BlackRock (NYSE:BLK) Latin American Investment Trust (LON:BRLA)(BRLA) is managed by Ed Kuczma and Sam Vecht. The managers are constructive on the outlook for Latin American equities, believing the favourable interest rate environment is supportive for consumption growth. They seek high-quality businesses that are able to grow earnings and cash flows over the economic cycle. The managers have reduced the trust’s cyclical exposure, focusing more on companies with internal growth drivers and attractive dividend yields. Following the adoption of a new, higher dividend policy in FY18, BRLA currently offers a c 6% dividend yield.

The market opportunity

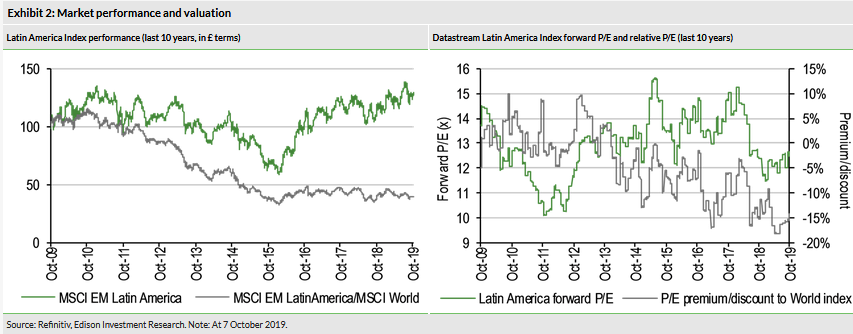

Latin American equities look more attractively valued versus the world market compared to their 10-year average. While 2019 economic growth estimates for the region have been revised lower, partly due to the US-China trade dispute, there is potential for higher growth in coming quarters. Brazil is the dominant economy in Latin America and its interest rates are at record lows, which should be very supportive of future consumption growth.

Why consider investing in BRLA?

Highly experienced co-managers, who are able to draw on the broad resources of BlackRock’s investment teams.

Relatively concentrated portfolio of Latin American equities, diversified by geography and sector (45 stocks, down from c 55 a year ago).

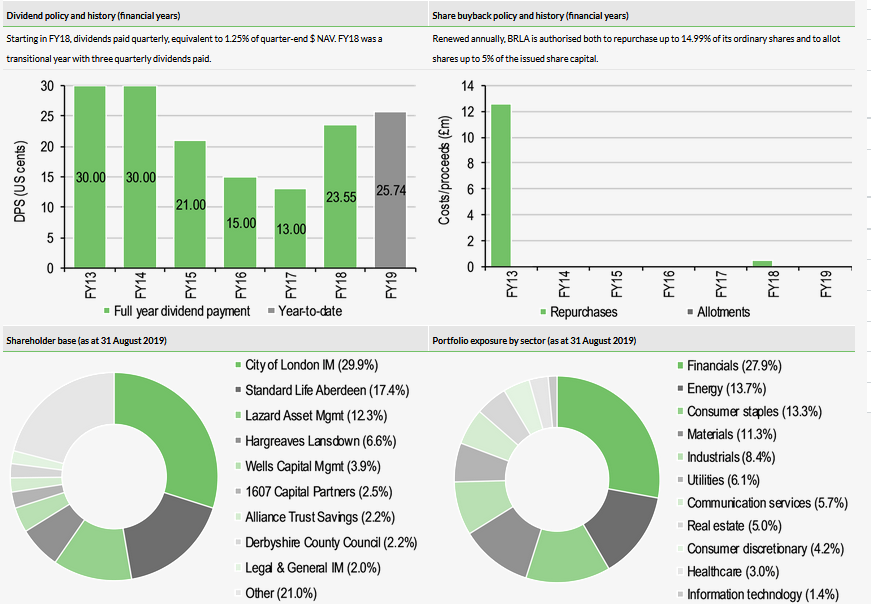

Regular quarterly dividends equivalent to 1.25% of $ NAV at the end of each calendar quarter; attractive c 6% dividend yield.

