Our first bullish outlook on the biggest cryptocurrency, titled “Bitcoin Hiding an Ace in the Sleeve” was published less than a year ago, on August 1st, 2016, when BTCUSD was trading near $620. It has been a wild ride, but ten months later, the price on most exchanges is hovering around $2900 per Bitcoin. And suddenly, everyone loves it, so the logical question arises: is this a Bitcoin bubble? Let’s see…

“As a result of the rapidly-increasing usage of the Blockchain technology, many investors were eager to invest, at any valuation, in any cryptocurrency that had one of the Blockchain-related prefixes or a “coin” suffix in its name, leading to a crypto bubble. During the bubble, the valuations of virtual currencies in the crypto sector … increased extremely rapidly. Venture capitalists, eager to profit on this investment demand, moved to raise and invest capital faster and with less caution than usual. A combination of rapidly increasing coin prices, market confidence that the mining … would turn future profits, speculation in coins by individuals, and widely available venture capital created an environment in which many investors were willing to overlook risks … in favor of basing confidence on technological advancements.”

No, this paragraph does not come from the future. It comes from an article about the Dot-com bubble on Wikipedia. All we did was to replace a few words, such as “Internet” and “stocks” with “Blockchain” and “coins”. We highly recommend you read the original article. The parallels between the rise and fall of the Dot-com bubble and the current crypto-mania are striking.

For example, it says that during the Dot-com boom, companies, which hardly had a working business model and had never made a profit, were able to raise huge amounts of money just by going public, because investors were so immersed dreaming about the bright future of the Internet, that they thought it does not matter what you buy as long it has “.com” in its name. Today, we can say that 20 years ago, the Internet really was the future. This, however, did not prevent the Dot-com crash in 2000-2002. It then took the NASDAQ stock market index over 15 years to return to its dot-com peak.

The history of the automobile industry is another great example of unrealistically high expectations. Throughout the 20th century, there have been nearly 2000 automobile companies in the United States alone. Today, only three of them are still operating, despite the fact that the internal combustion engine really was a revolutionary invention, which changed the world in a million different ways.

In recent months, we hear about new initial coin offerings (ICO) almost every day. There are nearly 1000 alternative cryptocurrencies already. History might not repeat itself, but it does rhyme. Chances are most of these ICOs will disappoint, to say the least.

While the Dot-com bubble was inflating, people were quitting their jobs, in order to make stocks trading a career. Many were willing to put all of their own and even borrow money to buy Internet stocks. It did not take long to find a similar story supporting the hypothesis of a Bitcoin bubble. A man with the online nickname gingerbreadfutters purchased 191 Bitcoins with an equity loan of over $325 000 on his own house. “Do not bet the house on it” is obviously not a popular motto during bubbles.

There is no doubt that Blockchain’s potential as a technology is enormous. This, however, does not promise that the price of the cryptocurrencies based on it will rise forever. Yes, more and more people are opening accounts to trade Bitcoins every day. This might sound encouraging at first, but when Main Street adopts Wall Street, it is usually time to run and hide, not buy.

Also, when bubbles form, high-profile people and the media start extrapolating the current trend into infinity, coming up with bombastic forecasts about the future price of the discussed assets. In 2011, Kingsview Financial’s Zeman said gold was supposed to reach $5000 and $7000 over the next few years. It crashed by nearly $900 by late-2015. The NASDAQ should have hit 6000 by 2001, it lost 4000 instead. And the Dow Jones Industrial Average was on its way to 20 000 in 2007, when it suddenly plunged to roughly 6500 by March, 2009.

What are the prediction about the future price of Bitcoin now? On May 4, 2017, Business Insider published the opinion of one of Snapchat’s first investors, who believes Bitcoin is going to cost half a million dollars by 2030. Wences Casares, a member of PayPal’s board of directors, thinks it will hit $1 million in the next 5 to 10 years.

If that is not an extrapolation of the current trend into infinity, we do not what is.

All of this suggests Bitcoin has entered a phase of over-optimism, which often coincides with the end of the bull market. Now, let’s take a look at the Elliott Wave point of view. It helped us prepare for the Bitcoin surge last year. It might as well warn us about its end and the collapse of the Bitcoin bubble.

