On June 20, 2016, we issued an updated research report on AptarGroup, Inc. (NYSE:ATR) . The company will benefit from broad product diversification, expansive geographic reach and product introductions. Moreover, incessant efforts to reduce costs will aid margins.

The company reported first-quarter 2017 earnings per share of 77 cents, up 4% year over year. Earnings also beat the Zacks Consensus Estimate of 75 cents. Earnings came at the higher end of the company’s guidance range of 72–77 cents per share.

For second-quarter 2017, AptarGroup expects earnings to be in the range of 92–97 cents. Compared with the comparable adjusted earnings per share of 87 cents for the prior-year quarter, the mid-point of the guidance reflects 9% improvement year over year. Growth will be driven by the Pharma and Food + Beverage segments.

In the Beauty + Home segment, AptarGroup continues to proactively manage costs and remains focused on higher growth areas such as skin care, cosmetics and home care markets. During the quarter, the company participated in several global beauty product launches including Estée Lauder's revitalizing eye gel, which features AptarGroup’s Skin Master cool touch applicator. It is increasing presence in the growing color cosmetics market. The company’s dispensers were selected for two new global liquid foundations by Coty and LVMH. In Europe, L'Oreal selected its airless serum dispenser for a new professional hair care product and the Miracle-Gro brand is using the dispensing pump for a line of plant care products.

The Pharma segment continues to benefit from strong demand across its portfolio of devices, mainly for devices used for allergy treatment, decongestions and ophthalmics along with components sold to the injectables markets. In the first quarter, AptarGroup announced that its ophthalmic squeeze dispenser was the very first and only U.S. FDA-approved multi-dose delivery system for prescription eye treatment formulations without any preservatives. Its nasal spray pump was featured on the launch of another generic prescription allergy treatment in the U.S.

Further in the quarter, AptarGroup received an order for the first integrated electronic nasal lockout device (Aptar’s eLockout) approved by the EMA following a multi-year development with Takeda Pharmaceuticals International AG. The device uses advanced electronic technology that enables safe patient compliance by controlling the number of doses available during a 24-hour period and also features a child-resistant cap. This marks a major milestone for the company given that the eLockout device is the first and only fully integrated electronic nasal drug delivery device to be approved by a European regulatory authority.

Moreover, the company signed an agreement to acquire a 20% minority ownership position in Kali Care, a Silicon Valley-based technology company, which provides digital-monitoring systems for ophthalmic medications. AptarGroup’s leading dispensing technologies in combination with Kali Care’s smart sensors, data analytics and cloud services has the prospects to become a valuable solution for clinicians. Last year, the company entered into a partnership with Propeller Health, a leading digital platform for respiratory health management, to develop a fully-integrated connected metered dose inhaler (cMDI) that combines electronic sensing, dose counting and wireless communicating capabilities. These strategic collaborations underline its endeavors to bring innovation in healthcare.

AptarGroup acquired Mega Airless in 2016. This transaction was a key element of its strategy to expand portfolio and accelerate growth in the airless systems markets. The company has been able to achieve all of the financial targets with Mega through the first year. Going forward, AptarGroup anticipates further acquisitions to drive growth.

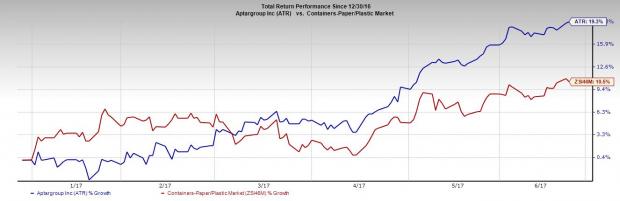

AptarGroup outperformed the Zacks categorized Containers-Paper/Plastic subindustry, year to date. The company's shares gained around 19.3% while the industry increased roughly 10.5%. Investors appreciate the company’s commitment to cost containment across business segments, while focusing on the key areas such as innovation, sales, marketing and new business development.

AptarGroup has a long-term estimated earnings growth of 9.33%. The company has delivered an average positive earnings surprise of 1.78% in the last four quarters. Its earnings estimate for fiscal 2017 has gone up 5% and for fiscal 2018 has moved up 4%.

At present, AptarGroup sports a Zacks Rank #1 (Strong Buy).

Other top-ranked companies in the industrial product space include AGCO Corporation (NYSE:AGCO) , Deere & Company (NYSE:DE) and Rockwell Automation Inc. (NYSE:ROK) . AGCO and Deere flaunt the same rank as AptarGroup while Rockwell Automation carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has expected long-term growth of 12.11%.

Deere has an expected long-term growth of 9.17%.

Rockwell Automation has an expected long-term growth of 10.63%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AptarGroup To Grow On Product Strength & Cost Containment

Published 06/20/2017, 09:59 PM

Updated 07/09/2023, 06:31 AM

AptarGroup To Grow On Product Strength & Cost Containment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.