By Sarah Roden

On April 9, LinkedIn Corporation (NYSE:LNKD) announced plans to acquire lynda.com, an online learning company, in a deal valued at $1.5 billion. The deal is expected to close in the second quarter of this year and will be paid in approximately 52% cash and 48% stock.

Lynda.com offers members unlimited access to 128,000 educational videos on business, software, technology, and creative skills. The videos are taught by industry experts and are provided in multiple languages. Different subscriptions are available for students, companies, and government entities.

The acquisition will bolster LinkedIn’s platform by turning the professional networking site into a professional development site. LinkedIn and lynda.com will continue to operate independently but will begin exploring methods of integration. LinkedIn noted that most lynda.com employees will be joining LinkedIn in the future.

LinkedIn CEO Jeff Weiner commented in a press release, “The mission of LinkedIn and the mission of lynda.com are highly aligned. Both companies seek to help professionals be better at what they do.” In an interview with CNBC, Weiner elaborated that LinkedIn users will be able to use courses on lynda.com to acquire skills necessary for a specific position. Weiner noted that the acquisition will be mutually beneficial to both websites as LinkedIn has the recognizable platform and large user base while lynda.com has a “premium library of skill-based courses.”

Analysts are primarily bullish on LinkedIn following the announcement of the lynda.com acquisition.

On April 9, analyst Mark Mahaney of RBC Capital reiterated an Outperform rating on LinkedIn, though he did not provide a price target. Mahaney noted that lynda.com is a “logical strategic fit for LinkedIn” due to complementary synergies and business models. The analyst added, “LinkedIn believes that the lynda.com acquisition could increase the company’s TAM by $30B, including corporate employee education and certifications.”

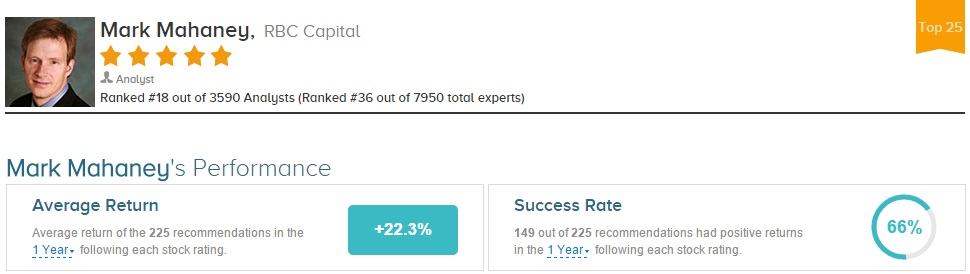

Mark Mahaney has an impressive track record recommending LinkedIn, making 11 ratings on the website since February 2012. He has a 100% success rate recommending the professional network website with a +46.2% average return per LKND recommendation. Overall, Mahaney has a 66% success rate recommending stocks with a +22.3% average return per rating.

According to Smarter Analyst, Youssef Squali of Cantor Fitzgerald maintained a Buy rating on LinkedIn with a price target of $280. Squali views the lynda.com acquisition as a “significant step toward building the world’s first economic graph.” Because the missions of each site are well-aligned with each other, the partnership is poised to address the “skills gap” as professionals will “be empowered to further develop their skills in order to get hired into the right job.” Squali added the deal will extend LinkedIn’s addressable market to the highly fragmented corporate employee education and professional certification market,” which is a $30 billion opportunity.

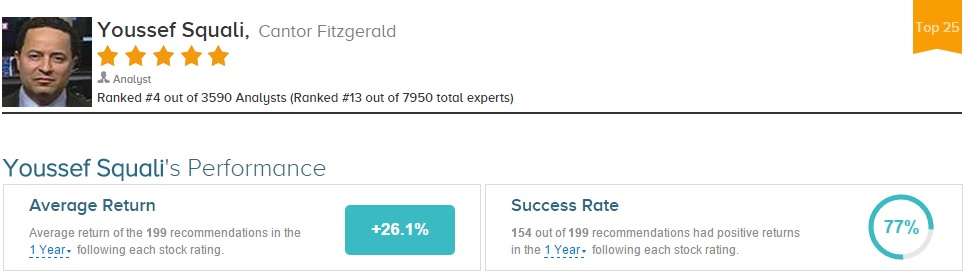

Youssef Squali has rated LinkedIn 12 times since November 2011, earning an 89% success rate recommending the website with a +16.1% average return per LNKD rating. Overall, Squali has a 77% success rate recommending stocks with a +26.1% average return per recommendation.

On average, the top analyst consensus for LinkedIn on TipRanks is Moderate Buy.

Sarah Roden writes about stock market news. She can be reached at Sarah@tipranks.com