At the end of April, we found for Bitcoin:

“For now, and in either case, we are looking for marginal lower prices for the short term, then a bounce back to resistance followed by -at least- another leg lower.”

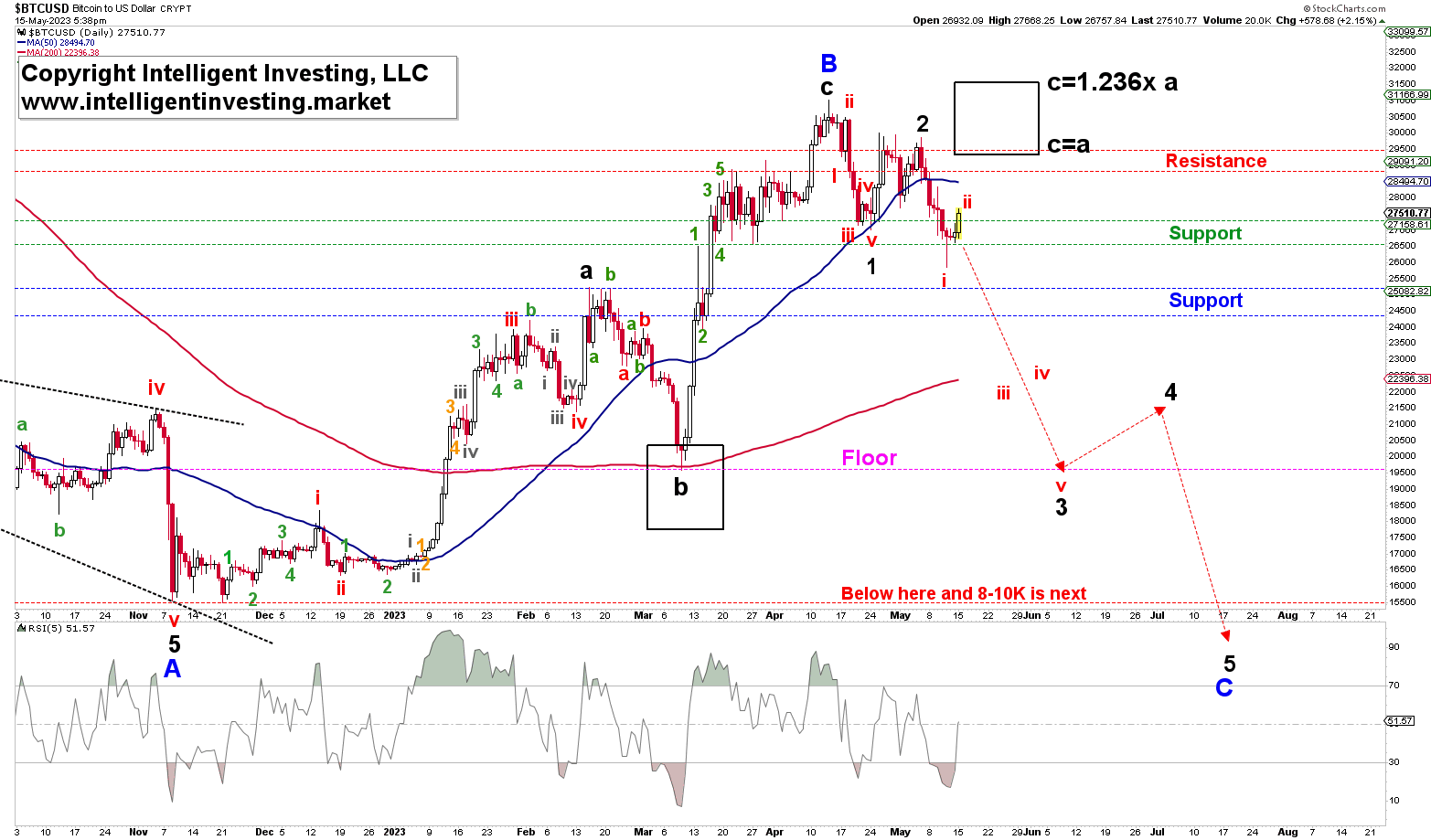

Fast forward and BTC did exactly that. It produced a counter-trend rally into resistance and another drop, aka “leg lower.” Figure 1 below shows - based on this pattern - the most Bearish option: a 3rd of a 3rd wave down possibility. We have no certainty yet that this option is operable, but we know that if BTC stays below the May 6 high of $28,944, labeled as black W-2, and then drops below last Friday’s low at $25,848, labeled as red W-i, we must consider the red W-iii underway.

