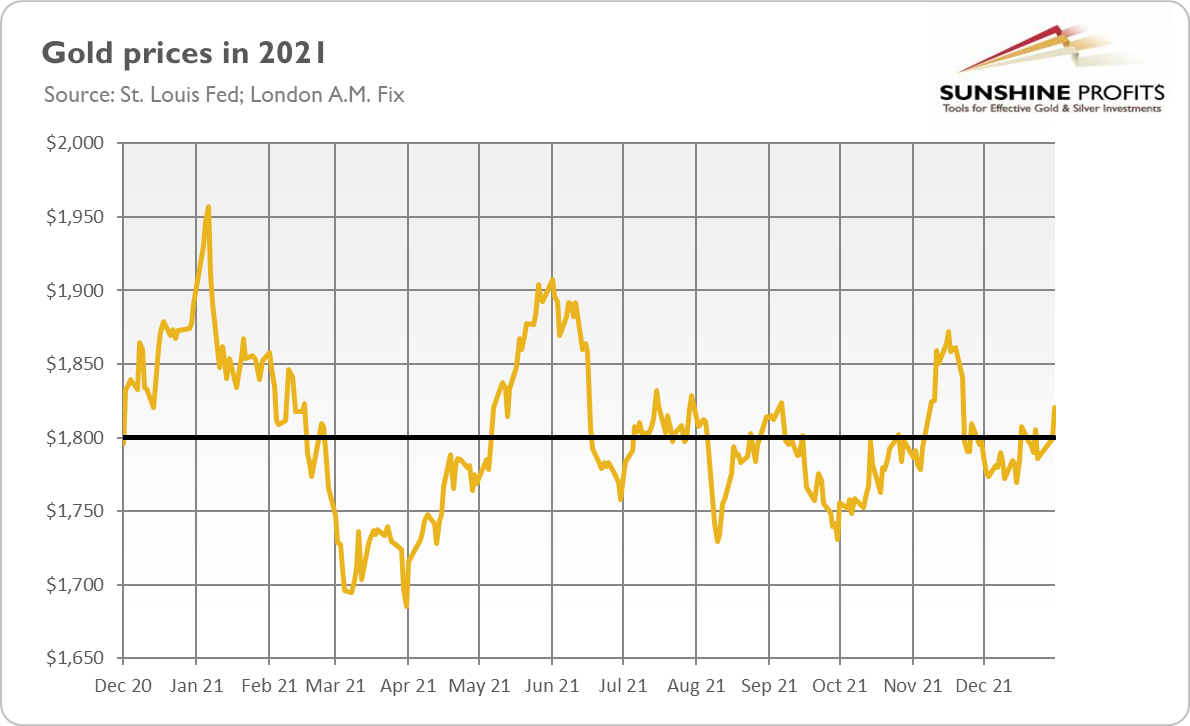

The start of 2021 wasn’t successful for gold. After a few days of rally, the yellow metal entered a bearish trend. 2022 looks uncomfortably similar.

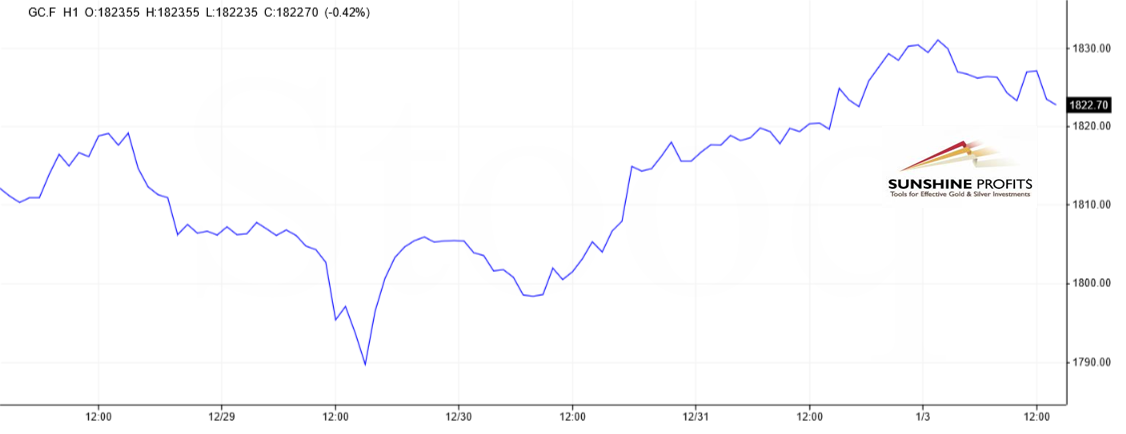

So far, so good—the first three days of 2022 didn’t bring a new catastrophe. It’s probably just the calm before the storm, but the new year started well. Even the price of gold has risen! As the chart below shows, the yellow metal managed to jump above the key level of $1,800 at the very end of 2021, but it still maintains its position (at least as of early Jan. 3, 2022).

