Bentley Systems (NASDAQ:BSY), Incorporated stands as a prominent global leader in the realm of infrastructure engineering software. With a focus on sectors like commercial, transportation, and utilities, the company offers innovative and comprehensive solutions. We will into delve into Bentley's impressive second-quarter performance in 2023, highlighting strategic announcements and business achievements that collectively make it an appealing choice for investment in the market.

Impressive Financial Performance in Q2 2023

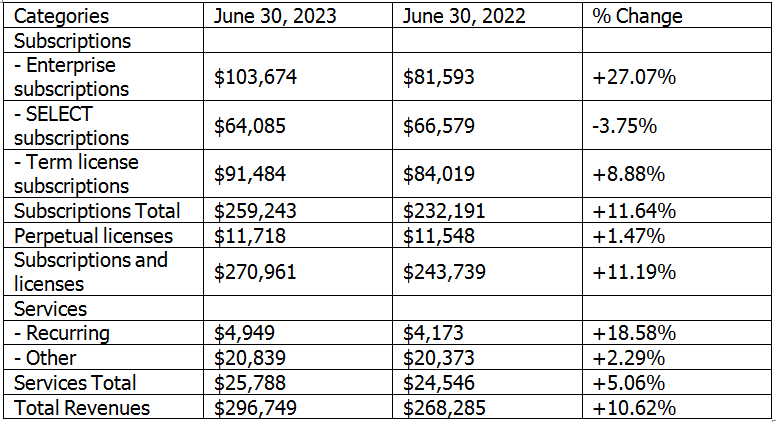

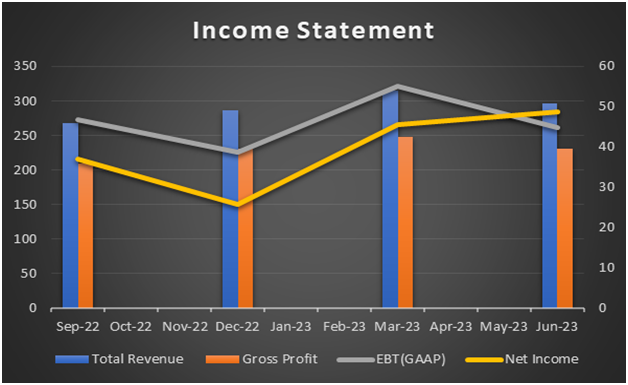

Bentley Systems' financial performance in the second quarter of 2023 demonstrates remarkable growth and resilience. Notably, the total revenues surged to $296.7 million, reflecting a substantial 10.6% increase from the preceding year. A pivotal driver for Bentley, subscription revenues, showcased a robust growth rate of 11.64%, reaching $259.2 million. Additionally, the Annualized Recurring Revenue (ARR) exhibited a healthy growth rate of 13%, soaring to $1,105.9 million. These statistics underscore the strong market acceptance and demand for the company's software solutions.

Strategic Announcements for Growth

Bentley Systems' growth trajectory is further fortified by strategic announcements. One such significant move is the acquisition of Blyncsy, which exemplifies the company's commitment to bolstering its infrastructure asset analytics capabilities. Blyncsy's AI-driven services revolutionize the identification of maintenance requirements within roadway networks. This acquisition not only enhances Bentley's digital twin ecosystem but also positions the company at the forefront of an evolving transportation landscape.

Driving ARR Growth through Initiatives

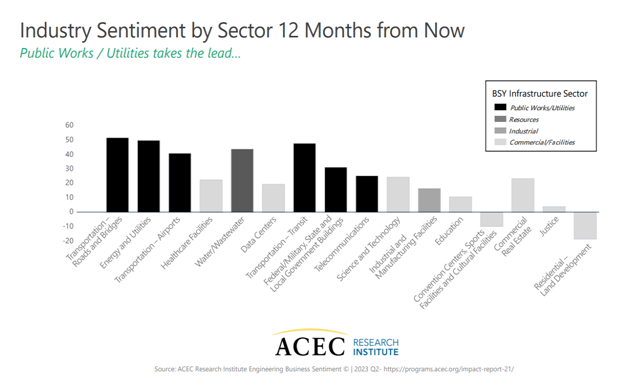

The company's E365 and Virtuosity initiatives play a pivotal role in driving robust ARR growth. Bentley strategically aligns its resources with industry sentiments, catering to priority sectors including Public Works/Utilities, transportation, energy, education, and healthcare. Leveraging the escalating demand for infrastructure digitalization, Bentley Systems is adeptly poised to meet diverse customer needs and propel further growth.