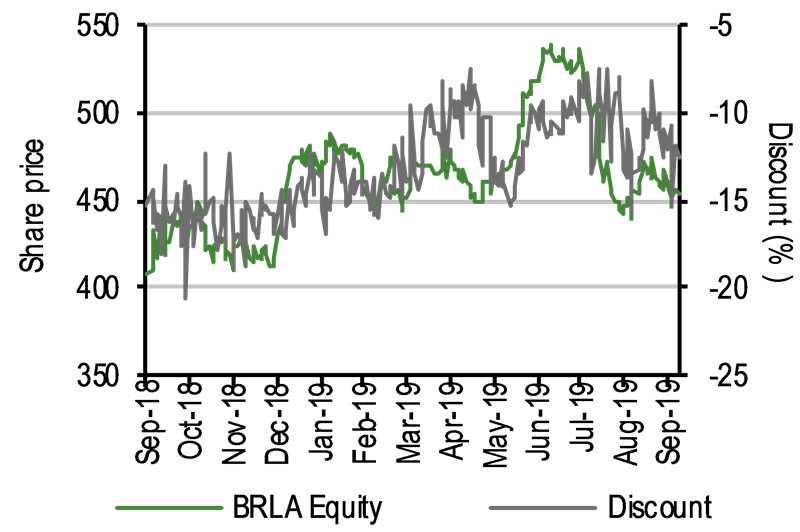

Discount narrower under new managers

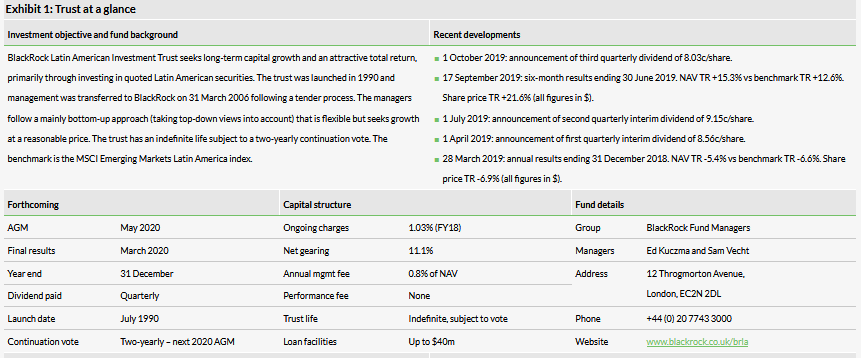

BRLA is currently trading at a 12.5% share price discount to cum-income NAV. This is modestly narrower than the 13.1%, 13.5% and 12.9% average discounts over the last one, three and five years respectively. BRLA has a formulaic dividend policy based on the value of its quarter-end NAV, and currently yields 5.9%.

Share price/discount performance

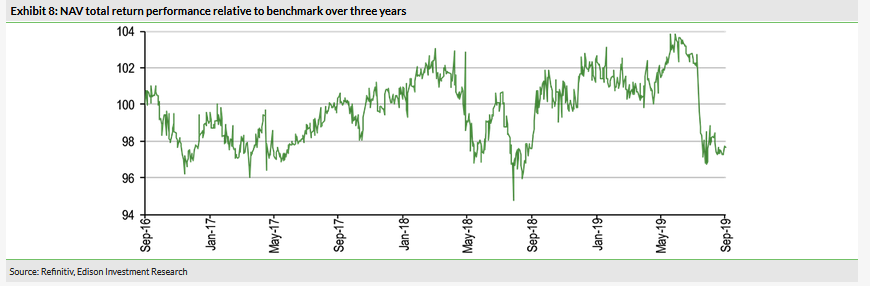

Three-year performance vs index

Exhibit 1: Trust at a glance

Market outlook: Selectivity warranted

While the Latin American equity market can be volatile, as illustrated recently by a major sell-off in Argentina following a surprise outcome in the primary presidential election, there are attractively valued, high-quality investments available in the region.

The Latin American economy is dominated by Brazil and although growth expectations for the country have been reduced over the course of this year, partly due to the US-China trade dispute, the favourable interest rate environment and market-friendly president are supportive of higher GDP growth in the future. In aggregate, Latin American equities are trading at relatively attractive valuations. On a forward P/E multiple basis, the Datastream Latin America Index is trading at a 15.5% discount to the world market, which is a meaningfully wider differential than the 4.5% 10-year average discount. Investors seeking global equity exposure may find this valuation backdrop worthy of consideration.

Fund profile: Exposure to Latin American equities

Launched in July 1990, BRLA has been managed by BlackRock (NYSE:BLK) since March 2006. Its shares are quoted, in sterling, on the Main Market of the London Stock Exchange, while its financial statements are reported, and its NAV quoted, in both US dollars and sterling.

