The AUD/USD has reversed strongly over the last couple of days moving back towards and below 0.91 however it has held up well over the last 24 hours receiving some support from the 91 cents level. In the week prior it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out last week. A couple of weeks ago, it fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93 before its recent reversal. It was only a few weeks ago the AUD/USD moved up towards the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93 however a few weeks ago, it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150.

Over the course of the last month or so the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continues its rally up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so had seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at previous key levels at 1.04, 1.0360 and 1, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong trend that would have caught many people on the wrong side of.

The Australian dollar continued to rise fuelled by a strong consumer sentiment in August. The index jumped 3.5% for the August reading. Optimism about the economy is on the rise ahead of the September 7 election. US Tapering fears are a concern for the AUD as well as some employment and wage data which suggest a weak Australian economy. So far the US Federal Reserver has not given any timelines surrounding the end of its QE program. There is market speculation that the program could start winding down in September or the end of the year. The biggest factor against that line of thinking is the fact that Bernanke will most likely not be at the head of the Fed beyond next year. The Fed might wait for after the succession to start its tapering and potential interest rate raise. The Wage Price Index came in slightly lower than expected at 0.7% versus a 0.8% forecast. Employment and all of the related statistics are closely watched as one of the weakest points of the Australian economy.

AUD/USD August 15 at 00:30 GMT 0.9151 H: 0.9160 L: 0.9085

During the early hours of the Asian trading session on Thursday, the AUD/USD is continuing to ease back towards 0.91 after trading up towards 0.9160 in the last 12 hours or so. Despite its slowing and slight recovery the last few weeks, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just below 0.9130.

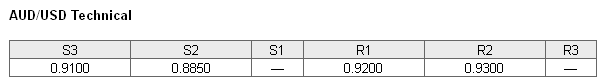

Further levels in both directions:

• Below: 0.9100 and 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved up away from 60% as the Australian dollar has rallied back above 0.91. The trader sentiment remains in favour of long positions.

Economic Releases

- 08:30 UK Retail Sales (Jul)

- 12:30 US CPI (Jul)

- 12:30 US Empire State Survey (Aug)

- 12:30 US Initial Claims (09/08/2013)

- 13:00 US Net Long-term TICS Flows (Jun)

- 13:15 US Capacity utilisation (Jul)

- 13:15 US Industrial production (Jul)

- 14:00 US NAHB Builders survey (Aug)

- 14:00 US Philadelphia Fed Survey (Aug)