It reminds me of the beginning of 2021. Gold also started last year with a bang, only to plunge later. Its price increased 3.5% during the first week of the year, reaching $1,957, and then began its big downward move. As the chart below shows, the yellow metal plunged below $1,700 at the very end of March.

Hence, although January is historically a good month for gold, it might be too early to celebrate, and investors should exercise caution. However, luckily for gold bulls, there is one significant difference between 2021 and 2022. Last year, there were Georgia runoffs and Democrats took over both the White House and the full Congress (the House and the Senate). That was when the blue wave plunged the yellow metal.

This year should be politically calmer for the US (so, we don’t count the odds of Russia invading Ukraine and China attacking Taiwan), but the major threat to the gold market remains the same: a rise in the real interest rates. In January 2021, it was the blue wave that triggered a rebound in rates, but it may be induced by many more factors in the future. It could be the development of a new cure against coronavirus and the end of the pandemic, a more hawkish Fed, or a decline in inflation.

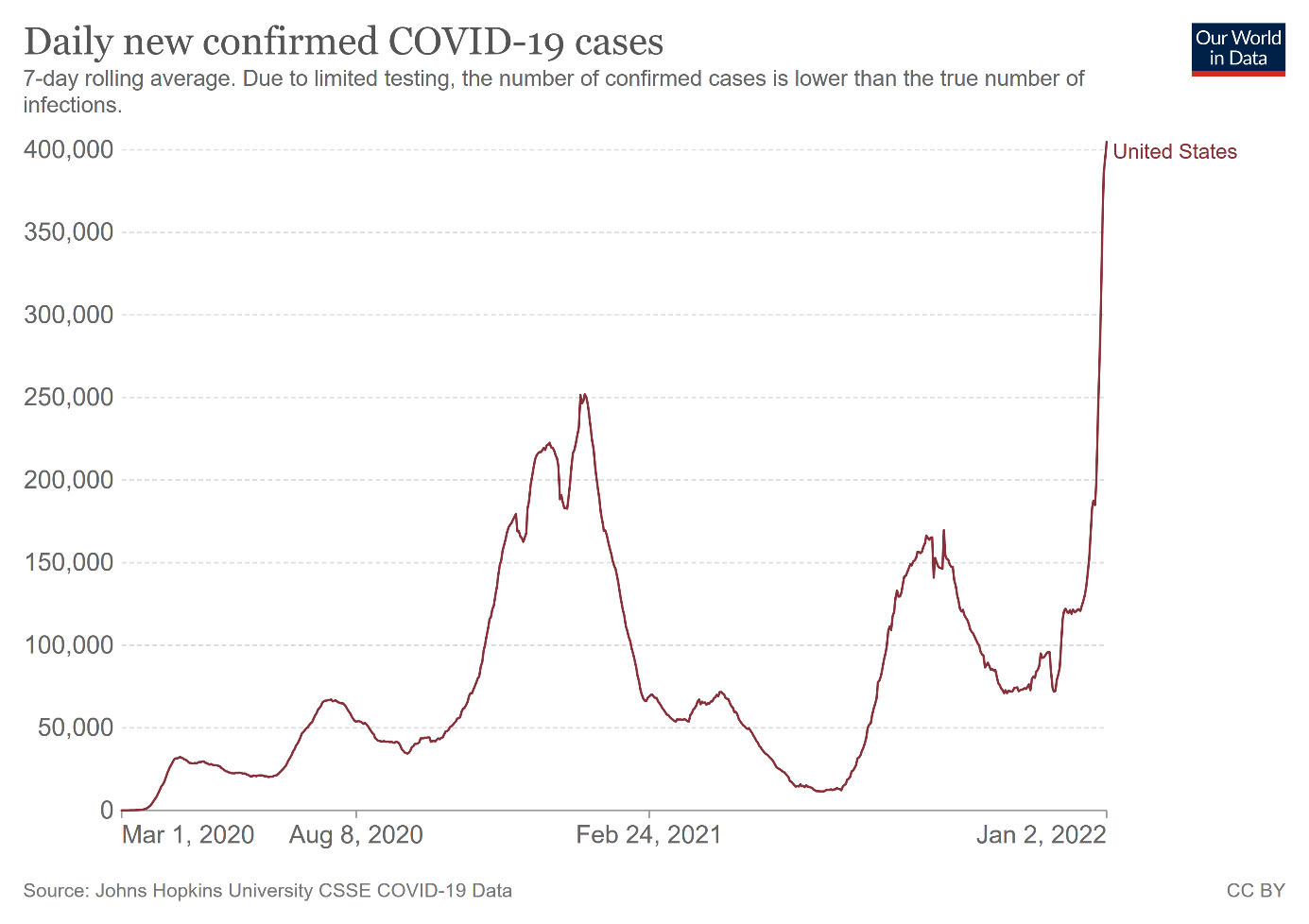

The spread of the Omicron variant keeps worries alive. After all, as the chart below shows, the 7-day rolling average of COVID-19 cases in the United States has hit a record high of about 405,000. When we are completely back to normalcy, risk appetite and bond yields may increase.

