The white metal is priced for an economic outcome that’s unlikely to materialize.

With liquidity-fueled assets outperforming in 2023, they’ve decided that QT and higher interest rates are not going to spoil their party. Moreover, with silver and gold also liquidity beneficiaries, they have adopted similar attitudes. However, while the gambit can persist in the short term, a major climax should unfold over the medium term.

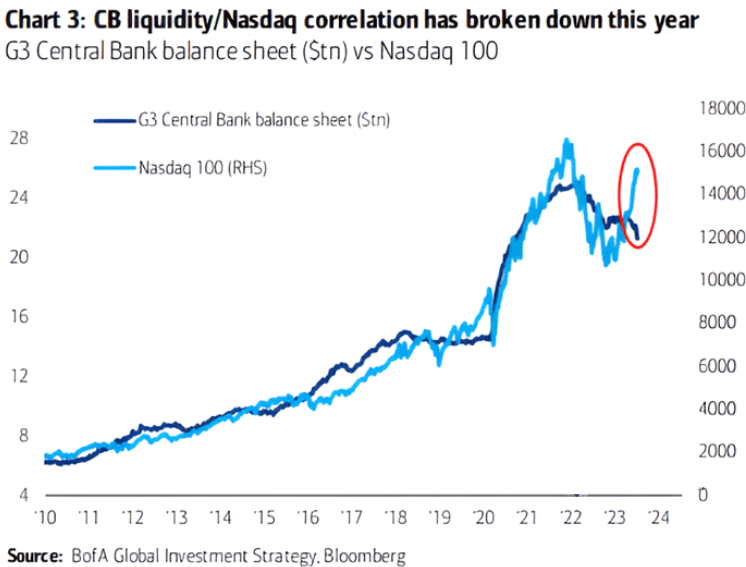

To explain, the light blue line above tracks the Nasdaq 100, while the dark blue line above tracks the combined balance sheets of the Fed, the ECB, and the BOJ. If you analyze the divergence on the right side of the chart, you can see that AI optimism has the crowd assuming that liquidity no longer matters.

But, with QT continuing to intensify, a Big Tech drawdown should sink the S&P 500 and capsize the PMs.

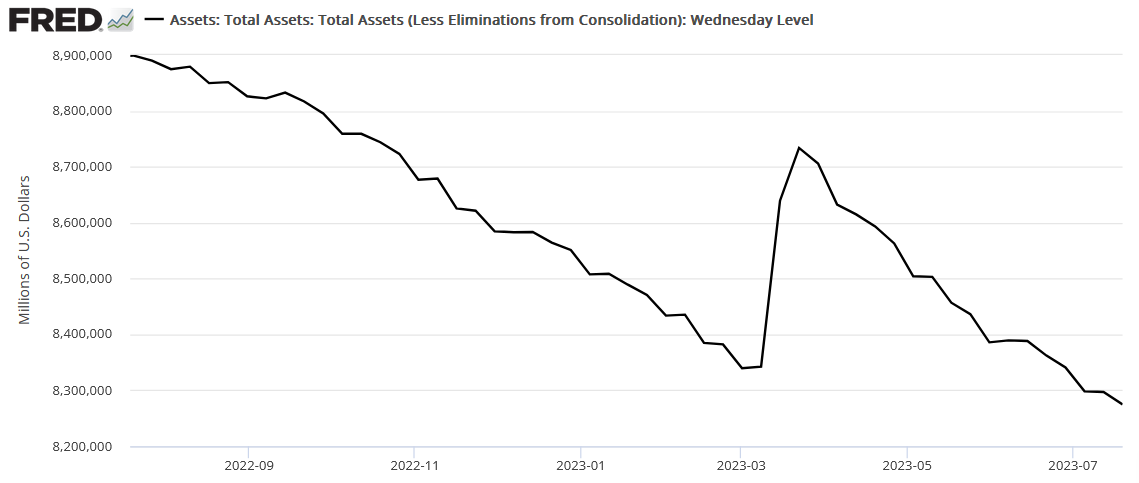

To explain, the Fed’s balance sheet hit another cycle low this week (updated on Jul. 20), as the bank-run rally is long gone. As such, the central bank continues to siphon liquidity out of the system, and the policy action should have immense consequences in the months ahead.