Following the announced departure of former manager Will Landers, since 24 December 2018, BRLA has had two co-managers, Sam Vecht and Ed Kuczma. Vecht is a managing director in BlackRock’s global emerging markets equities team, having joined Merrill Lynch Investment Management in 2000 (which merged with BlackRock (NYSE:BLK) in 2006). He has managed a number of UK investment trusts since 2004, including funds invested in Latin America. Kuczma joined BlackRock in 2015 as a senior research analyst on the Latin America equity team and has more than 15 years’ experience investing in the region across all sectors and countries.

The managers aim to generate long-term capital growth and an attractive total return from a diversified portfolio of companies whose shares are listed, or whose main operations are in, Latin America; fund performance is benchmarked against the MSCI Emerging Markets Latin America Index. The fund’s closed-end structure allows Vecht and Kuczma to have a longer-term investment horizon and hold a higher percentage of smaller-cap/less-liquid names than if they were running a comparable open-ended fund. BRLA’s board views 105% of NAV as a neutral level of gearing, which is utilised actively in a range of 5% net cash to 15% geared (at the time of drawdown). Net gearing should not exceed 25% of NAV in normal market conditions; at end-August 2019 it was 9.5%. Other investment limits dictate that BRLA’s exposure to Brazil, Mexico, Chile, Argentina, Peru, Colombia and Venezuela are each a maximum plus or minus 20pp of the benchmark index weights, while for all other Latin American countries the limit is plus or minus 10pp. At the time of investment, up to 15% of the portfolio may be in a single company; the fund may not hold more than 15% of a company’s market cap; and a maximum 10% of BRLA’s gross assets may be invested in unquoted securities. Derivatives may be used for efficient portfolio management or to reduce risk (covering up to 20% of the portfolio) and currency exposure is unhedged.

The fund managers: Ed Kuczma and Sam Vecht

The manager’s view: Constructive outlook for Latin America

Kuczma is constructive on the outlook for Latin American equities. While acknowledging that the global backdrop is challenging given the ongoing US-China trade dispute, which is negatively affecting the Latin American commodity complex, he cites reasons for optimism. In general, inflation in Latin America is under control, a situation the manager believes should continue in coming months, which should allow central banks to further reduce interest rates to stimulate growth. Kuczma also highlights tight government fiscal budgets in Brazil and Mexico, along with ambitious private sector-backed infrastructure projects, which should have a positive multiplier effect on the Latin American economy. Higher growth expectations should be positively received by investors given forecasts have come down over the course of 2019, heavily influenced by the trade situation.

Offering his observations on the individual Latin American countries, the manager says that in Brazil the most positive development in recent months is pension reform, which is progressing faster than expected, and anticipated cost savings over the next 10 years are also larger than initial forecasts. The smooth passage for pension reform provides momentum for additional reforms, such as tax, telecoms and energy, which would be supportive for the Brazilian and Latin American markets.

Kuczma is also encouraged by privatisation, which can lead to companies being managed much more efficiently. He cites state oil company Petrobras (BRLA’s largest position at c 10% of the portfolio), which is selling non-core operations, such as loss-making refineries and petrol stations, and is undergoing cost-reduction initiatives including headcount reductions and a voluntary redundancy programme. This should allow the company to focus on its core operations of oil and gas exploration and production. The manager explains that Petrobras has undertaken a significant amount of infrastructure capex in recent years, which should afford it good operating leverage and lead to higher returns in the future. He believes that the company is at an inflexion point of having world-class production growth. However, Kuczma notes there are other less encouraging developments in Brazil; the multiple fires in the Amazon (NASDAQ:AMZN) basin are a major geopolitical issue and raise a yellow flag for foreign trade deals for Latin America, including the recent agreement between the European Union and the Mercosur states (Argentina, Brazil, Paraguay and Uruguay).

