Mini-crash for equities ignites panic selling? Check.

The commodity super-slump, ever-widening credit spreads, corporate sales recession and rapid deterioration in market internals throughout June and July assured a reassessment of risk. The brutality and swiftness of that risk reassessment was less destructive for those who respected the dozens of warning signs and acted proactively.

Extremely oversold conditions and short covering spark panic buying? Check.

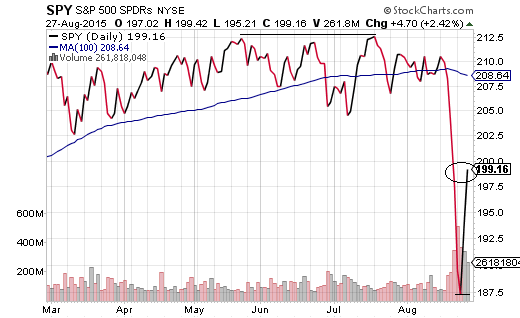

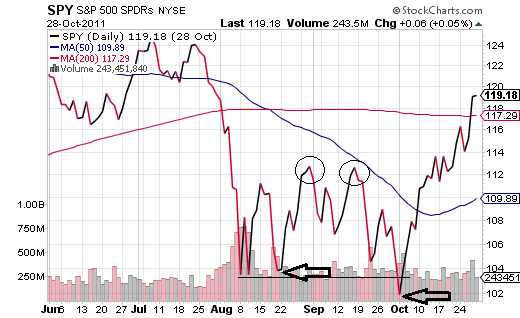

As I explained on Tuesday after six days of relentless price depreciation, the S&P 500 had only closed on the lowest end of its 3-standard-deviation range (0.13% probability) on two other occasions – at the tail end of the eurozone sell-off (10/3/2011) and on Tuesday, 8/25/2015. That’s why I wrote in Tuesday’s article, “Yes, you’re going to see higher prices in the immediate term. Relief rallies happen.”

On the other hand, corrections in other key historical periods (e.g., 1987, 1998, 2010, 2011, etc.) suggest that relief rallies are likely to be short-lived. Typically, stock prices bounce significantly off potential lows, then retest those lows a few weeks later. The S&P 500 SPDR Trust (NYSE:SPY) plunged 16% in late July-early August of 2011. The exchange-traded index tracker went on to recover one-half (nearly 8%) in late August and September, but ultimately broke to new lows in early October.

Similarly, the current correction for SPY came close to 12%. Should anyone be surprised in the vehicle’s ability to reclaim one-half (approximately 6%) of the erosion in price? If history teaches us that benchmarks tend to retrace half of their losses before retesting their lows – if you feel like you’ve been here before and you don’t choose to be scarred like that again – perhaps you might anticipate better buying opportunities in the weeks ahead.

The critical concern at this juncture, however, is to address whether or not new information genuinely makes risk taking more desirable. For instance, have prospects for the global economy truly improved? Are corporations actually going to post top-line revenue increases in the 3rd quarter or blockbuster profitability in the 3rd quarter? Will the Federal Reserve’s timeline for tighter borrowing costs be compatible with real prospects for the U.S. economy? If the answers to these questions are “affirmative,” then stocks may be off to the races.

Let’s start with the macro-economic backdrop. Is it possible that the seasonally adjusted, revised-and-re-revised GDP of 3.7% for the U.S. in Q2 is a game changer? Probably not. For one thing, the economic growth for the year is at 2.2% – the same low annualized rate that it has been throughout the six-year recovery. Second, the most respected forecasting arm of the Federal Reserve, the Atlanta Fed, anticipates 1.4% 3rd quarter GDP, which means decelerating activity. Last, but hardly least, the global economy is reeling, from debt-slammed Europe to commodity dependent Latin America to recession-wracked China. It follows that prospects for the global economy do not look substantially better, other than the hope and faith that investors may place in China’s multi-faceted stimulus efforts.

Perhaps there is new data to suggest that corporations are growing their bottom line earnings per share that would justify a sustainable bullish stock uptrend. This does not look to be the case. According to S&P data compiled by the web log, Political Calculations, trailing 12-month earnings per share for the S&P 500 have declined from S&P analyst projections throughout 2015 from the projections analyst made three months ago (May 20, 2015), six months prior (February 15, 2015) and nine months earlier (November 13, 2014). Top-line revenue? The revenue recession began at the start of 2015 as the Dow Industrials posted sales declines in Q1 (-0.8%) and Q2 (-3.5%); analyst projections for sales declines are coming in at -4.0% for Q3.

So new information on the global economic expansion is not particularly compelling. Meanwhile, companies do not appear to be enhancing their top or bottom lines, which does not help price-to-sales (P/S) or price-to-earnings (P/E) valuations. Why, then, would stock investors become enchanted by anything that has taken place in the last few days?

Granted, President of the New York Fed, Bill Dudley, helped send stocks rocketing on Wednesday (8/26) with commentary that hiking the Fed’s overnight lending rate in September is looking “less compelling.” Anything that pushes off the possibility of higher debt servicing costs or higher financing costs excites stock bulls.

Keep in mind, of course, nobody at the Fed has suggested that they would not raise interest rates here in 2015. It follows that the hope for a continuation of Fed accommodation – hope for a rate hike delay, a slower pace for rate hikes (e.g., every other meeting), and/or smaller increments (one-eighth of a point) – remains the best bet for stock bullishness.

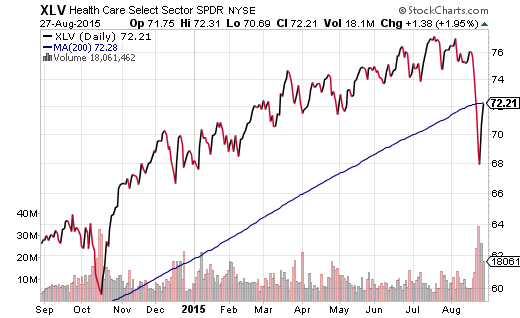

We are still proceeding with caution. Most of our clients have 50% exposure to domestic equity ETFs such as iShares S&P 100 (NYSE:OEF), SPDR Select Health Care (NYSE:XLV), iShares U.S.A. Minimum Volatility (NYSE:USMV), Vanguard Mid Cap Value (NYSE:VOE) and Vanguard High Yield Dividend (NYSE:VYM). In some instances, we have bought the dips on accidental high yielding dividend aristocrats like Wal-Mart (NYSE:WMT). Investment grade bonds make up 25% of most portfolios with funds like iShares 3-7 Year Treasury (NYSE:IEI) and Vanguard Total Bond Market (NYSE:BND).

Most importantly, in May and June, when the S&P 500 regularly sat near the 2100 level, we raised our money market cash account levels. Those cash levels are still at 25%. The purpose? Cash reduces portfolio volatility during periods of market stress, limits the downside loss during sell-offs and provides opportunity to buy quality assets at lower prices. Even if I am wrong about the S&P 500 retesting its lows, we are unlikely to miss the bull train as we await a definitive confirmation of improving market internals.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.