Figure 1

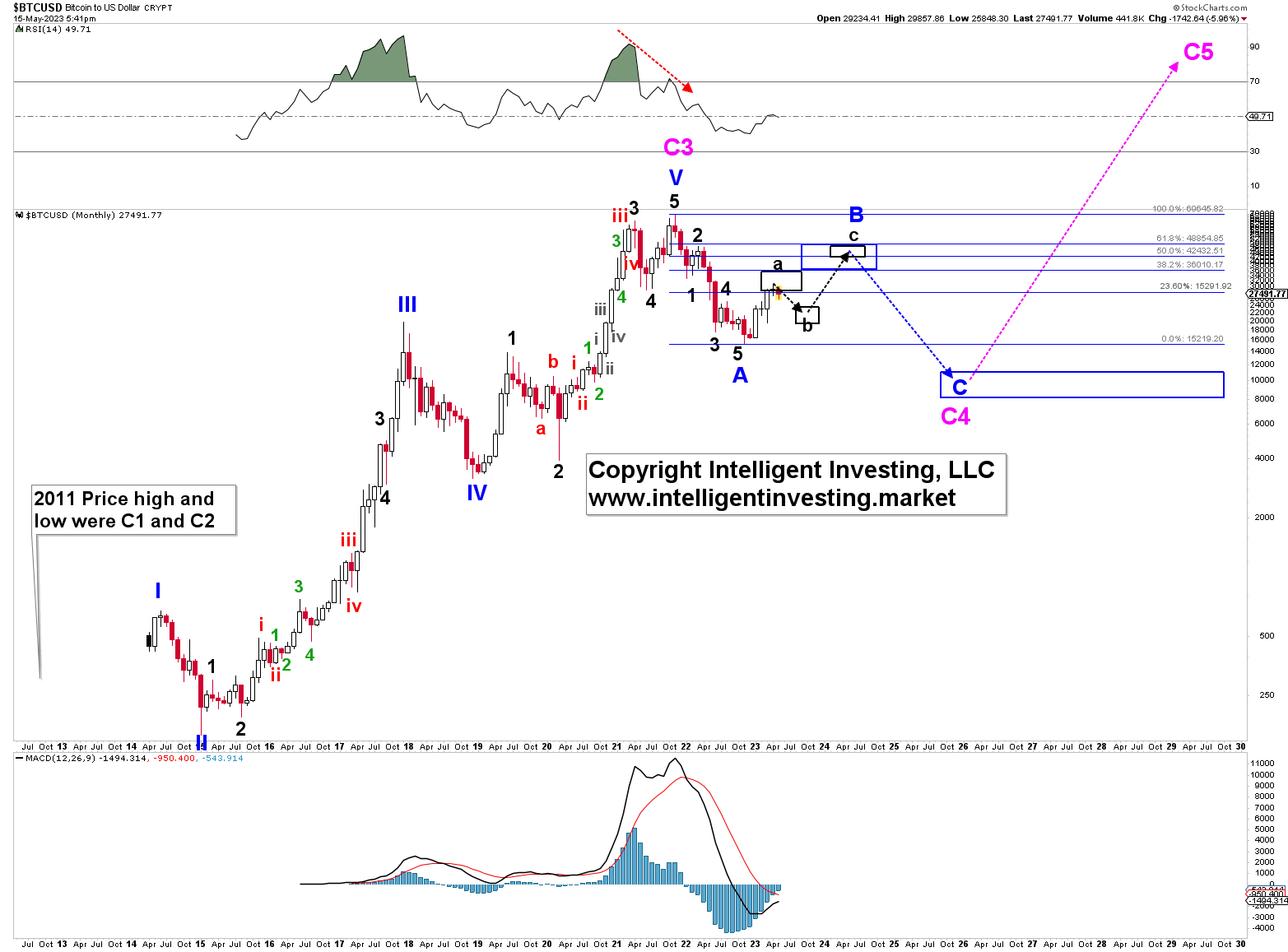

The alternative scenario, which we already tracked last, however, also remains in play. In that case, where the three larger waves up are only black W-a of the larger blue W-B. See Figure 2 below.

Figure 2

In that case, the price action since the April high, here labeled as black W-a, has only been three waves lower per the red W-a, -b, -c sequence and reached the ideal c=a extension on Friday. As such, black W-b could be considered complete, albeit rather brief and shallow, because B-waves always comprise three waves. And as Figure 2 states, B-waves do not have to necessarily bottom at a 50-62% retrace of the prior W-a. In addition, black W-b can subdivide further where Friday’s low as only red W-a and red W-b is now underway.