Regarding Mexico, Kuczma says that following the 2018 presidential election, there were fears about the aggressive social and infrastructure programme versus an austere fiscal balance; president Andrés Manuel López Obrador (AMLO) has promised not to allow the government debt to GDP ratio to rise. There has been a tough transition since the government came to power as new, multiple layers of ministers have led to delays in project approvals, which has affected economic growth; hence, consensus expectations have moved down during 2019. The construction of a new airport in Mexico City has been cancelled by the government in favour of upgrading three smaller facilities, a decision Kuczma suggests is irrational given the current Mexico City airport is operating at full capacity. The manager notes there was a positive development in August as negotiations for an international natural gas pipeline between the US and Mexico resulted in a neutral agreement; it was a sign that AMLO may be less dogmatic towards the private sector than previously thought.

The manager says that recent events in Argentina are concerning. There was a primary election in early August 2019, which once again went against pollsters’ predictions (much like the election of Donald Trump and the outcome of the UK’s European referendum). Kuczma and his team visited Argentina in July this year. The trip included meetings with politicians, with the expectation that the primary election outlook would be a ‘coin toss’. Economic indicators, such as consumer confidence, lower inflation and higher purchasing power, should have provided a tailwind to incumbent conservative president Mauricio Macri in the run-up to the primary election. However, left-wing opposition leader Alberto Fernández achieved a landslide 15pp victory, which led to c 40% slide in Argentina’s equity market in a single day, a magnitude almost unprecedented in global markets over the last 50 years. The primary result has led to much uncertainty, including whether Argentina will continue to receive assistance from the International Monetary Fund if Fernández wins in October’s poll. There is a downward spiral of currency weakness, higher inflation and more economic pain for the economy. In addition, there is now a risk that Argentina will be returned to frontier status, having been promoted to the MSCI Emerging Markets Index in June 2019, which provided a meaningful boost to the domestic equity market.

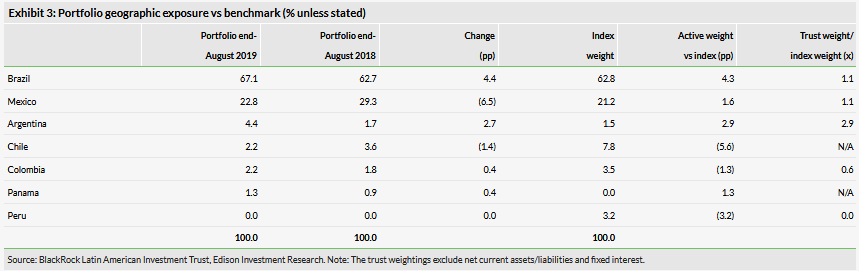

Kuczma says that smaller economies in Latin America are more susceptible to the negative effects of the trade war, as their economies are less diversified. Peru and Chile are dependent on copper mining and economic growth expectations in these countries have come down. BRLA has underweight exposures to both countries, along with Colombia, which is experiencing negative spill-over effects from the Venezuelan crisis.

Asset allocation

Investment process: Primarily bottom-up stock selection

Vecht and Kuczma aim to generate an attractive total return, ahead of the performance of the benchmark MSCI Emerging Markets Latin America Index. The fund is relatively concentrated with 45 names (down from c 55 a year ago), typically companies with mispriced growth potential and/or those whose attributes of sustained value creation are underappreciated by the wider market. The managers seek companies with a quality management team, a good corporate governance track record and a regard for minority shareholders; positive fundamentals in terms of good long-term earnings growth, strong cash flow generation and a robust balance sheet; and an attractive valuation. They are able to draw on the deep resources of BlackRock’s relevant analyst teams, who conduct on-the-ground research, meeting with target companies, their competitors and suppliers, as well as with government officials, central bankers, industry regulators and consultants. Potential investee companies undergo thorough fundamental research, the results of which are considered alongside top-down, macro analysis. The managers invest across the market cap spectrum, with an investible universe of c 250 names compared with c 120 in the index; however, around 70% of the portfolio is in larger-cap companies (>$10bn). Portfolio turnover is typically 40–60% pa (44% in 2018, which was mainly adding to or reducing existing positions).

From a top-down perspective, the managers explain that there are four main drivers (four Cs) to the regional economy to be considered:

Consumption – Kuczma is the most constructive on this driver, especially in Brazil and Mexico. Brazil has seen a dramatic reduction in interest rates from 14.25% two years ago to 6.00% now. He expects further rate reductions as inflation is benign and growth is stagnant. The Mexican government has raised the minimum wage and there are changes in social policies to support the population, while it is focusing on a stable peso to support consumption.

