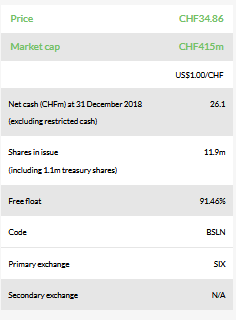

Basilea (SIX:BSLN) has announced positive top-line data from the Phase III TARGET trial which is evaluating Zevtera/Mabelio (ceftobiprole) in the treatment of acute bacterial skin and skin structure infections (ABSSSI). Ceftobiprole, a broad spectrum antibiotic, met primary and secondary efficacy endpoints including non-inferiority to standard of care vancomycin plus aztreonam in the intent-to-treat population. While this news is positive, TARGET is one of two cross-supportive Phase III trials required for the US filing; top-line data from the second study in Staphylococcus aureus bacteraemia (SAB) bloodstream infections (ERADICATE) is expected in H221. A US launch date of 2022/23 for ceftobiprole could be feasible, with a focus on SAB and ABSSSI. We value Basilea at CHF1,082m or CHF100/share.

Zevtera fortunes reside in US market

Zevtera/Mabelio (ceftobiprole) is a broad-spectrum antibiotic for the treatment of drug resistant Gram-positive infections, including methicillin-resistant Staphylococcus aureus (MRSA), and Gram-negative bacterial infections, including Pseudomonas. The product is available in major European countries (approved for both community and hospital-acquired bacterial pneumonia) and some international markets through multiple partners and further roll-outs are expected (ex US) in 2019 and 2020. We believe the major commercial opportunity for Zevtera resides in the US market. Data from the TARGET study could be used to support a post-marketing label extension outside the US.

TARGET hitting efficacy and safety

The TARGET trial evaluated 679 patients – ceftobiprole met pre-specified primary efficacy of non-inferiority (with the pre-specified margin of 10%) to vancomycin plus aztreonam (91.3% vs 88.1%). Ceftobiprole was well tolerated; drug-related adverse events in both treatment groups were nausea, diarrhoea and headache. Full data from this study will be presented at an upcoming scientific conference. We forecast $550m in peak sales for ceftobiprole; comprising US peak sales of $317m in 2027, this is predicated on securing a US commercialisation partner.

Valuation: rNPV of CHF1,082m or CHF100/share

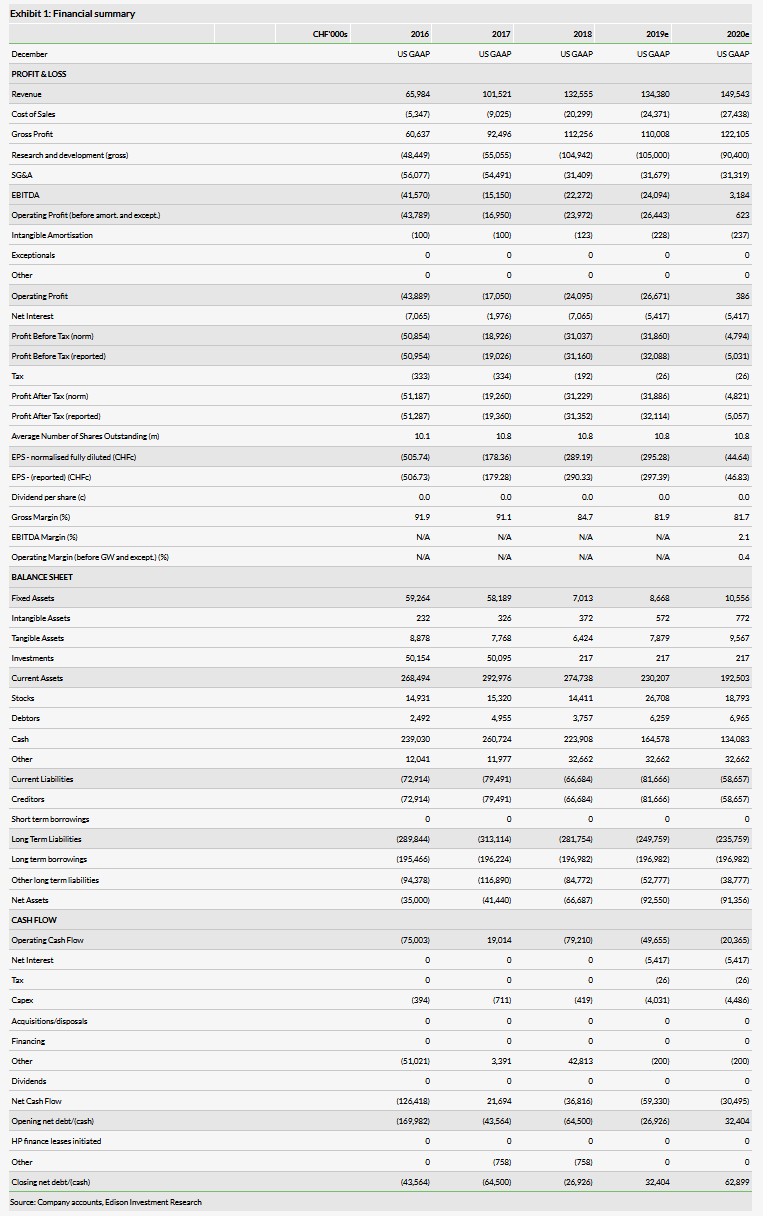

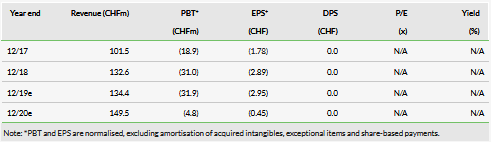

We value Basilea at CHF1,082m. Our valuation is based on an NPV analysis, which includes the main portfolio of products (anti-infectives Cresemba and Zevtera/Mabelio, oncology assets BAL101553 and Derazantinib) and net cash of CHF26.1m at 31 December 2018.

Business description

Basilea Pharmaceutica is focused on anti-infectives and oncology. Its marketed products are Cresemba (an antifungal) and Zevtera (an anti-MRSA broad-spectrum antibiotic). The R&D pipeline includes two oncology drug candidates in clinical development.