For example, we have stated repeatedly that higher interest rates are the first part of our bearish fundamental thesis, and the second is a recession. Furthermore, while the US Dollar Index benefits from higher Treasury yields, it often soars during periods of economic stress. And with recession winds blowing despite the soft landing narrative, historical probabilities continue to support an ominous economic conclusion.

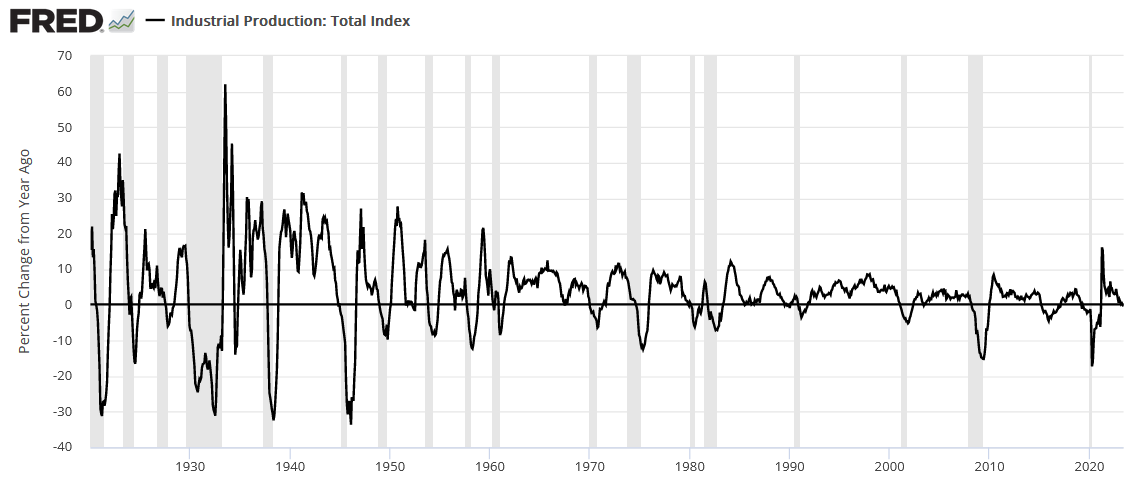

To explain, the black line above tracks the year-over-year (YoY) percentage change in U.S. industrial production, while the vertical gray bars represent recessions. And on Jul. 18, the metric went negative YoY for the first time since before the coronavirus pandemic.

Moreover, while a false signal was realized in 2015, 18 of the last 23 times U.S. industrial production has gone negative YoY, it’s culminated with recessions (since 1920). As a result, while silver is priced for perfection, storm clouds continue to form, and it should not be a surprise if (when) an economic malaise arrives.

Resilient Consumers

Before the second act can begin, the liquidity drain should continue as consumers remain relatively cash rich. As evidence, Bank of America (NYSE:BAC) – the second-largest U.S. bank – released its second-quarter earnings on Jul. 18. CFO Alastair Borthwick said during the Q2 conference call:

“Broadly speaking, average deposit balances of our consumers remain at multiples of their pre-pandemic level, especially in the lower end of our customer base.”

He added:

“The consumer is still in a pretty healthy place. You can see that in the unemployment statistics, and you can see it in the way that they're just continuing to spend a little bit more money YoY. So, you know, I feel like we've been pretty consistent. The consumer is pretty resilient. That remains the case, and we're benefiting it from right now.”

