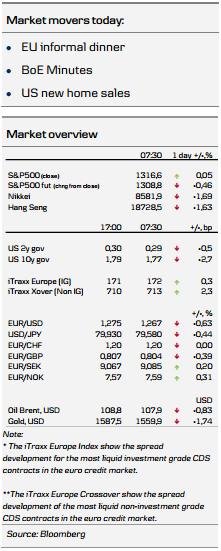

Markets Overnight

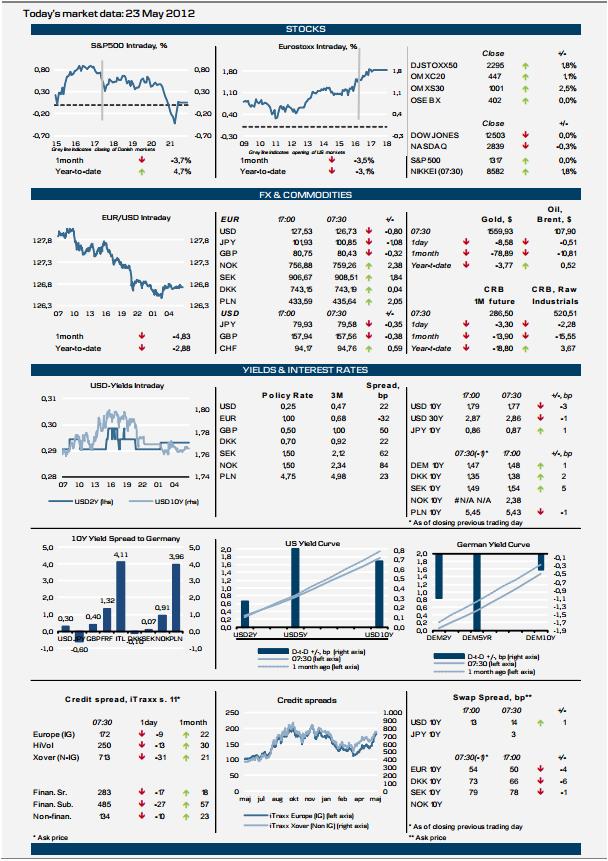

European equities rallied the most in a month, up approximately 2%, boosted by hopes that the EU today will announce new growth measures and that China will speed up infrastructure projects and in general boost the economy. The positive sentiment was initially carried over to the US fuelled by stronger-than-expected new home sales but in the last hour gains were erased and the market ended the day flat. Sentiment turned sour as former Greek President Papademos said that “Greece is considering preparations to leave the euro," and warned that if Greece defaults and exits the euro, “the consequences for the financial system and the real economy will be profound and far-reaching.” Adding to the worsening sentiment was yet another dreadful day for Facebook. The stock dropped 8.9% on its third day and is now down 19% since going public.

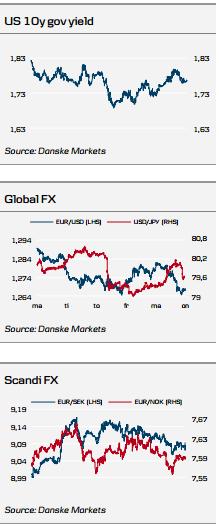

Bank of Japan this morning said that it will not add further monetary stimuli after it stepped up its asset purchase programme last month. Even though the announcement was expected it has pushed USD/JPY down to 79.53 after the cross has been trading above 80 ahead of the announcement. If the current turmoil continues it is quite likely that BoJ will

add further stimuli in July when new inflation forecasts are expected to show little progress in fighting inflation. Yesterday OECD warned that Japanese debt is heading into uncharted territory and Fitch cut Japan's foreign currency level by two notches to A+.

Otherwise the news flow has been dominated by comments and speculations ahead of today's EU summit. One of the key issues is whether the eurozone should introduce eurobonds as proposed by newly elected French President Hollande but once again German Chancellor Merkel has clearly been dismissing the calls and there are few signs that she is softening her stance. In our view it is quite likely that the meeting will turn out to be a disappointment and it will underline that there is no easy way out. No major landmark decisions are expected to be taken.

