AUD/USD continues to power upwards and hit 10-week highs earlier today. The Australian dollar climbed 1.5% on Wednesday and has edged higher today. In the European session, AUD/USD is trading at 0.6796, up 0.14%.

US dollar slides after Powell speech

Fed Chair Jerome Powell spoke on Wednesday and gave the markets what they wanted to hear with regard to the December rate hike. Powell strongly hinted that the Fed would slow the pace of rate increases at the Dec. 14 meeting, after four successive 75 bp hikes. Powell said that slowing down at this point “is a good way to balance the risks”, as the Fed Chair is trying to slow the economy while avoiding a recession. The markets duly responded by pricing in a 50-bp rate hike at 80%, up sharply from 65% prior to Powell’s remarks. This sent financial markets higher, while the US dollar was broadly lower.

Investors focussed on Powell’s hint that rate hikes will slow at the next meeting, choosing to ignore his comments that rates could rise higher than previously expected and for a prolonged period in order to curb stubborn inflation. The likely easing to 50 bp was a green light for the markets, and what is down the road can be worried about another time.

In Australia, Private Capital Expenditure disappointed in Q3 with a reading of -0.6%. This was below the Q2 reading of 0.0% and way off the consensus of 1.5%. The RBA meets on Dec. 6 after having eased on rate hikes, with two straight increases of 25 bp. The cash rate is currently at 2.85%, and there is a good chance that the RBA will again raise rates by 25 bp next week, as it looks to fight inflation while guiding the economy to a soft landing.

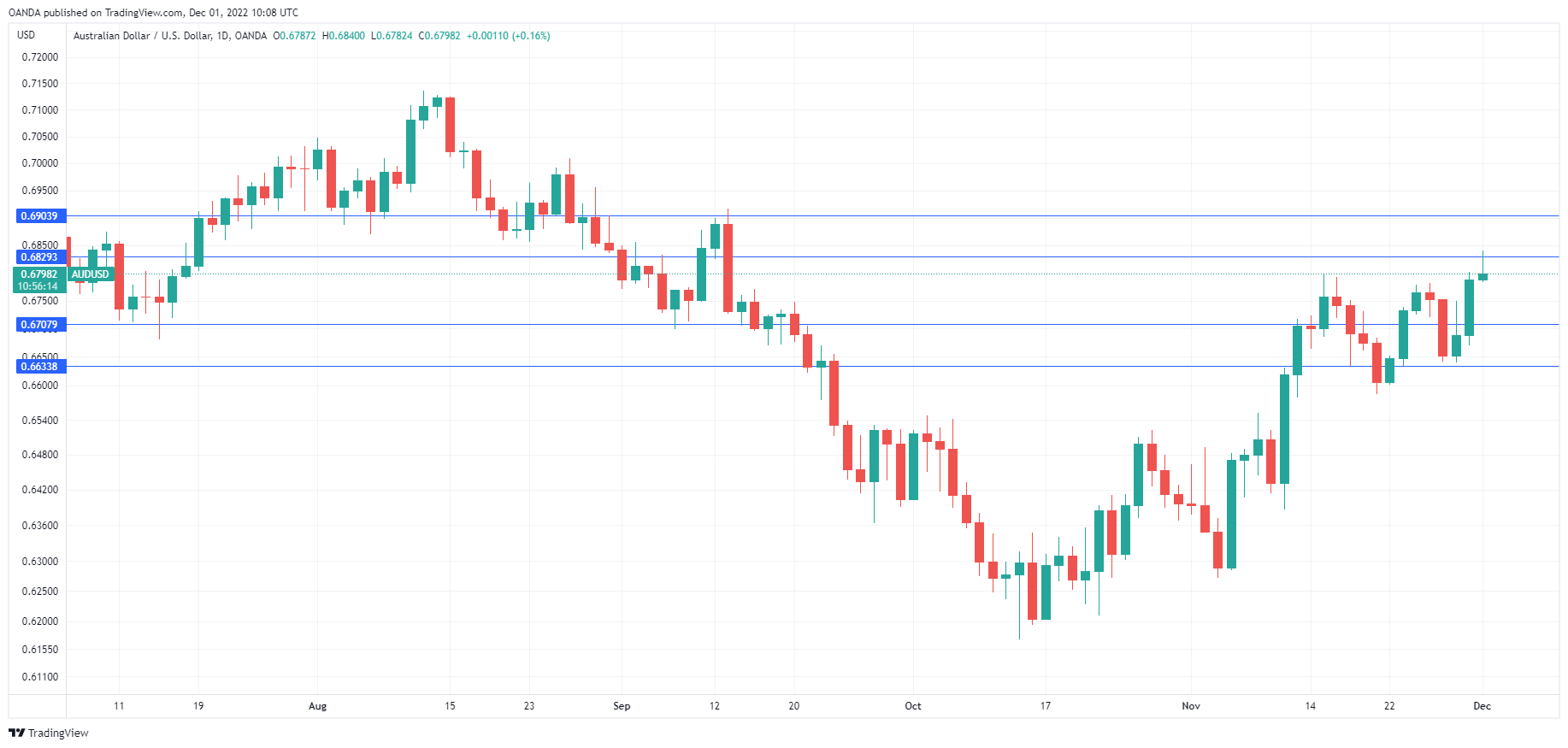

AUD/USD Technical

- AUD/USD is testing resistance at 0.6829. Above, there is resistance at 0.6903

- There is support at 0.6707 and 0.6633