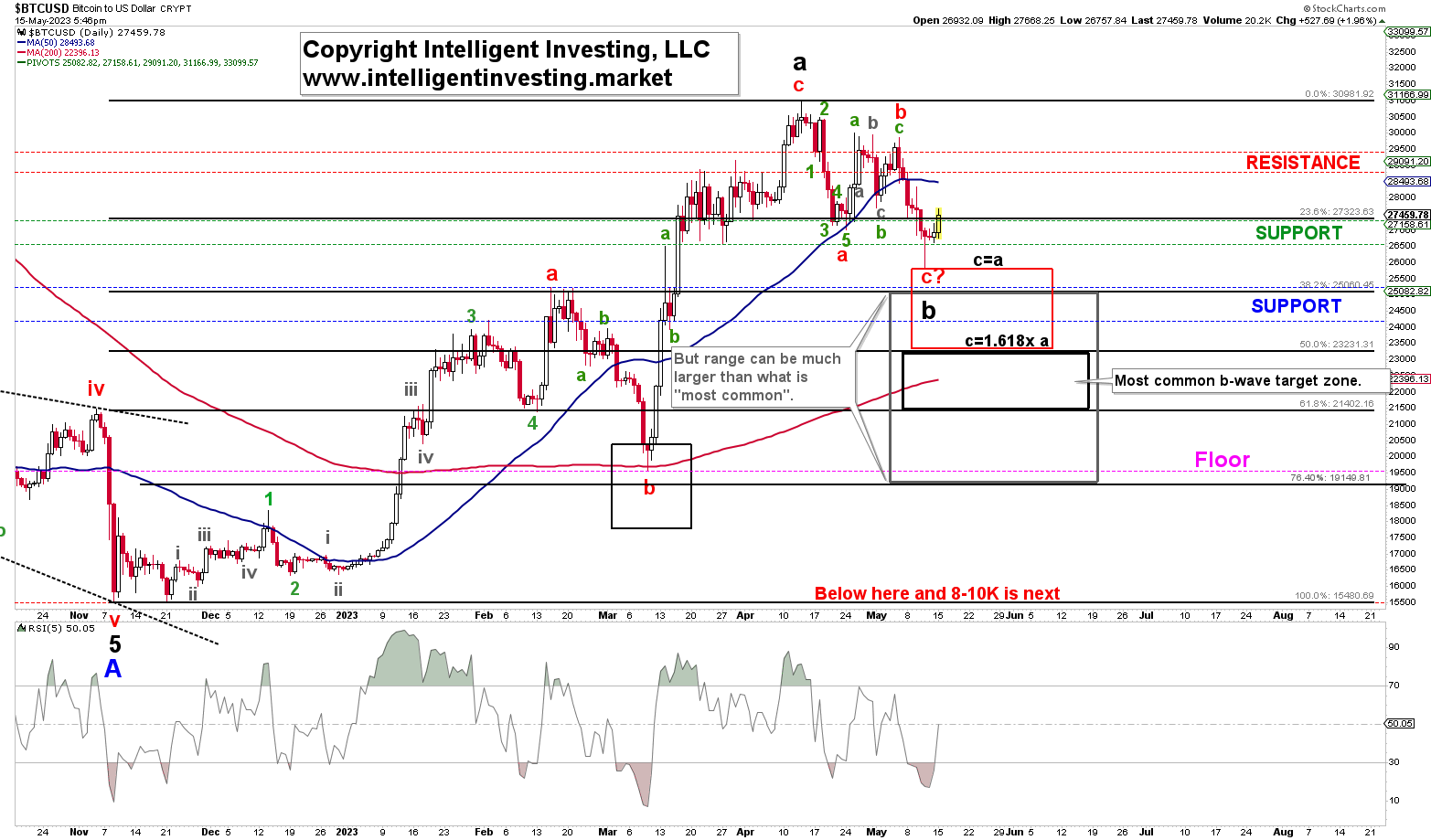

Figure 3

Currently, it is still too early to know if a significant bottom has been struck, but we do know that BTC held horizontal support at the $27+/-0.5K zone. However, it is below its declining (blue) 50-day Simple Moving Average, below resistance, and below the initial bounce highs. Thus, in the short term, if Friday’s low holds, we should look for a retest of those important levels (50d SMA and Resistance). From there, BTC can decide if all the black W-b is completed, if W-b is becoming more complex, or if the red W-iii of W-3 will kick in.

It is okay to acknowledge that the current environment is uncertain. There are simply times we do not have all the answers. All financial markets move from clear to less clear and to clear again. Knowing that means we can trade the clear, easy, setups, which have a much higher chance of being profitable. Know when not to trade, as they say. At this stage, we have our price levels above and below to tell us which option BTC will choose and we will trade them accordingly.