The concerns about the euro debt crisis continue to weigh on the euro and EUR/USD has been trading below 1.2650 - the lowest level since 13 January. We expect the downward pressure on the euro to continue ahead of the 17 June election in Greece. The negative sentiment also weighed on Asian stocks and Nikkei is down 1.4% this morning. Equity futures point to a negative European opening. In the fixed income market US Treasurys reversed losses as sentiment turned sour and we should expect the Bund future to open higher this morning.

Global Daily

Focus Today:News from the informal EU meeting held today will be the centre of attention. The meeting is likely to add some colour to the growth measures discussed but any concrete decisions have to wait until the 28 June regular EU summit. Otherwise, the calendar is dominated by UK and US data releases. Minutes from the Bank of England meeting and UK retail sales are due today. Later in the day the scheduled round of US data is likely to add to the string of positive releases on the housing market. The FHFA measure of home prices is likely to show a moderate increase in March and new home sales are expected to post a rebound in April.

Fixed Income Markets: The markets have turned slightly more positive ahead of the EU summit as they usually do when expectations are built on what politicians will deliver. As no concrete decisions will be made, the market sentiment is likely to worsen, sending US and German bond yields lower again. A call for more monetary stimuli around the globe appears to have gained some traction over the past few days. IMF is calling for Bank of England to ease, OECD is calling for more ECB stimuli. In emerging markets there has been announced easing in Brazil, in Russia the central bank has indicated that it stands ready to expands its balance sheet to support banks and yesterday there were stories about China considering launching big policy changes over the summer.

A move towards more monetary easing would be significant and it is one of the triggers we are looking for to unnerve the markets and unleash growth. However, one should keep in mind that the ECB and People's Bank of China are rarely ahead of the curve; hence we expect further worsening of the sentiment before these central banks act. Today Germany is launching a new two-year bond, which for the first time in history has a coupon of 0%. Up to EUR5bn will be issued. Further, Germany will issue nine-year inflation linked bonds of up to EUR1.5bn.

FX Markets: The euro is expected to stay under pressure today ahead of the EU summit later today and as no major landmark decisions are expected to be taken, we believe that the market will continue to trade on the risk of Greece leaving the euro, putting downward pressure on EUR/USD, EUR/GBP and EUR/JPY.

The pressure on the euro is also visible in EUR/DKK that is now trading close to the lowest level since 2004 and below the levels that triggered intervention and subsequent rate cuts in 2011. As we continue to expect the "reaction function" of the Danish central bank to stay broadly unchanged (intervention followed by interest rate changes), the likelihood of an independent Danish rate cut over the next month or two has once again gone up.

We also recommend keeping an eye on BoE minutes and UK retail sales to see if the latest sterling support is sustainable. Both numbers have the potential to move sterling.

Both NOK and SEK continue to have a hard time performing in this negative environment and the recent gains are at risk of reversing today. That said, note the very strong GDP numbers out of Norway yesterday and the possibility that Swedish labour market data will stay strong, adding support to SEK.

Scandi Daily

Denmark And Norway:No key data releases today

Sweden: April labour market data may have some impact on the market. Last month the unemployment rate turned out considerably lower than expected at 7.7% nsa. The surprising decline was at odds with the usual seasonal pattern. Hence, there may be a slight upside risk to the April outcome, which is projected by the market to rise to 7.8%. Should, however, unemployment turn out lower than expected again, it appears as if the underlying fundamentals reveal a stronger trend than we have been anticipating. As the market is pricing a quite high probability (70%) of a rate cut in July, a low outcome may put upward pressure on money market rates, which have dropped on the back of European debt turmoil. Riksbank's Deputy Governor Wickman-Parak will hold a presentation on the economic outlook and monetary policy at 16:30 CET. We doubt it will contain any news.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.