Commodities – this driver is facing headwinds, although the manager remains positive on the outlook for energy stocks due to stock-specific reasons. He has a negative view on iron ore and bulk materials due to lower Chinese growth. There are also regulatory issues in Mexico and Peru, which may mean that it will be more difficult to get projects approved.

Credit – in Brazil, banks are supported by low household and corporate indebtedness. Institutional investors typically buy fixed income securities due to their high yields and relatively low risk. However, with lower interest rates there is increased appetite for equities, which should lead to lower stock market volatility, while supporting equity valuations. The manager also notes that a record number of new accounts have been opened at brokerage firms, indicating increased demand from retail investors.

Currencies – Kuczma believes that better economic growth and pension reform in Brazil should be supportive for the real. However, while the Mexican government is focused on a stable peso, the manager is concerned about the outlook for the Argentine peso given the uncertainty following the recent primary election.

Current portfolio positioning

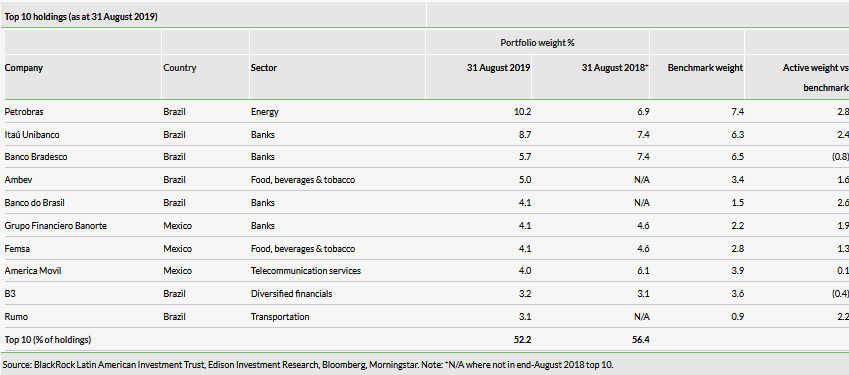

At end-August 2019, BRLA’s top 10 positions made up 52.2% of the portfolio, which was a lower concentration compared with 56.4% a year earlier; seven positions were common to both periods. As shown in Exhibit 3, the Latin American market is dominated by Brazil, where the trust has a modest overweight exposure. Over the 12 months to the end of August, the largest weighting changes are Brazil (+4.4pp) and Mexico (-6.5pp).

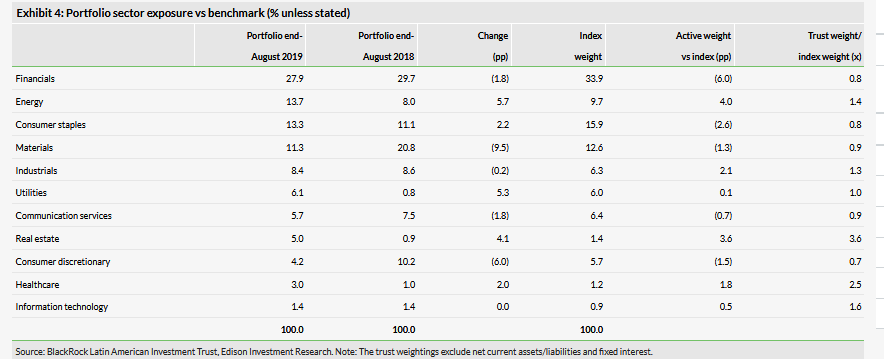

In terms of sector exposure (Exhibit 4), over the 12 months to end-August the largest increases are energy (+5.7pp) and utilities (+5.3pp), which are outweighed by the two largest decreases, materials (-9.5pp) and consumer discretionary (-6.0pp). Looking at active weights, those to note are a positive view on energy (+4.0pp) and real estate (+3.6pp), with an underweight in the largest sector financials (-6.0pp).

Kuczma highlights some of the changes in BRLA’s portfolio in recent months. Purchases include:

Copa – a Panamanian airline that is enjoying strong margin expansion. The company operates in an attractive location; headquartered in Panama City, its main hub is at Tocumen International Airport, with flights connecting North and South America. Copa flies frequently to many underserved markets, which leads to a loyal customer base and pricing power.

