Barrick Gold Corporation (NYSE:GOLD) recorded net earnings (on a reported basis) of $2,277 million or $1.30 per share in third-quarter 2019 against net loss of $412 million or 35 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) were 15 cents, which beat the Zacks Consensus Estimate of 10 cents.

Barrick recorded revenues of $2,678 million, up roughly 46% year over year. The figure also surpassed the Zacks Consensus Estimate of $2,619.8 million.

Operational Highlights

Total gold production was 1.31 million ounces in the third quarter, up 14% year over year. Average realized price of gold was $1,476 per ounce, up 21% from $1,216 per ounce in the year-ago quarter.

Cost of sales per ounce went up roughly 25% year over year to $1,065 million. All-in sustaining costs (AISC) rose 25.4% year over year to $984 per ounce in the quarter.

Copper production increased 6% year over year to 112 million pounds. Average realized copper price was $2.55 per pound, down around 8% year over year.

Financial Position

At the end of the third quarter, Barrick had cash and cash equivalents of $2,405 million, up around 42% year over year. Long-term debt was $5,494 million at the end of the third quarter.

Net cash provided by operating activities rose 42.2% year over year to $1,004 million in the quarter.

Barrick also increased dividend on the back of robust third-quarter operational performance and growth in cashflows. The company’s board has declared a dividend of 5 cents per share for third-quarter 2019, marking 25% hike from the second quarter’s dividend payout. The dividend is payable on Dec 16, 2019 to shareholders of record at the close of business as of Nov 29, 2019.

Guidance

For 2019, the company continues to anticipate attributable gold production in the range of 5.1-5.6 million ounces at AISC of $870-$920 per ounce. However, cost of sales is now expected to increase in the range $940-$990 per ounce, up from previous expectation of $910-$970 per ounce.

The company continues to expect copper production in the range of 375-430 million pounds at AISC of $2.40-$2.90 per pound and at cost of sales of $2.30-$2.70 per pound.

Capital expenditure is projected between $1,400 million and $1,700 million, unchanged from previous view.

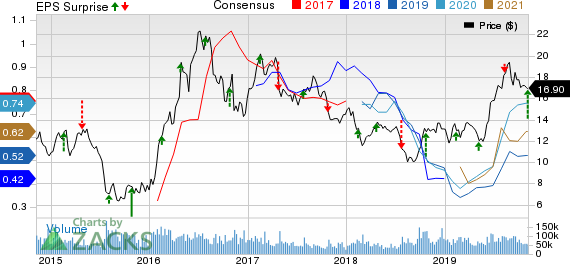

Price Performance

Barrick’s shares have gained 29% in the past year compared with the industry’s 53.6% rally.

Zacks Rank & Stocks to Consider

Barrick currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kinross Gold Corporation (NYSE:KGC) , Franco-Nevada Corporation (TSX:FNV) and Agnico Eagle Mines Limited (NYSE:AEM) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an expected earnings growth rate of 210% for 2019. The company’s shares have surged 80.8% in the past year.

Franco-Nevada has a projected earnings growth rate of 39.3% for 2019. The company’s shares have rallied 48.3% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 67.6% in the past year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

Franco-Nevada Corporation (FNV): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Original post