- Australian GDP falls to 0.2%

- AUD/USD rebounds after two-day losing streak

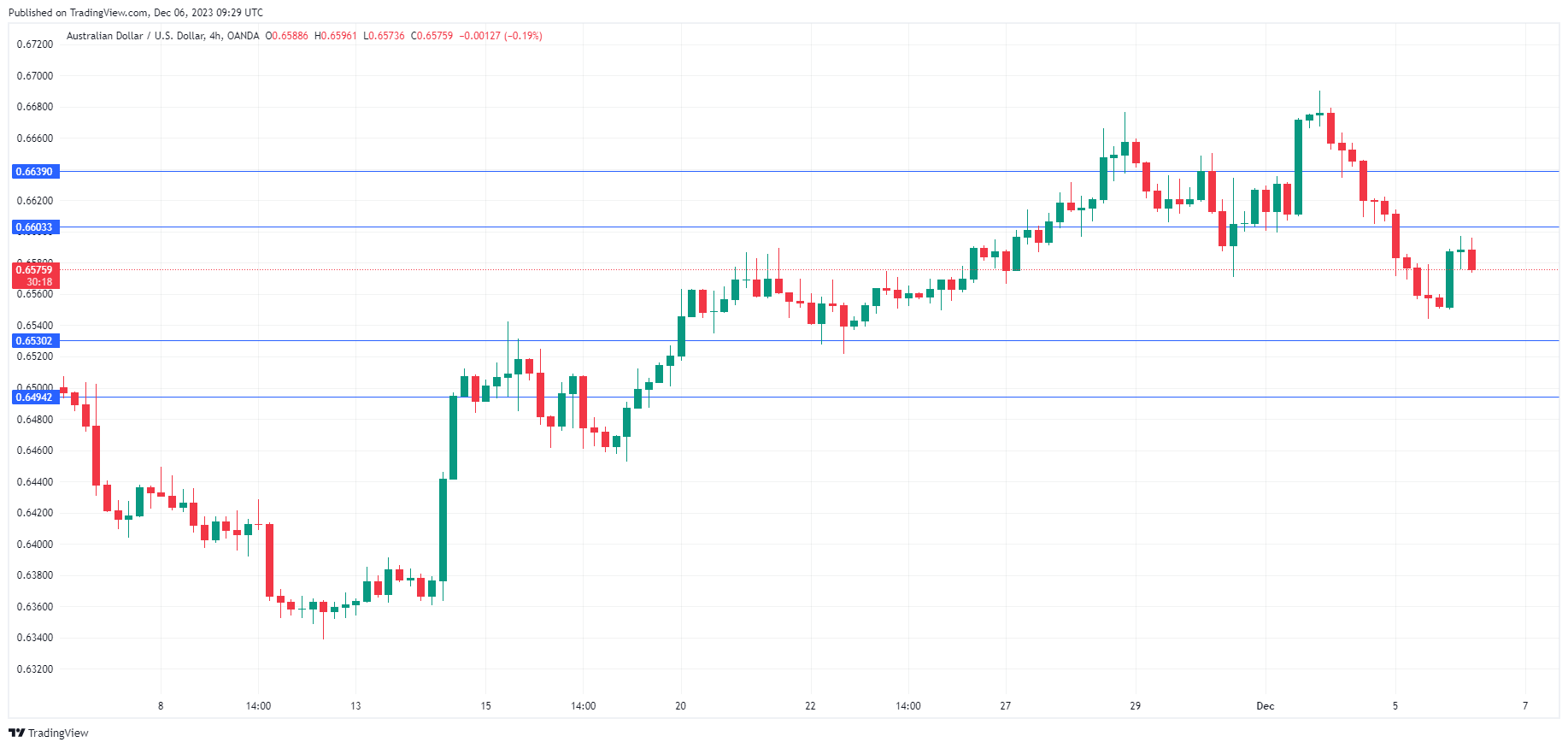

- There is support at 0.6530 and 0.6494

- 0.6603 and 0.6639 are the next resistance lines

The Australian dollar has bounced back on Wednesday and snapped a two-day losing streak. In the European session, AUD/USD is trading at 0.6574, up 0.34%.

Australian GDP Eases to 0.2%

Australia’s GDP rose 0.2% q/q in the third quarter, below the consensus estimate of 0.4% and the second quarter print of 0.4%. This was the weakest rate of expansion since Q3 2022, as household consumption showed no growth and exports dropped for the first time since Q1 2022. Despite the weak release, the Australian dollar is higher today.

The soft GDP report points to weak consumer spending, as consumers are being squeezed by elevated borrowing costs and high inflation. In October, headline inflation eased to 4.9% y/y, down sharply from 5.6% in September. The trimmed mean, a key core inflation indicator, ticked lower to 5.3%, down from 5.4% in September. Inflation has been heading in the right direction but consumers are still seeing pricing rising, albeit at a slower pace.

The drop in exports is a worrisome event and is largely due to the slowdown in China, which is Australia’s largest export market. China’s growth has been slowing, debt is rising and the property sector is in crisis with some of the largest construction companies facing bankruptcy. On Tuesday, Moody’s rating agency cut its credit outlook for China from stable to negative. Moody’s maintained China’s credit rating at A1, but the credit outlook downgrade reflects deep concern about the state of China’s economy.

On Tuesday, China’s Caixin Services PMI improved in November to 51.5, up from 50.4 in October. This indicates weak growth, with the 50 line separating contraction from expansion. The manufacturing sector has been a drag on the economy, with manufacturing PMIs indicating contraction in eight of the past nine months.