Ecopetrol –the national oil company in Colombia. Kuczma describes the company as ‘under-owned, undervalued and unloved’. It has a relatively new CEO who is very energetic about raising the firm’s production profile and making acquisitions to diversify its operations. There is potential for a change in legislation that would allow increased exploration and development of unconventional gas assets, similar to the prolific Permian Basin in the US.

Enel (MI:ENEI) Chile – added to the fund following a period of Chilean market weakness. The manager says that this energy company offers a nice mix of earnings stability, a discounted valuation and an attractive dividend yield. This relatively defensive position is deemed appropriate given the uncertain macro backdrop due to the ongoing US-China trade dispute.

Grupo Aeroportuario del Pacífico (GAP) – a Mexican airport group with a high level of passenger growth. The company’s business model focuses on regional airports, which brings pricing flexibility; it has two low-cost carrier operating hubs in Guadalajara and Tijuana.

Kimberley-Clark de México – this consumer goods company is benefiting from improved wages in Mexico driving demand for products such as disposable nappies and higher-quality toilet paper, which appeal to the emerging middle class. This is a defensive business where margins are improving due to lower pulp prices and the company offers an attractive c 4% dividend yield.

Recent sales include BRF (a Brazilian poultry player that has improved its margins and debt profile; the stock was sold following a revaluation), and Falabella (a Chilean department store that had posted a series of weak retail sales, partly driven by a switch to ecommerce and also due to an influx of Venezuelan refugees who are prepared to take lower-salaried jobs in Chile, which is a drag on purchasing power).

BRLA’s Argentinian exposure has also been reduced, particularly in banks, where there is a risk of higher delinquencies, rising interest rates and lower economic growth. The trust continues to have a position in energy company YPF, which Kuczma considers to be an attractive asset. YPF has the largest asset in the Vaca Muerta shale basin. Kuczma says that regardless of who wins the presidential election, both parties have stated that energy is a priority for development.

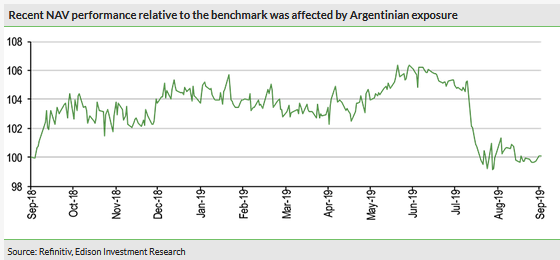

Performance: Recent results affected by Argentina

In H119, BRLA’s NAV and share price total returns of +15.3% and +21.6% were ahead of the benchmark’s +12.6% total return (all figures in $). The top three contributors to returns were all Argentinian stocks, Banco Macro (bank), Globant (technology services) and YPF (energy), whereas the top detractors were Vale (Brazil, mining) and Cemex (Mexico, cement).

Kuczma explains that performance in August 2019 was tough due to the trust’s exposure to Argentina, which was significantly affected by the surprise landslide opposition win in the primary round of the presidential election. However, he highlights continued good performance from the majority of the fund’s Brazilian holdings, helped by favourable reform progress. There is a bias to the consumer, with holdings including ASUR, which is benefiting from increased demand for air travel; Localiza Rent a Car; and exposure to the healthcare sector. In contrast, the position in Brazilian telecom company Oi (formerly known as Telemar) has delivered weaker than expected operating results, as its capex programme to support future growth is a medium-term drain on cash flow, while telecom reform was only recently approved, having previously been expected in Q119.

