An interesting article on HowMuch puts the Bitcoin phenomenon into proper perspective.

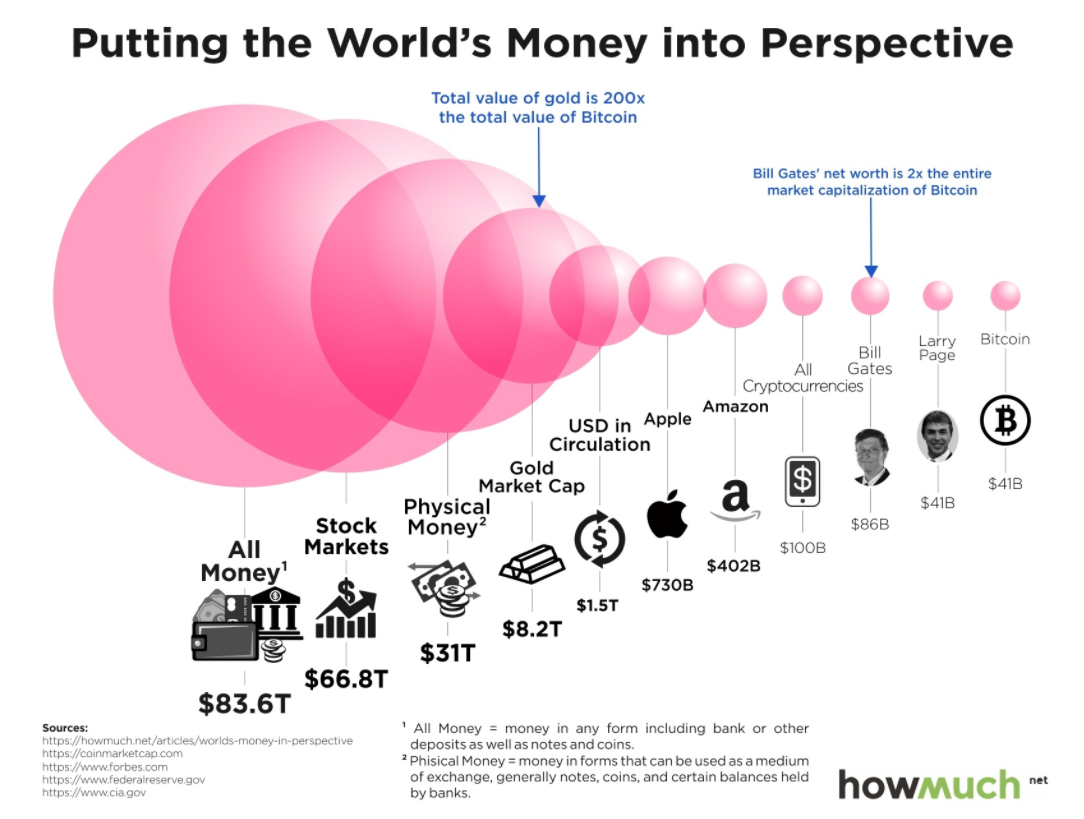

Google (NASDAQ:GOOGL) founder Larry Page’s net worth beats bitcoin’s entire market cap. Microsoft (NASDAQ:MSFT) founder Bill Gates’s net worth is double Bitcoin.

Please consider The Bitcoin Economy, in Perspective.

Last year, Bitcoin became more stable than gold, and earlier this year, the price of a Bitcoin surpassed that of an ounce of gold for the first time. Currently, all the bitcoin in the world is worth $41 billion. If that amount is hard to grasp, just think of it as one Larry Page – because $41 billion also happens to be the net worth of the guy who co-founded Google with Sergey Brin.

Bill Gates, the richest man in the world is worth $86 billion, or the net worth of Larry Page and Bitcoin combined – with enough change to buy the L.A. Lakers, the Toronto Maple Leafs, the Chicago Cubs and the Solomon Islands (not a sports team, but an entire country).

Money, of course, is fiduciary, which means it only has as much value as the trust we place in it. The same goes for gold: it derives its value solely from its rarity, combined with its desirability. The current world supply of mined gold is around 171,300 metric tonnes, which could be molded into a cube with sides of about 68 feet (20.7m). Its total value? Currently around $8.2 trillion. Or about 200 times the total value of Bitcoin.

Does that sound overly dramatic? If the see-sawing rise of Bitcoin tells us anything, it is that people are losing their trust in money, and other traditional measures of wealth. Let’s talk again when the total value of all cryptocurrencies surpasses that of the world’s supply of gold.

Cramer Yet Again

Jim Cramer said the value of a Bitcoin could hit $1 million. The price is currently at $2629.

If it the price of a Bitcoin did hit $1 million, its total market cap value would go up to about $15 trillion.

I spoofed Cramer’s analysis in Jim Cramer Goes Batty “Bitcoin May Hit $1,000,000”: Act Now Before It’s Too Late!

It’s far more likely that bitcoin crashes to $100 than rises to $1 million.