Bitcoinis again the focus of mainstream media attention, as the benchmark crypto coin has jumped up 54% in just one month. This is probably what allows BTC to so far avoid a full-scale correction. In addition to institutional investors, demand can also grow among retail buyers. The truth is that BTC attracted the main attention of large investors after the March collapse when it was bought back at $4.5K. However, nobody likes losing stories, and this is what the market is all about. The enthusiasm among the general public begins only when the asset is already at the peak of the bullish cycle.

Of course, the current highs are not final, and Bitcoin is likely to exceed $20K, but a real roller coaster awaits the cryptocurrency along the way. The hypothetical retail investor is now asking only one question: isn't it too late to buy Bitcoin? It is not too late if there is a willingness to take the risk, quietly watching the massive rollbacks, and then taking a relatively small profit and then waiting for some time continued growth. A really good time to buy was back in March when everyone was fearful.

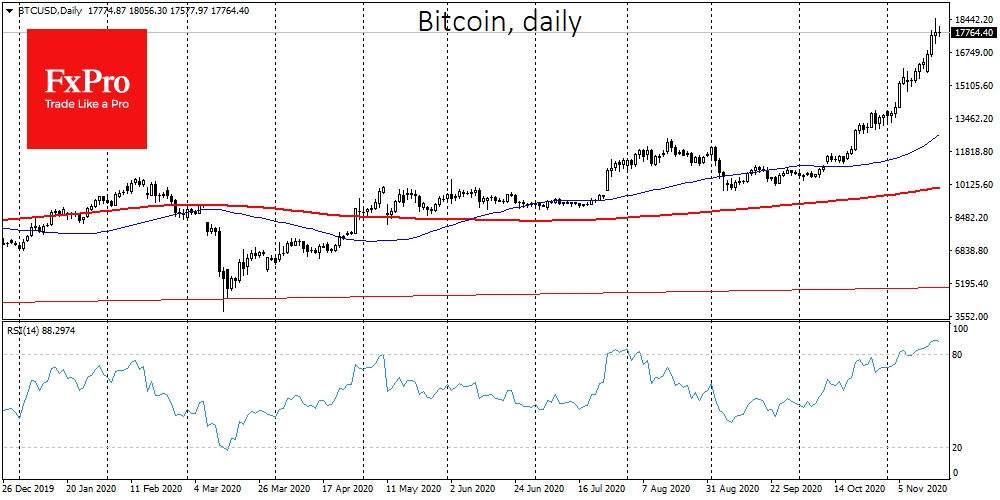

At this point, Bitcoin will have to pass a serious test. The BTC is at a very high price level, with technical indicators showing that it is extremely overbought. Thus, the Crypto Fear & Greed Index for Bitcoin and the largest cryptocurrencies has reached "94", which corresponds to the "extreme greed" mode. Of particular concern is the fact that the indicator was at these maximum values at the end of June 2019, when the crypto market passed the peak of the rally and started the correction. In addition, the RSI index is at its highest levels since June 2019, the last time that there was a prolonged correction after growth.

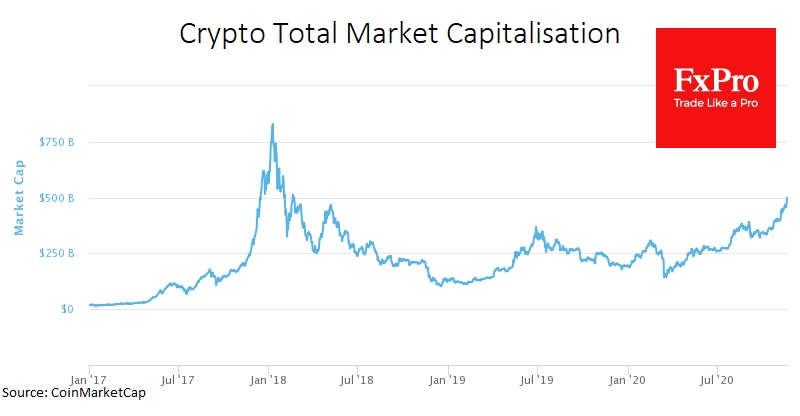

These are factors against continued Bitcoin growth, however, market indicators are impressive with the total capitalization exceeding $500 billion. It should be noted that this threshold was only surpassed during the historic crypto market rally in 2017. The Bitcoin Dominance Index is also very high, currently at 66.2%. In December 2017, it was around 63%, after which it began to decline rapidly due to the growing popularity of altcoins. Now the main focus is on Bitcoin, but as the number of mentions of cryptocurrencies in the media increases, interest in altcoins will also begin to intensify, as retail investors will be looking for options for successful investment at relatively low prices.

Grayscale Investments reported that their investments in crypto assets exceeded $10 billion, contributing to the growth of cryptocurrencies. The fund includes leading crypto coins including BTC, BCH, ETH, LTC, XRP, and ZEC. Bitcoin has been growing rapidly lately and the transformation of past resistance levels into reliable support levels, the exit of technical indicators from the extremely overbought zone, and the possibility of aggressive asset buyback at a discount could well form the basis for the rally to continue.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Is Overbought But Crowd Excitement Supports It

Published 11/19/2020, 08:17 AM

Updated 03/21/2024, 07:45 AM

Bitcoin Is Overbought But Crowd Excitement Supports It

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Hi Alex, I need your help to learn this trading

❤️

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.