Finally, food! The kids had their slices. I had a break from my conversation. And I was hungry after coaching and refereeing eight periods of second-grade basketball.

I grabbed the greasiest slice of Margherita pizza on the tray and folded it like a proper East Coast refugee. And paused.

“Coach Brett?”

“Yeah buddy,” I replied to one of my players, slice still in hand.

“Do you have 40 cents?”

“No, sorry, buddy.” I shrugged. And I was attempted to eat once again.

Then my daughter approached.

“Dad. Do you have 40 cents?”

Forty cents. That was pretty specific. One could be a coincidence. Twice felt like a hustle.

“Who taught your team how to panhandle like pros?!” I turned to Coach Sean, who was being approached by another member of our second-grade basketball team. Asking for forty cents.

Apparently, inflation has spilled over into gumballs. Their multi-decade “ceiling” of 25 cents officially cracked. Our postseason basketball party turned into a hunt for loose change.

To be fair, I “held strong” only because I was already broke. Minutes earlier, my daughter raided my wallet for dollar bills, which were promptly “invested” in the video arcade. Which was conveniently located next to the suddenly half-empty gumball machine.

The kids had a field day. It took me back, as I ranted to my co-coach, to my time working in downtown San Francisco. The best panhandlers knew how to be specific and modest in their requests. Forty cents.

Alright, let’s flip this around and pretend we are asking ourselves for living expenses. And instead of raiding Coach Brett’s wallet, we are tapping our own brokerage account.

You know, the account that we contributed to for decades. Pullbacks aside, we mostly watched it grow. And grow. And grow.

Now it’s time to retire. Which means we’re no longer contributing to the account.

Most investors want their monthly “ask” of their own accounts to be small. This isn’t a rainy-day fund, it’s a retirement fund. Twelve months of living expenses aren’t enough. Twelve years is more like it, with even more being even better.

We hope retirees are not planning to live on loose change. Let’s say we need $6,000 per month. We’re going to have to scrape this from the giant pile of money we spent our lives accumulating.

So how high does that stack of greenbacks need to be? Well, 553 vanilla investors recently surveyed by Bloomberg MLIV Pulse said $3 million to $5 million.

Between $3 million and $5 million for a comfortable retirement! These “poor” guys and gals.

They obviously have cash but no cash flow. If they had regular income, they wouldn’t need to shoot such high savings goals that, let’s face it, are unrealistic to most folks.

We dividend investors are different. We take our savings and buy assets that generate income. Which means we can turn a modest pile of money into steady cash streams.

“Toll bridges” like Alerian MLP ETF (NYSE:AMLP) are my favorite. AMLP owns 15 infrastructure companies—energy middlemen that charge for access to their pipelines.

As long as energy prices merely grind sideways, these toll bridges keep collecting. Which means these dividends continue to get paid.

The world in 2023 has serious supply constraints in the energy market. It’s a geopolitical mess out there. So, skip the producers. Give me the pipelines for a steady, secure retirement.

When we last discussed AMLP, we highlighted its recent dividend increase to $0.75 per share. But it’s tough to keep up with AMLP’s payout! The fund recently raised its dividend again to $0.77 per share!

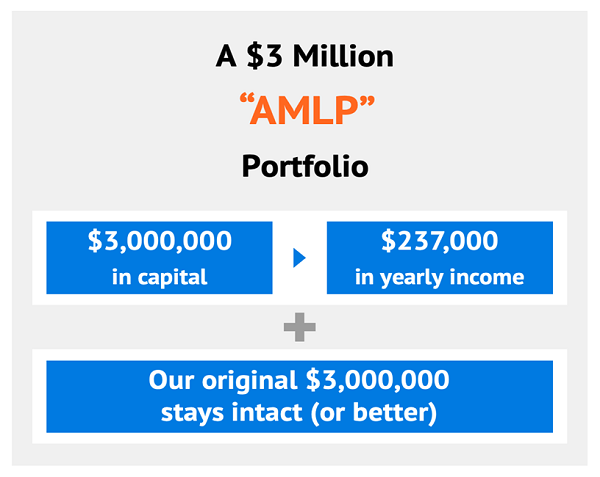

That $0.77 annualizes to a tip-top 7.9% yield. Or $237,000 in dividend income on the $3 million retirement minimum quoted in the survey.

What if we “only” have a million dollars? No problem. That’s still $79,000 in annual dividend income. Which covers the $6,000 in monthly expenses we discussed earlier (with room to spare!), not to mention (but I must) Social Security.

Of course, we want to diversify. We’ll give AMLP more “big yield” companies as we construct our retire on dividends portfolio.

See? We don’t need millions (with an “s”) of dollars to retire well. Attainable financial goals are fine, provided we know how to turn savings into reliable income.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."