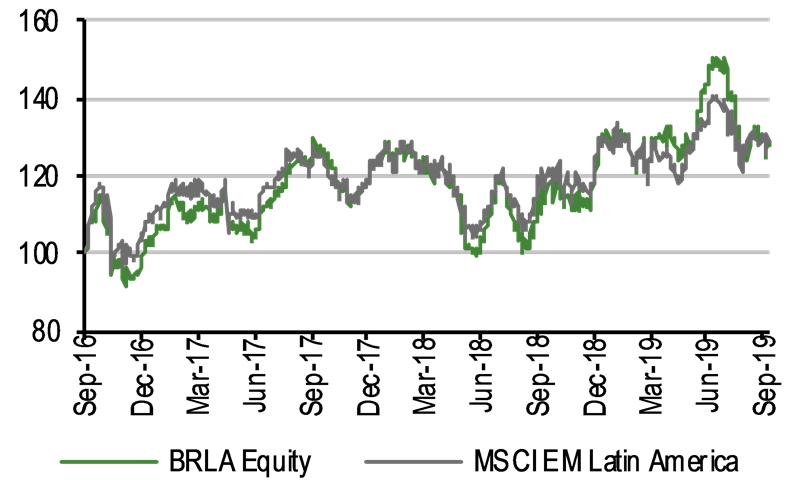

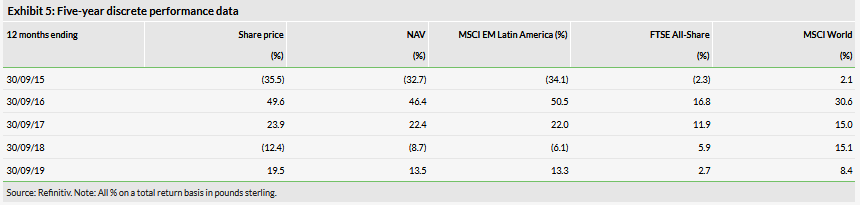

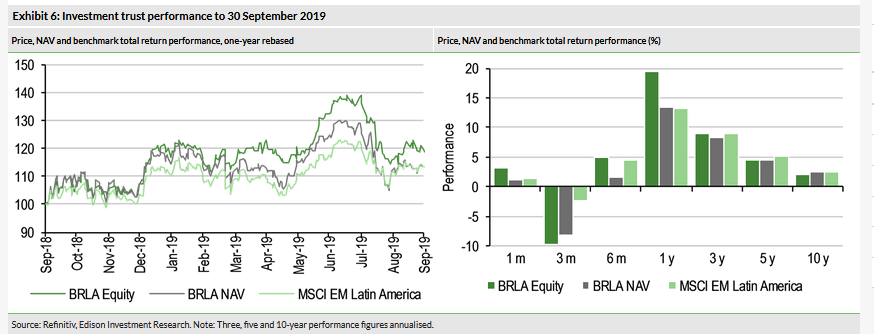

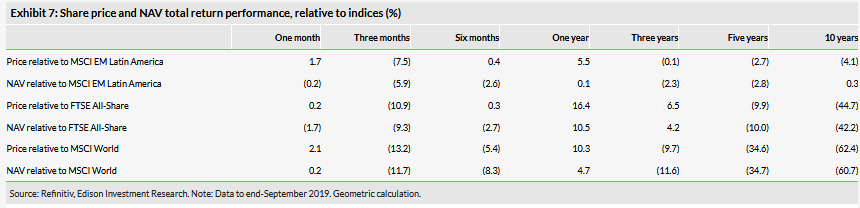

Recent significant Argentinian market weakness affected BRLA’s August 2019 relative returns (see Exhibits 6, 7 and 8). Unfortunately, this has also had a negative impact on the trust’s longer-term track record, although its NAV and share price total returns remain ahead of the benchmark over the last 12 months, and its NAV is modestly outperforming over the last decade.

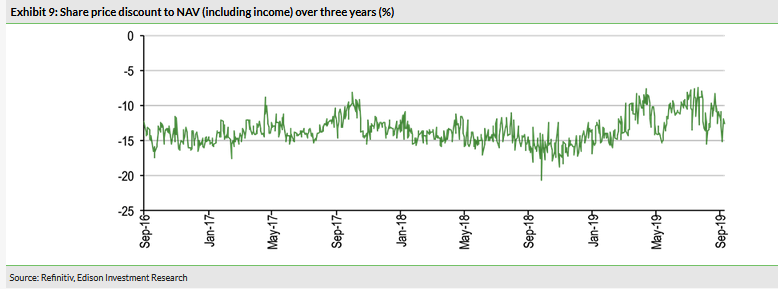

Discount: Much narrower than in Q418

In an effort to reduce BRLA’s discount volatility, the board employs a discount control mechanism. A 24.99% tender will be triggered (subject to the biennial continuation votes in 2020 and 2022 being passed) if the trust underperforms the benchmark by greater than 1% pa over the four years ending on 31 December 2021, or if BRLA’s average share price discount to cum-income NAV exceeds 12% over this period.