$ MM

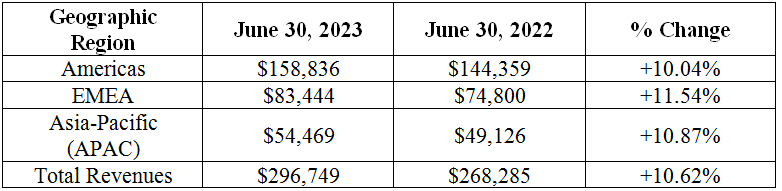

Balanced Geographical Expansion

Bentley Systems' growth is not confined to a single region but is well-distributed across the globe. The Americas lead with a notable 10.04% increase in revenues, driven by successful sales initiatives and a thriving Public Works & Utilities sector. Meanwhile, the EMEA region experiences growth of 11.54%, thanks to Bentley's expanding presence and strategic leveraging of EU funding opportunities. The Asia-Pacific region showcases a robust growth rate of 10.87%, attributed to government investments, engineering offshoring, and heightened engagement with SMBs.

Urgency for Digital Transformation

Expanding backlog and increasing infrastructure demand underscore the urgency for digital transformation within the industry. Bentley Systems is well-equipped to assist professionals in streamlining operations, addressing skill shortages, and enhancing efficiency. This ability positions Bentley favorably to meet the mounting infrastructure requirements. Notably, survey results indicate confidence in Bentley's capabilities, showcasing a median backlog of a year and positive sentiment for future backlogs despite macroeconomic uncertainties.

Fueling Growth Through Product Portfolio Advancements

Bentley's growth is further fueled by significant advancements in its product portfolio. Innovations in iTwin capabilities, PlantSight, OpenCities, Seequent, Leapfrog, GeoStudio, ProjectWise, SYNCHRO, MicroStation, and OpenBridge underscore the company's commitment to enhancing software solutions and addressing evolving customer needs. The integration of AI-driven Digital Twins exemplifies Bentley's potential for diverse AI applications, setting the stage for sustained growth and meeting industry demands.

A Compelling Investment Opportunity

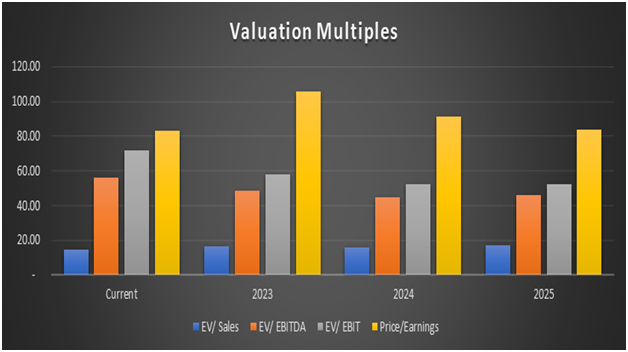

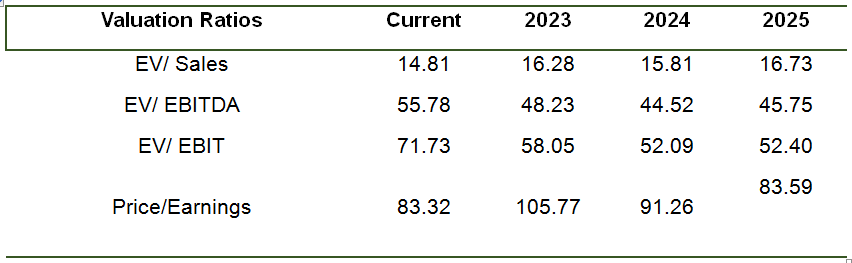

Source/Note: Estimates are based on calculations by Equisights

Based on the provided valuation multiples, the stock currently trading at $45.19 presents a favorable outlook for potential investors aiming for a target price of $59. The estimated EV/Sales and Price/Earnings ratios show a gradual improvement over the forecast period, indicating a potential increase in revenue and earnings.

Additionally, the declining trend in EV/EBITDA and EV/EBIT ratios suggests improving operational efficiency and profitability. However, it's important to note that these multiples should be considered alongside other factors such as industry trends and company-specific developments before making an investment decision.

Disclosure: We don’t hold any position in the stock. We don’t hold any position in the stock.