AUD bulls still control the situation above the mark of 0.9300

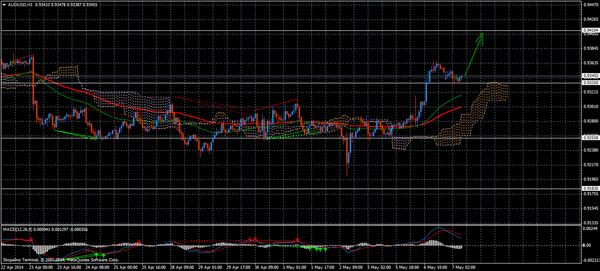

The AUD/USD fell this morning under bearish pressure and is now trading at 0.9337, moving away from the Asian high of 0.9357. Above the mark of 0.9300, but still too far from the highs. On Tuesday evening, AUD/USD broke above the level of 0.9300 and hit the mark of 0.9354 against the background of the coincidence of technical factors and the general weakening of USD. Retail sales in Australia in March failed to meet expectations (their growth was +0.1% vs. +0.3%).

The fell short of forecasts activity index AiG and the slow growth of HSBC PMI index in the services sector in China even more have clouded the macroeconomic picture. The AUD/USD has retreated from yesterday's high, but still is trading above the mark of 0.9300, which is a positive factor for the bulls technically.

Today, on May 7, 2014, in Congress, it will be held the speech of FRS Janet Yellen. The speech could trigger a surge in volatility. It is necessary to monitor the level of support 0.9300. If it is broken, the bears rush to the next level of 0.9280. The growth will be constrained by Tuesday maximum of 0.9366.

Central Pivot: 0.9329, below are located the support levels of 0.9289, 0.9228 and 0.9188, and above - resistance levels of 0.9390, 0.9430 and 0.9491. Time Moving Averages deployed up, 200SMA is at 0.9279, and the daily 20EMA - at 0.9286. Local deployed up and RSI is at 58.

Yesterday, the NZD/USD was among the pairs that showed the best results - the price soared to multi-year highs against the background of widespread sales of USD. Data of employment in New Zealand fell short of forecasts, but the rollback of NZD/USD from the overbought levels, has occurred because the representatives of RBNZ`s guilt, who warned about the possibility of CBR interventions to curb the further growth of NZD. During the day, the dynamics of the pair NZD/USD will be determined by the general mood of the market against USD. Growth can be contained in the area of 0.8750, while support noted at 0.8680 and 0.8750.