The announcement that Trump plans to delay EU auto tariffs provided the DAX quite the tailwind yesterday. Technically, we suspect it could extend its bounce from here.

Since the prior analysis in April, the bullish channel has maintained its structure and the breakout from compression rallied just shy of the September high around 12,400, after creeping along the inside of the upper trendline. A retracement already appeared due given the length of the prior up-leg, although soured sentiment around trade wars proved to be the catalyst for its correction. Still, it’s encouraging that levels from the previous analysis have held and no adjustments have had to be made.

Moreover, since Trump announced a delay to EU auto tariffs, the index went on to print a bullish outside day which respected the 50-day eMA, lower channel line and 11,850 support area. This strongly suggests the corrective low could be in.

Trend continuation assumes an eventual break of the May high, although intraday traders could see bullish continuation pattern towards this key level. Given it’s near the September highs, then we’d expect a price reaction upon the next attempt to break it. Above here, the August and July highs come into focus.

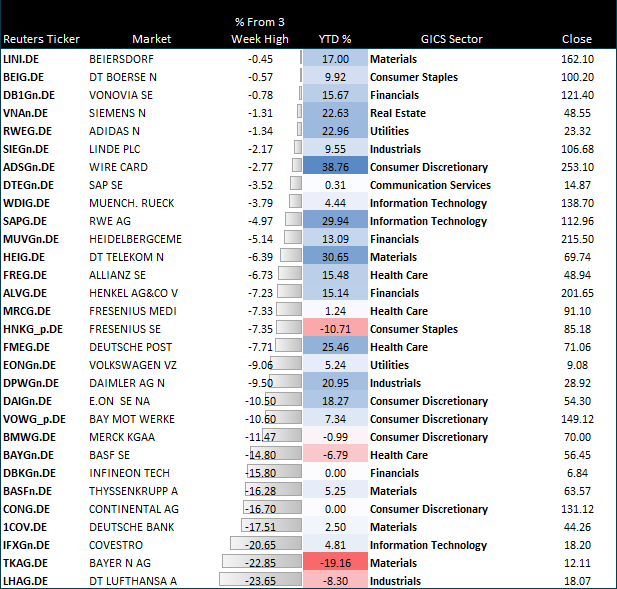

For those interested in DAX equities, we’ve included a table which shows to which percentage they have fallen from their 3-week high to see how they fared during DAX’s correction. In theory, we could look at the smallest correction as a sign of strength to assume the rally would continue if DAX pops higher. However, they likely look overextended to the upside, some could be defensive stocks or rallying on earnings. Therefore, we could look towards the middle of the table as this includes equities whose retracements held up relatively well during the DAX’s decline, and then combine with YTD% as another sign of strength.

Looking at it from this metric, RWEG, SAPG, MUVG and HEIG could warrant a closer look as they neither appear over-stretched to the upside, whilst having a bullish trend structure and showing signs they have completed their corrections. Now, we just need the DAX to rally.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."