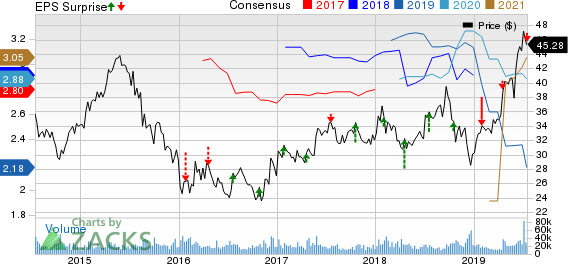

Blackstone (NYSE:BX) has reported second-quarter 2019 distributable earnings of 57 cents, beating the Zacks Consensus Estimate of 50 cents. Moreover, the figure reflects improvement from 56 cents earned in the prior-year quarter.

Shares of Blackstone gained nearly 2.3% in pre-market trading, indicating that investors have taken the results in their stride. However, the full day’s trading will depict a better picture of the actual price performance.

Results benefited from growth in assets under management (AUM) and lower expenses. However, a decline in revenues acted as a headwind.

Net income attributable to Blackstone was $305.8 million, down from $742 million in the year-ago quarter.

Revenues & Costs Decline, AUM Improves

Total segment revenues for the reported quarter were $1.32 billion, down nearly 1.3% year over year. However, the top line surpassed the Zacks Consensus Estimate of $1.23 billion.

Total revenues on a GAAP basis declined 43.5% year over year to $1.49 billion.

Total expenses (GAAP basis) decreased 15.2% year over year to $862.2 million due to a fall in total compensation and benefits costs, and fund expenses.

Fee-earning AUM grew 16.5% year over year to $387.86 billion. Total AUM amounted to $545.48 billion as of Jun 30, 2019, up 24.1% year over year. The rise in total AUM was largely driven by $45.1 billion of inflows, partially offset by $10.6 billion of realizations.

As of Jun 30, 2019, Blackstone had $4.8 billion in total cash, cash equivalents and corporate treasury investments, and $10.7 billion in cash and net investments.

Share Repurchase Update

The company repurchased 7 million shares in the reported quarter. Notably, it increased the share repurchase authorization to $1 billion.

Our Viewpoint

Blackstone delivered decent performance in the second quarter. Its conversion from a publicly traded partnership to a corporation is expected to help in attracting more investors for its stock. Moreover, growth in AUM, driven by inflows, is expected to aid the top line in the near term. However, the company's high dependence on management and advisory fees can affect financials in the near term.

Currently, Blackstone carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Release Dates of Other Asset Managers

BlackRock (NYSE:BLK) is slated to release second-quarter results on Jul 19. Federated Investors, Inc. (NYSE:FII) and Invesco (NYSE:IVZ) are scheduled to report quarterly numbers on Jul 25.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

BlackRock, Inc. (BLK): Free Stock Analysis Report

Federated Investors, Inc. (FII): Free Stock Analysis Report

Invesco Ltd. (IVZ): Free Stock Analysis Report

Blackstone Group Inc/The (BX): Free Stock Analysis Report

Original post

Zacks Investment Research