The Australian dollar has posted slight gains on Tuesday. Early in the North American session, AUD/USD is trading slightly above the 0.73 line. On the release front, the RBA released the minutes of its May policy meeting. Australian Motor Vehicle Sales dropped 2.5% in April, compared to a 2.2% gain in the previous release. In the US, Core CPI posted a small gain of 0.2%, while CPI improved to 0.4%. Both readings were within expectations. Building Permits came in at 1.12 million, very close to the forecast. Later in the day, Australia will release Wage Price Index, an important employment indicator. On Wednesday, the Federal Reserve releases the minutes of its April policy meeting. Australia will publish Employment Change and the Unemployment Rate.

The RBA released the minutes of its May policy meeting, when it surprised the markets and lowered interest rates from 2.00% to 1.75%. The minutes indicated that the deflationary trend could continue. In March, CPI dipped 0.2%, and this weak number played a factor in the RBA’s decision to lower rates earlier this month. In the minutes, the RBA also expressed concern about weak wage growth. Will the RBA press the rate trigger shortly? With a national election scheduled for July 2, the RBA is unlikely to make any monetary moves until August. The markets are expecting more cuts in 2016, but it’s an open question as to how deep the RBA could cut rates. Analysts at Commonwealth Bank expect two quarter-point cuts, which would lower rates to 1.25% by the end of 2016. JP Morgan, however, says that rates could fall to 1.0% by the end of the year. The Australian dollar has looked dreadful in May, losing over 300 points. Much of that drop can be attributed to the RBA’s rate cut and dovish tone, and the minutes will put even more pressure on the Australian dollar as the markets prepare for further rate cuts.

The Federal Reserve, never far from the financial headlines, will take over center stage on Wednesday with the release of the April minutes. The Fed has sent out the message that a June hike is on the table, but the markets remain skeptical, following the soft Nonfarm Payrolls report earlier this month and Tuesday’s weak consumer inflation reports. With the economy showing mixed employment numbers and inflation stuck at low levels, a June hike would be nothing less than a shock, a reason in itself for the Fed to remain on the sidelines and avoid causing market turbulence. The markets are clearly expecting rates to remain at the current level of 0.25%, with the implied probability of a hike down to just 4%.

The US economy remains generally solid and last week wrapped up on a high note, as retail sales and consumer confidence reports beat expectations. Core Retail Sales posted a strong gain of 0.8%, above the estimate of 0.6%. Retail Sales surged 1.3%, its strongest gain in over six years. The gain was all the more impressive as the markets had anticipated a decline of 0.3%. Consumer confidence also looked sharp, as UoM Consumer Sentiment jumped to 95.8 points, compared to the estimate of 89.9 points.

AUD/USD Fundamentals

Monday (May 16)

- 21:30 RBA Monetary Policy Meeting Minutes

- 21:30 Australian New Motor Vehicles Sales. Estimate -2.5%

Tuesday (May 17)

- 8:30 US Building Permits. Estimate 1.13M. Actual 1.12M

- 8:30 US CPI. Estimate 0.3%. Actual 0.4%

- 8:30 US Core CPI. Estimate 0.2%. Actual 0.2%

- 8:30 US Housing Starts. Estimate 1.12M. Actual 1.17M

- 9:15 US Capacity Utilization Rate. Estimate 75.1%

- 9:15 US Industrial Production. Estimate 0.3%

- 20:30 Australian MI Leading Index

- 21:00 RBA Assistant Governor Guy Debelle Speaks

- 21:30 Australian Wage Price Index. Estimate 0.5%

Upcoming Key Events

Wednesday (May 18)

- 14:00 US FOMC Meeting Minutes

- 21:30 Australian Employment Change. Estimate 12.1K

- 21:30 Australian Unemployment Rate. Estimate 5.8%

*Key releases are highlighted in bold

*All release times are EDT

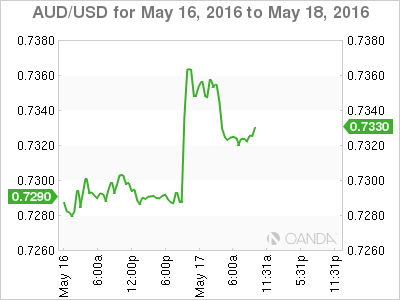

AUD/USD for Tuesday, May 17, 2016

AUD/USD May 17 at 9:20 EDT

Open: 0.7286 Low: 0.7282 High: 0.7366 Close: 0.7326

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7049 | 0.7160 | 0.7251 | 0.7339 | 0.7472 | 0.7560 |

- AUD/USD posted strong gains in the Asian session but has retracted in European trade and surrendered most of the earlier gains

- 0.7251 has strengthened in support

- 0.7339 was tested earlier in resistance and is a weak line

- Current range: 0.7251 to 0.7339

Further levels in both directions:

- Below: 0.7251, 0.7160 and 0.7049

- Above: 0.7339, 0.7472, 0.7560 and 0.7678

OANDA’s Open Positions Ratio

AUD/USD ratio has shown movement towards long positions on Tuesday. Long positions command a strong majority (61%), indicative of trader bias towards AUD/USD continuing to move higher.