Taking advantage of low prices, large and small investors are "aggressively" increasing their Bitcoin holdings.

Bitcoin posted its worst quarterly loss in more than a decade during the second quarter of 2022. Having lost around 58% of its value, the flagship cryptocurrency has seen the steepest price fall since the third quarter of 2011 when it plunged by more than 65%.

Meanwhile, seemingly taking advantage of low prices, whales are aggressively accumulating Bitcoin.

Bitcoin’s Worst Quarter in 11 Years

Bitcoin started the second quarter of the year trading around $45,000, but finished the quarter at below $19,000, according to data by CoinMarketCap. This represents a drop of around 58%, marking the worst quarterly performance for the leading cryptocurrency since the third quarter of 2011 when it lost more than 65% of its value.

At the time of writing, Bitcoin is trading around $19,200, mostly flat over the past 24 hours. The digital asset is down by around 40% over the past month and by more than 72% compared to its all-time high of $69,000 recorded in November last year.

Bitcoin’s poor performance comes as multiple crises have played out over the past several months. In early May, Terra’s logarithmic stablecoin UST lost its dollar peg which led to the crash of the entire Terra ecosystem, cumulatively erasing more than $40 billion in value from crypto.

The incident sent ripple effects across the entire industry. Last month, crypto lenders Celsius and BlockFi came under increasing scrutiny following the former’s decision to pause withdrawals. Contagion has also spread to other crypto firms, with crypto hedge fund Three Arrows Capital now facing liquidation.

However, it is worth noting that JP Morgan strategists believe the current phase of deleveraging in cryptocurrencies is coming close to an end. According to their net leverage metric, an indicator that assesses the borrowing capacity, “deleveraging is already well advanced,” meaning that the worst is behind crypto. They said:

“The current deleveraging cycle may not be very protracted [given] the fact that crypto entities with the stronger balance sheets are currently stepping in to help contain contagion [and that venture-capital funding], an important source of capital for the crypto ecosystem, continued at a healthy pace in May and June.”

Bitcoin Holders in Accumulation Mode

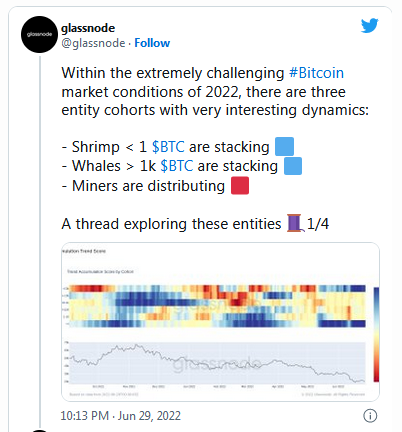

Taking advantage of low prices, investors are increasing their Bitcoin holdings. According to data by crypto intelligence firm Glassnode, both Bitcoin shrimps (those who own less than one BTC) and Bitcoin whales (those who own more than 1,000 BTC) are stacking more BTC.

More specifically, shrimps have been accumulating Bitcoin at the most aggressive rate since March 2020, adding 36,750 BTC per month, which is 0.2% of the circulating supply. These small Bitcoin investors now hold 1.12 million BTC in total, Glassnode said.

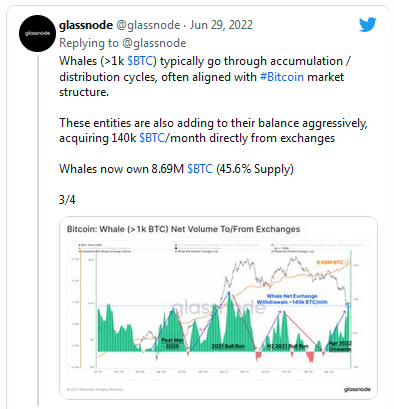

Likewise, whales are adding more Bitcoin to their portfolio aggressively, purchasing 140,000 BTC per month directly from exchanges. These large holders now own 8.69 million BTC or over 45% of the total supply.

On the other hand, Bitcoin miners, who have seen their income drop significantly amid the recent market crash, are in distribution mode, selling between 3,000 to 4,000 BTC per month. As of now, miners hold a total of 65.200 BTC.