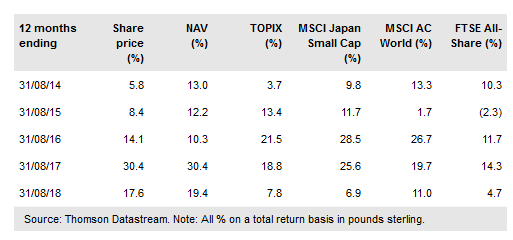

Atlantis Japan Growth Fund Ltd (LON:AJG) is advised by Atlantis Investment Research Corporation (AIRC). Lead portfolio adviser Taeko Setaishi aims to generate long-term capital growth from a portfolio of primarily smaller-capitalisation Japanese equities. AIRC’s philosophy is that over the long term, a company’s share price performance is driven by its earnings growth, especially for smaller companies. Setaishi notes that Japanese equities have experienced negative investor fund flows in 2018, which has had a large impact on the Japanese stock market. However, while overall economic growth in the country remains modest, the adviser is continuing to find companies with attractive fundamentals that are trading on reasonable valuations, particularly in small and mid-caps. While recent performance has been more challenging, AJG has outperformed its benchmark TOPIX index over the last one, three, five and 10 years.

Investment strategy: Four-stage stock selection

Setaishi employs a largely unconstrained approach to individual stock selection, seeking companies with strong fundamentals and attractive valuations. She uses a four-stage investment process: periodic screening, company visits, in-depth fundamental research and the construction of a buy list. Sector allocations can vary markedly compared with the TOPIX index; for example, at end July, c 45% of the portfolio was invested in industrial stocks versus a benchmark weighting of c 8%. Gearing of up to 20% of NAV is permitted; net gearing was 4.2% at end July 2018.

To read the entire report Please click on the pdf File Below: