Silver just completed its head and shoulders pattern, and it has very important implications.

Yes, they are bearish.

Yesterday, I wrote about silver’s potential head-and-shoulders pattern and that it would be created once silver declined some more.

It already happened.

Significant Breakdown and Implications

The silver price declined profoundly yesterday, and it approached its December low.

This is a major breakdown, and since the downside target based on this H&S pattern is close to the October low, we can expect a sharp downswing here. This is in perfect tune with my gold price forecast for January 2024.

Now, here’s the important part:

It would be perfectly normal for silver to first move up a bit, perhaps to the rising neckline, which would then serve as resistance and decline only thereafter. The verifications of breakdowns are normal, but they are particularly common in case of breakdowns below the head-and-shoulders patterns.

Consequently, if we see some immediate term “strength” here, please be aware that this is very likely just a normal part of a very bearish pattern and nothing to be concerned with.

So far today, we saw just a tiny rebound, and it might or might not be enough to verify the breakdown. Silver could slide right away here, or it could move higher – to about $23.6 and then slide from that level. Either way, a big decline is the most likely short-term outcome for silver. The same goes for the next several months.

Yes, I continue to expect silver to soar substantially in the following years, but not without declining profoundly first. Please note that silver is not even half as expensive as it was at its 2011 top – and that’s in nominal terms. In real terms (when adjusted for inflation), the silver price is much lower.

Silver, being an industrial metal, is likely to be negatively affected by declines in the stock market. Consequently, what we see right now in the S&P 500 and in the NASDAQ is likely to trigger a significant decline in the white metal.

Stock Market Trends and Their Impact

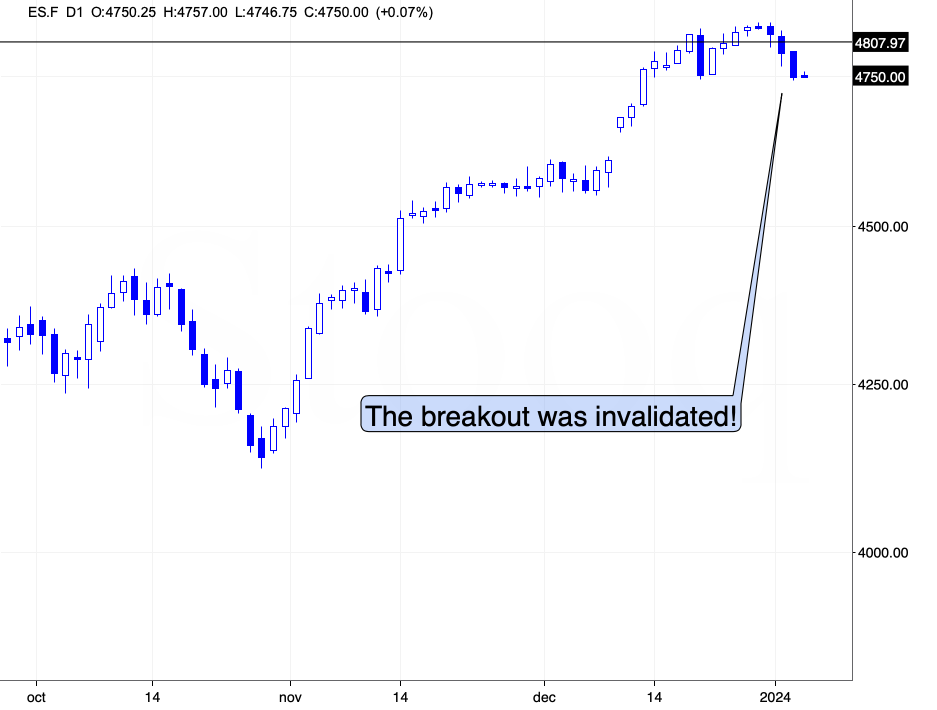

The breakouts to new all-time highs in both the S&P 500 and in the tech stocks were invalidated, which served as major sell signals. As a reminder, while breakouts generally need to be confirmed, for example, by three consecutive closes above a certain price level, invalidations of breakouts serve as immediate sell signals.

The year ended, the Wall Street pros (“pros”?) cashed in their bonuses based on the year-end stock market performance, and now stocks can easily slide. And that’s exactly what we see this year.

Stocks are correlated with silver (and even more so with junior mining stocks), so, what’s negative for the stock market is likely to also be negative for the prices of the above.

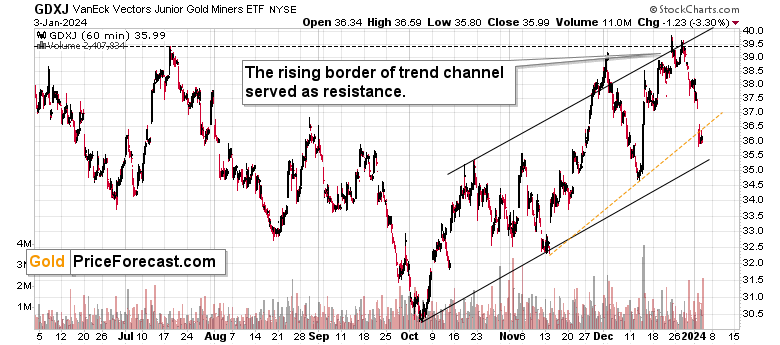

Also, did you see that quick plunge in junior miners?

I told you that this was the likely outcome when very few wanted to believe that and…That’s what juniors did.

The VanEck Junior Gold Miners ETF (NYSE:GDXJ) closed the day below $36, and it’s after the breakdown below it’s very short-term (marked with orange) support line. During yesterday’s session, juniors moved below this line, then they moved quickly back to it, and then they declined once again. That’s a tiny – but still – verification – of the quick breakdown. The decline can now continue, but another move to this level is not out of the question, either.

I previously wrote that our winning streak of 11 closed profitable (unleveraged) trades is likely to get longer, and yesterday’s slide in the GDXJ definitely confirms it.

Congratulations on staying strong and patient when juniors were moving higher, and it “felt” like they were breaking to new heights. It was a trap, and you didn’t fall for it