After a decade since the submission of the first Bitcoin Spot ETF application in the U.S. last week no less than 11 Bitcoin Spot ETFs were approved by the SEC!

The approval of the ETF marks one of the most monumental moments in Bitcoin's history.

This news is absolutely massive - and while price has traced back a bit since the exuberant levels on launch day, I cannot understate how bullish I think this is for long term price appreciation.

Institutional and retail investors alike now have access to investable vehicles on US soil that gives direct exposure to Bitcoin. Bullish.

SEC Commissioners in Divided Opinion Despite Approval

Particularly comments made by the SEC chair himself tells me that had it not been for Grayscale winning in court over the SEC, it is likely the ETFs would not have been approved.

His counterpart, Hester Pierce – also known as 'Crypto Mom' – celebrated the decision, noting that the approval of a Bitcoin spot ETF in the U.S. 'marks the end of an unnecessary but consequential saga.’

ETFs are Trading: What now?

In other words, we can expect the Bitcoin ETFs to do wonders for the capital influx into the Bitcoin network. One thing they don’t change, however, is Bitcoin’s fundamentals.

There’s a number of traders who are currently calling for lower valuation levels of BTC. Personally, I like to take a contrarian view on where BTC is moving next, and I think once we start seeing that the ETFs are providing consistent inflows on a weekly basis we will march higher in price.

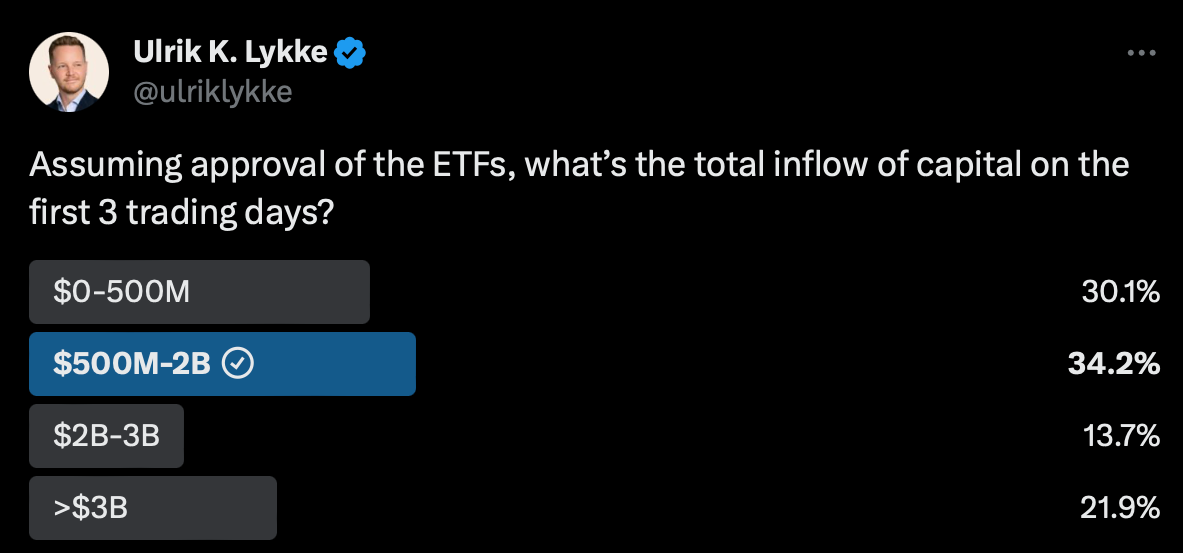

After all, the net inflows into the ETFs has already passed $1.4B in capital inflows after just three days of trading. My question to you is: What will that number be in 1-5-10-50 weeks?

Visa V to Pilot Web3 Customer Loyalty Service: (NYSE:Visa) is introducing a Web3 loyalty service enabling brands to establish digital wallets for storing reward points and experiences. The Visa Web3 Loyalty Engagement Solution seeks to transform the conventional loyalty experience by providing incentives and advantages for active engagement, such as involvement in augmented reality treasure hunts.

USDC Issuer Circle Files for IPO With SEC: Circle Internet Financial, the issuer of the USDC stablecoin, has submitted a confidential draft S-1 document to the U.S. Securities and Exchange Commission (SEC), intending to initiate the sale of shares to the public. As of now, the specific details regarding the number of shares and the offering's price range remain undetermined.