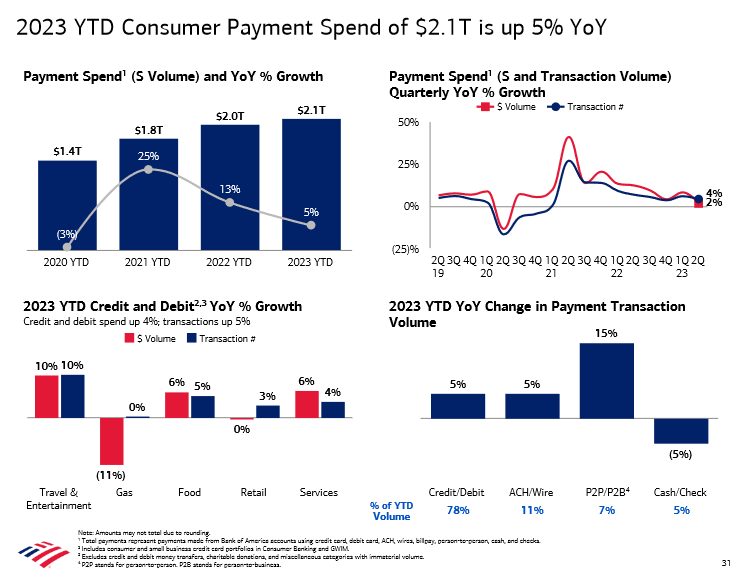

To explain, Bank of America has consumer spending up by 5% YoY, with strength seen in travel & entertainment and services. So, while we warned throughout 2022 that consumers would keep the Fed’s foot on the hawkish accelerator, little has changed. They’re still spending money, and as Bob Prince noted, it’s driven by income, not credit growth. And with oil prices ratcheting higher, the outlook is bullish for MoM inflation.

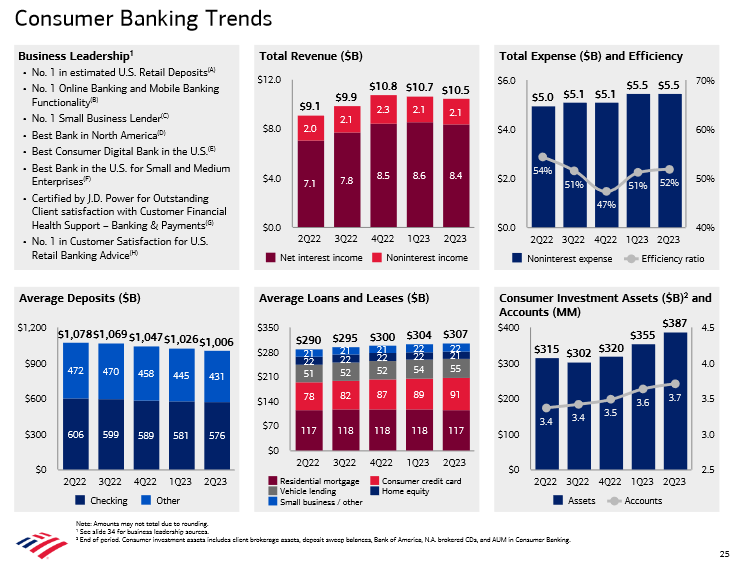

To explain, Bank of America has the largest U.S. retail deposit base, and the chart at the bottom left shows how checking account balances have only declined by $30 billion from their Q2 2022 high of $606 billion. In contrast, the chart at the bottom right shows that consumers’ investment assets have risen by $72 billion over that timeframe. As such, Americans are far from tapped out, and financial conditions should continue to tighten to eradicate inflation.

Overall, the crowds’ misguided pivot hopes hurt the U.S. dollar. But, that narrative reversed on Jul. 20, as interest rates and the USD Index rallied. And with more of the same poised to materialize over the medium term, gold, silver and mining stocks should suffer as the Fed further suppresses the U.S. economy.

Why do you think risk assets have ignored the liquidity drain?