Becton, Dickinson and Company (NYSE:BDX) reported third-quarter fiscal 2019 earnings per share (EPS) of $3.08, which beat the Zacks Consensus Estimate of $3.05. The bottom line also improved 5.8% on a year-over-year basis and rose 14.8% at constant currency (cc).

Becton Dickinson, also known as BD, raked in revenues of $4.35 billion, surpassing the Zacks Consensus Estimate by 0.06%. The reported figure increased 0.6% from the year-ago quarter. At cc, revenues rose 5.7%.

Segment Details

BD Medical

In the quarter under review, the Zacks Rank #3 (Hold) company reported worldwide revenues of $2.31 billion, up 2.9% from the year-ago quarter and 6% at cc. Per management, the segment's results were driven by performance in the Medication Management Solutions, Medication Delivery Solutions and Pharmaceutical Systems units.

BD Life Sciences

Worldwide revenues in the segment totaled $1.06 billion, down 1.9% year over year but increased 5.4% at cc.

BD Interventional

This segment generated worldwide revenues of $0.98 billion, up 2.8% from the year-ago quarter. At cc, revenues grew 5.2%. The segment's results reflect strong performance by the Urology and Critical Care and Surgery sub-units.

Geographic Results

US

In the fiscal third quarter, revenues in the United States improved 4.4% to $2.44 billion. Revenues grew 5% at cc. Per management, growth in the United States was driven by performance of the BD Medical and BD Interventional segments.

International

Revenues outside the United States grossed $1.91 billion, down 1.6% from the year-ago quarter. At cc, the segment grew 6.5%. Per management, international revenue growth in the third quarter was strong in China and EMEA.

Margin Analysis

In the quarter, gross profit amounted to $2.07 billion, up 2.9% from the prior-year quarter tally. Gross margin was 47.7%, up 60 bps from the prior-year quarter.

Operating income in the quarter grossed $626 million, down 22.3% from the year-ago quarter. As a percentage of revenues, operating margin in the quarter was 14.4%, up 240 bps year over year.

Adjusted operating income amounted to $716 million, up 9.6% from the year-ago figure.

Guidance Reaffirmed

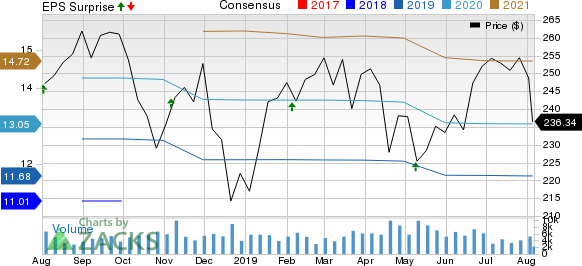

For 2019, the company continues to expect revenue growth of 8-9%. At cc, revenues are anticipated to increase 5-6%. The Zacks Consensus Estimate stands at $17.28 billion.

Adjusted EPS is expected between $11.65 and $11.75, indicating growth of 12% at cc. The Zacks Consensus Estimate is pegged at $11.68, within the projected range. However, this includes unfavorable impact of foreign currency.

Wrapping Up

BD exited the fiscal third quarter on a strong note. Strong performance at the core BD Medical and Interventional segments instills optimism in the stock. Domestic revenues increased year over year in the quarter under review, driven by segmental strength. Growth in China and EMEA is a positive. Expansion in gross and operating margins is also encouraging. BD has kept fiscal 2019 guidance intact.

Meanwhile, sluggishness in the core Life Sciences unit raises concern. International sales also declined in the quarter. Contraction in operating margins in the quarter remains a concern. Management expects unfavorable foreign currency to partially mar BD’s bottom line in fiscal 2019. Stiff competition in the MedTech space adds to woes.

Earnings of Other MedTech Majors at a Glance

Some better-ranked companies, which posted solid results this earnings season, are Stryker Corporation (NYSE:SYK) , Baxter International Inc. (NYSE:BAX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Its revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%.

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Its revenues of $2.84 billion outpaced the consensus estimate of $2.79 billion by 1.9%.

Intuitive Surgical reported second-quarter 2019 adjusted EPS of $3.25, which beat the Zacks Consensus Estimate of $2.85. Its revenues of $1.1 billion surpassed the Zacks Consensus Estimate of $1.03 billion.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research