We spend a lot of time reading forecasts. The financial news media is rife with new articles every day that take a position on the near-term future of inflation, interest rates, and stock prices. But are these forecasts of any use? James Montier, an author on the topic of behavioural finance, says no.

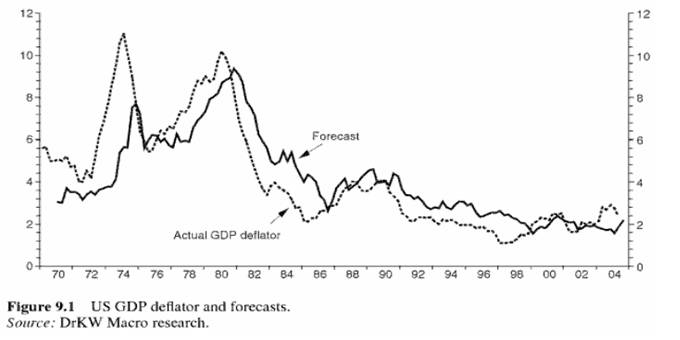

He has compiled and aggregated past forecasts for a number of popular financial metrics. The following chart illustrates how well forecasts of inflation have approximated actual inflation over the last several decades:

Note that the forecasts of the deflator actually lag the actual deflator! This forecast is telling you what happened, rather than what is about to happen!

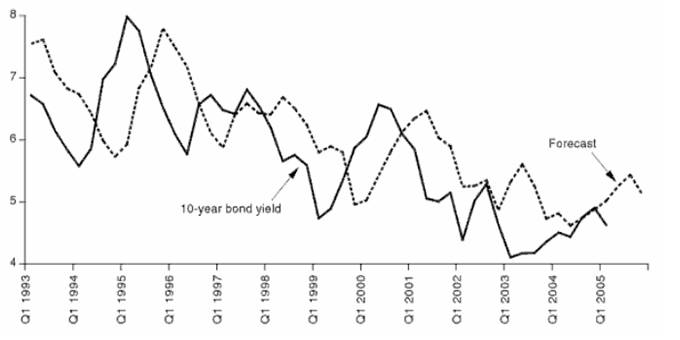

Next, consider forecasts of the US government 10-year bond yield:

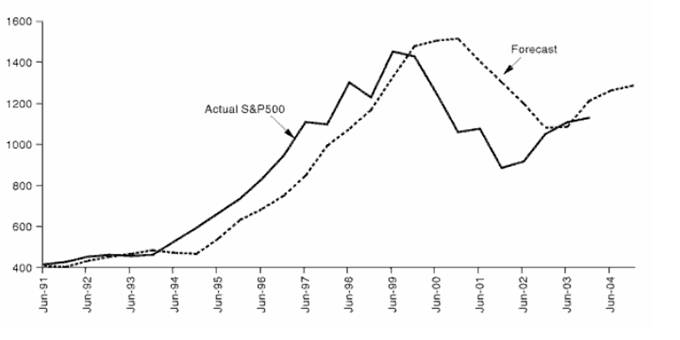

Once again, the same thing seems to be occurring, where the forecast is simply telling us what has already happened! Finally, a similar phenomenon occurs when forecasts of the S&P 500 are considered:

Of course, it should be noted that these forecasts are considered in the aggregate, whereas some forecasters may be able to consistently outperform others. However, there does appear to be a lack of supporting evidence that some forecasters are clearly superior.

Sixth-century BC poet Lao Tzu remarked that "those who have knowledge don't predict" while "those who predict don't have knowledge". So if forecasts are so useless, why do we spend so much time making them and reading about them?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Are Historical Forecasts Of Any Value?

Published 04/02/2012, 08:22 AM

Updated 07/09/2023, 06:31 AM

Are Historical Forecasts Of Any Value?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.