AUD/USD" title="AUD/USD" height="242" width="474">

AUD/USD" title="AUD/USD" height="242" width="474">

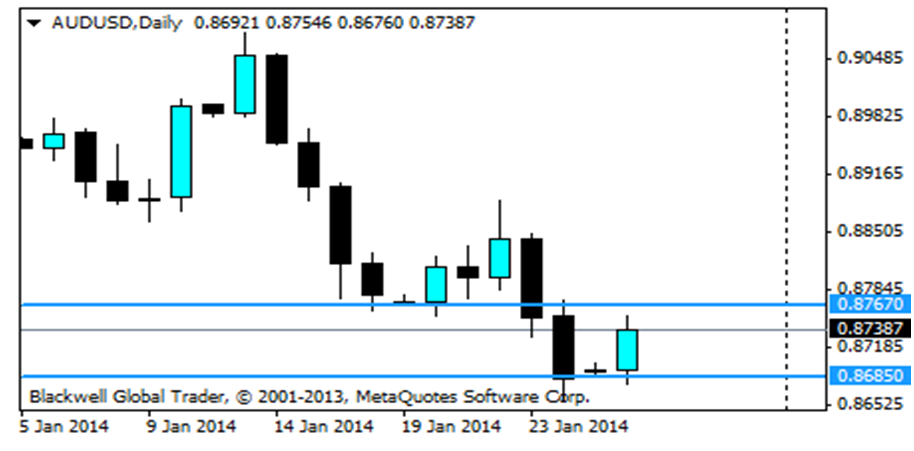

The Aussie just keeps weakening. On Friday, the AUD/USD suffered a further 100 pip drop, breaking through the 0.8767 support level whenChinese metric data heightened concerns that there may be a future drop in Australian exports. Additionally, an RBA member was quoted as saying that a value of 0.80 AUDUSD would be fair for this pair, encouraging further selling. Overall, this pair has decreased by 400 pips in just over 10 days and with the USD looking like it is going to strengthen this week, further losses might be ahead.

My expectations for the USD this week are bullish. This month, Advance Retail Sales, Small Business Optimism and Mortgage Applications have all impressed. Bloomberg is reporting that consumer expenditure for the previous quarter in the US was at its highest level in nearly four years, which suggests that Tuesday’s Consumer Confidence reading will likely surpass expectations.

Equally, I am expecting the Federal Reserve to taper Quantitative Easing (QE) on Wednesday. The employment economy is showing great progress, with initial jobless claims decreasing consistently, and two of the past three Non-Farm Payrolls (NFP) surpassing expectations. In fact, January’s weak NFP can be blamed upon the poor weather the United States faced in the past month. This would have affected data collection and January’s NFP will most likely be revised next Friday.

Bearing in mind the noticeable progress the United States economy has made in the past few months, alongside an improving labour market, there are high chances that the Federal Reserve will taper QE this week, further devaluing this currency pair.

In reference to Australian economic releases, they are light in quantity this week. The previous month has exposed some real fragilities in the Australian economy. Firstly, their GDP missed expectations in December, due to a noticeable decline in the mining industry. This was then followed by the IMF expressing that the Australian unemployment rate would hit a record high in 2014, due to their biggest employment sector, the mining industry, being in decline.

Although economic releases are low from Australia this week, all it can take is another member of the RBA to comment on the need for a lower valued currency, and the bears will reawaken.

In reference to my technical observations for the AUD/USD, I have already mentioned that Friday’s news encouraged this pair to break through the 0.8767 support level. The next level of support can be found at 0.8685. However, when alternating to the weekly charts, I can see future support levels at 0.8660, 0.8515 and 0.8421.

Overall, the Aussie is vulnerable at present. Although the RBA has repeatedly spoken about an overvalued currency since mid 2013, I don’t think anybody fully anticipated how fast the Aussie could weaken. If the USD does strengthen this week, as most expect it to do, then it is very possible that the Aussie could be set to break through more support levels in the upcoming days.