The trust’s current 12.5% share price discount to cum-income NAV is modestly narrower than the 12.9% to 13.5% range of average discounts over the last one, three and five years. It is significantly narrower than the 20.6% decade-wide discount that occurred during a period of global stock market weakness in October 2018. Renewed annually, BRLA is authorised to repurchase up to 14.99% of its ordinary shares; in FY18 a modest 110k shares were bought back (c 0.3% of the share base) at an average discount of 12.5%.

Capital structure and fees

BRLA is a conventional investment trust with one class of share; there are 39.3m ordinary shares in issue. The trust has an overdraft facility for up to $40m with Bank of New York Mellon (NYSE:BK); interest is payable at an annual rate of Libor +1%. Gearing is permitted up to 25% of NAV; at end-August 2019, net gearing was 9.5% (the historical range is from a modest net cash position to c 12% geared). BlackRock (NYSE:BLK) is paid an annual management fee of 0.80% of NAV, charged 75% and 25% to the capital and income accounts respectively; no performance fee is payable. In FY18, BRLA’s ongoing charge was 1.03%, which was 8bp below 1.11% in FY17.

The trust is subject to a two-yearly continuation vote; the next is due at the May 2020 AGM.

Dividend policy and record

In FY18, BRLA’s 15.13c per share revenue return was 2.1c higher than 13.03c per share in FY17; this was primarily due to a higher level of special dividends. The managers can also boost portfolio income by writing options, when deemed appropriate. As part of the board’s effort to lower the trust’s discount, it introduced a new dividend policy with effect from July 2018. There is now a regular quarterly dividend equivalent to 1.25% of $ NAV at the end of each calendar quarter, paid in May, August, November and February out of income and/or capital (previously the policy was to pay semi-annual dividends based on the fund’s level of income). The board believes that partial payment out of capital removes pressure on the managers to seek a higher portfolio yield, which may detract from the trust’s total returns. FY18 was a transition year with three interim dividends paid; so far, in FY19, three interim dividends have been declared (Exhibit 1), amounting to 25.74c. In H119, BRLA’s 7.92c per share revenue return was 3.1% higher year-on-year. Based on its current share price, the trust now offers a 5.9% dividend yield.

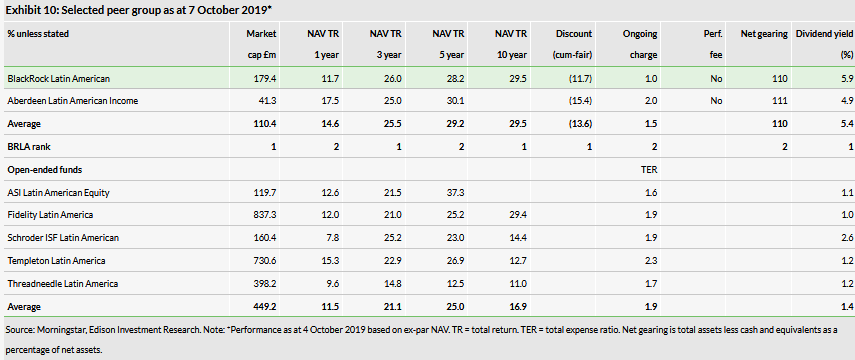

Peer group comparison

BRLA is the larger of two funds in the AIC Latin America sector. It has a higher NAV total return over three years, with lower returns over one and five years; however, a direct comparison cannot be made as c 40% of Aberdeen Latin American Income Fund’s portfolio is invested in government bonds. BRLA has the narrower discount, a more competitive ongoing charge and a broadly similar level of gearing. Both funds offer an attractive dividend yield, but BRLA’s is c 100bp higher. To enable a broader comparison, in Exhibit 10 we also include a selection of open-ended funds that invest in Latin America. BRLA’s NAV total returns are above the average of the open-ended funds over all periods shown.

The board

Following the retirement of Antonio Monteiro de Castro on 31 March 2019, BRLA’s board currently has five directors, all of whom are non-executive and independent of the manager. Chairman Carolan Dobson joined the board on 1 January 2016 and assumed her current role on 2 March 2017. The other four directors and their dates of appointment are: Laurence Whitehead (3 December 2003), Mahrukh Doctor (17 November 2009); Nigel Webber (1 April 2017); and Craig Cleland (1 January 2019). Whitehead announced his intention to step down at the May 2019 AGM after 15 years’ service, but has delayed his retirement until the end of this year to allow more continuity following the appointment of BRLA’s new co-managers in late December 2018. The board is undertaking a search for a new director.