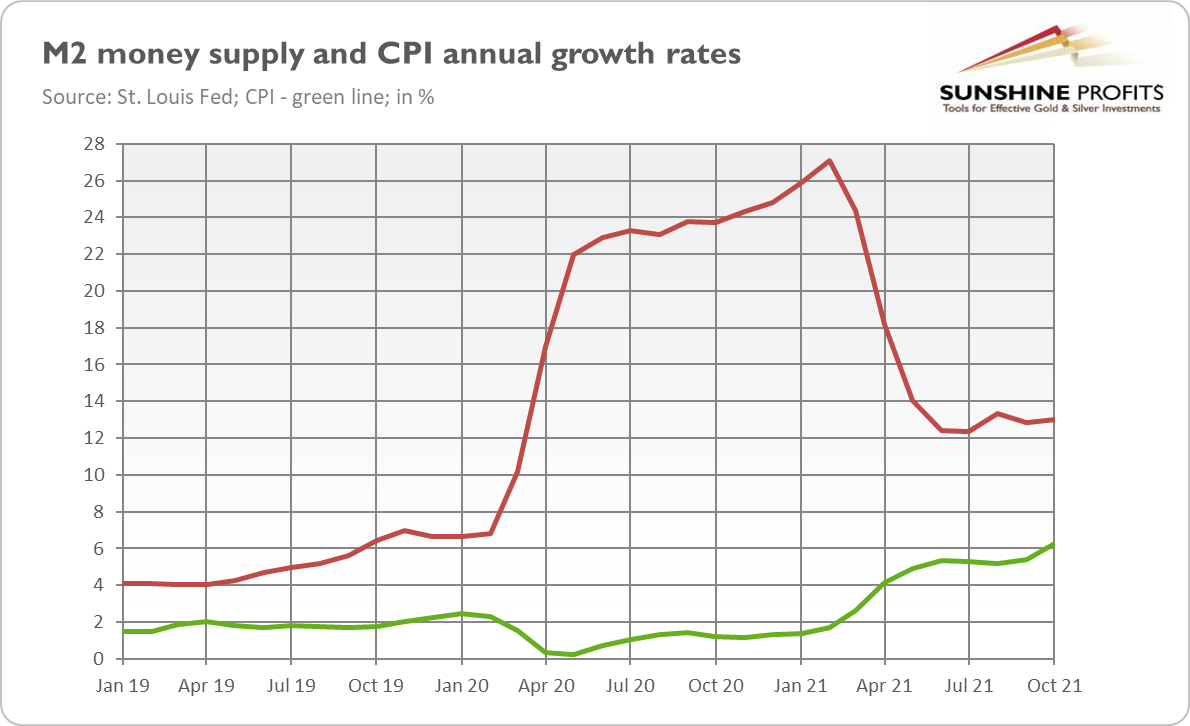

Another risk for gold is the stabilization of inflation and even subsequent disinflation. As the chart below shows, we got a one-off boost in the money supply, so inflation is likely to peak this year. Inflation expectations should ease then, and real interest rates may rebound in such a scenario.

What gives me some comfort here is that the pace of money supply growth hasn’t returned to the pre-pandemic level yet, but it stays at an elevated level (although much below the peak). It should support high inflation this year.

Moreover, the Fed is likely to remain behind the curve and the peak in inflation may only strengthen the dovish camp within the FOMC (although investors should remember that the composition of the voting members of the Committee has become more hawkish in 2022).

Implications For Gold

What does it all imply for the gold market? Will the yellow metal resume its long-term bullish trend in 2022? Well, this is what a majority of investors that took part in Kitco News’ annual outlook survey believe. Of nearly 3,000 retail investors, 54% said they see gold prices above $2,000 by the end of the year. This is also in line with Goldman Sachs’ call for gold in 2022.

Other forecasters see gold prices trading in a range between $1,800 and $2,000. It’s certainly a possible scenario. After all, much of the Fed’s tightening cycle has already been priced in; and the last time gold bottomed was in December 2015, just around the first hike in the federal funds rate after the Great Recession.

However, I expect more volatile trading with strong downside potential. As a reminder, my educated guess is that gold may plunge at some point amid a rebound in bond yields, but will rise later as worries about the next economic crisis accumulate.

Indeed, it’s quite funny, but I haven’t even finished this article, and the price of gold has already started to slide amid rising US dollar index and Treasury yields, in line with my warnings from the beginning of this text. This is how I became a prophet. Now I can see that as soon as you finish reading this article you will continue surfing the internet!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.