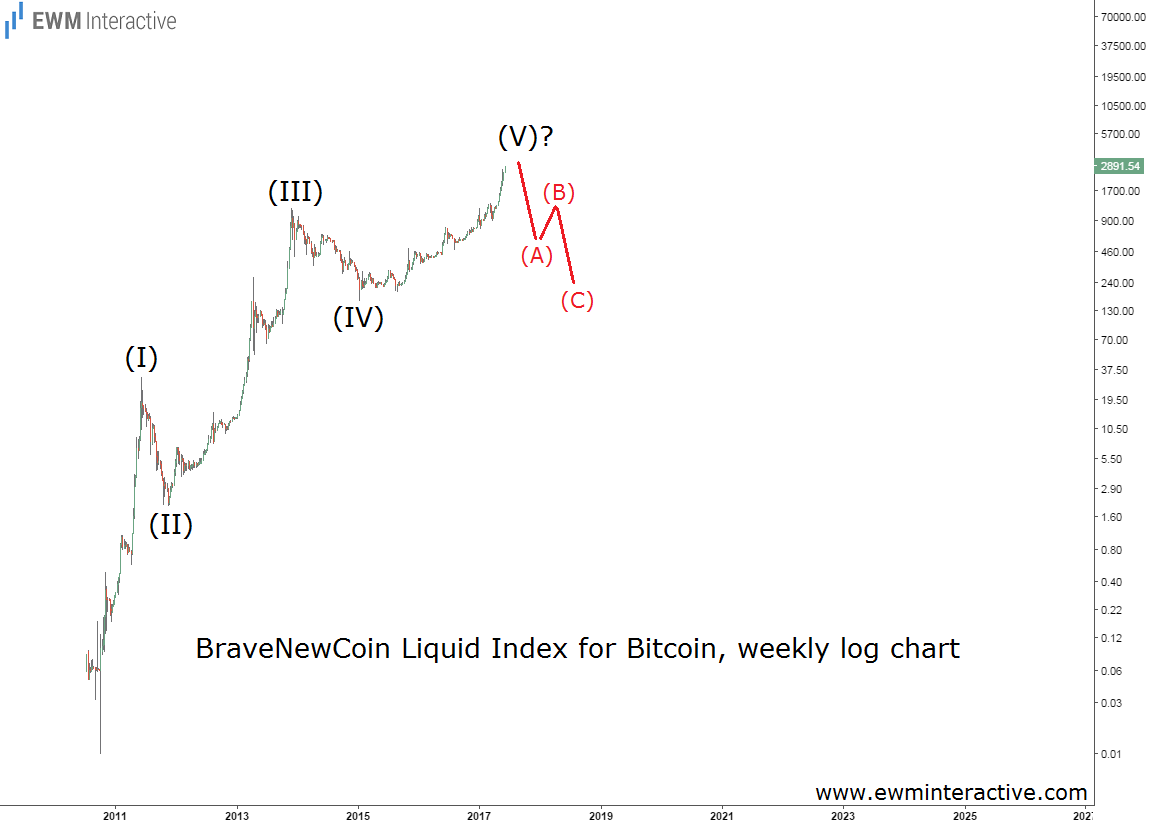

Trends form a five-wave sequence, called an impulse. Every impulse is followed by a three-wave correction in the opposite direction, which drags the price of the asset in question back to the termination level of the fourth wave of the impulse.

The weekly logarithmic chart of the BraveNewCoin Liquid Index for Bitcoin shows the cryptocurrency’s entire rise from as low as 1 cent in 2010 to as high as $2935 a few days ago. As you can see, the five-wave pattern we have been looking for is easily recognizable. This means that once wave (V) ends, a large degree correction should begin. Wave (IV) bottomed out at $164 in early-2015. Therefore, the bears could be expected to drag the price of Bitcoin back to the levels around $200 a coin, representing a 90% selloff from current levels. Impossible? The NASDAQ Composite plunged by 78% between March, 2000 and October, 2002.

So the question is what is left of wave (V)? The daily Bitcoin price chart below shows its internal wave structure.

May’s phenomenal surge, which saw Bitcoin’s market cap more than double fits perfectly in the position of the third wave, so a couple of fourth and fifth waves are still left. It looks like the virtual currency could still add a few hundred dollars more to its price, but most of the rally seems to be behind us already.

In our opinion, buying Bitcoins now is like buying a tulip in the 17th century or a hot dot-com stock in 2000 – motivated solely by greed, not by rational thought or calculated risk. Bitcoin gets more risky as it rises, not less.

Is it different this time? The Bitcoin bubble has all the traits of previous manias. If they resulted in disasters, why would it be any different with Bitcoin? In addition, the Elliott Wave Principle suggests the 7-year uptrend is close to its end.

And one last thing. Buying different cryptocurrencies with the intention to diversify and reduce the risk does not sound like a good idea. Think of the 2000 bankrupt car-makers in the 20th century and the hundreds of Internet stocks, which got crushed by 2002. If all the money are in a single sector or an industry, there is no real diversification. One day they might not call it just the Bitcoin bubble. The Crypto-bubble is much more likely.

In conclusion:

- history rhymes itself again

- a Bitcoin bubble is probably taking place right now

- it is time to be “fearful when others are greedy”

- the Elliott Wave principle supports the negative outlook

- the upcoming crash could erase 90% of Bitcoin’s market cap