American Water Works Company (NYSE:AWK) announced that its subsidiary, New Jersey American Water, will invest $4 million in 2017 to replace aging water mains that were installed way back in the 1900s.

The company aims to replace 11,000 feet of old pipelines and the old and soiled lines will be replaced with ductile iron pipes. The replacement of the mains will lower the possibility of failure of the water pipes and ensure continuous supply to its customers in the region.

This water main replacement project is part of New Jersey American Water’s multi-million dollar program to strengthen its water infrastructure and replace the old pipes before they reach the end of useful service life.

Ongoing Maintenance Work

The company, along with its subsidiaries, continues to strengthen the existing infrastructure. On the other hand, it is also replacing old and damaged pipelines, upgrading water treatment plants and rehabilitating the water storage facilities with the help of its units.

In June 2017, American Water Works announced that its subsidiary, Illinois American Water's $8.5 million Metro East water distribution system project is nearing its finish. (Read more: American Water Works Unit's $8.5M Project to Close Soon )

Water Industry Needs Consistent Investment

The overall water infrastructure in the United States is quite old. Some of the water mains are nearly a century old and require immediate replacement. Hence, all big operators in this fragmented water utility space are investing on a regular basis to upgrade and improve the quality of their existing infrastructure.

American Water Works aims to invest $5.9 billion from 2017 through 2021. In the past couple of months, the company has been very active in expanding operations through acquisitions and upgrading its existing infrastructure. It provides water and waste water services to nearly 15 million customers.

Aqua America Inc. (NYSE:WTR) , another utility, has plans to make capital investments of more than $450 million in 2017 as part of an ambitious investment target of more than $1.2 billion in the 2017-2019 period. Connecticut Water Service Inc. (NASDAQ:CTWS) aims to invest more than $150 million in the 2017-2019 period to strengthen its existing infrastructure.

Price Movement

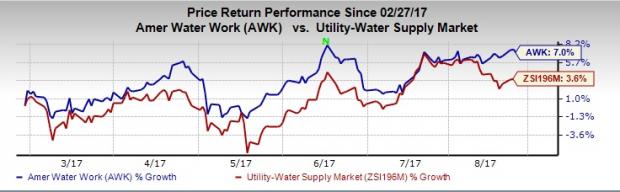

American Water Works’ stock has gained 7% in the last six months, outperforming the 3.6% rally of the industry.

The utility is well poised to benefit from strategic acquisitions and regulated investments to strengthen the existing infrastructure, which, in turn, is expanding customer base and providing a boost to its top line.

Zacks Rank

American Water Works currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock to Consider

A better-ranked stock in the same space is SJW Corporation (NYSE:SJW) currently sporting a Zacks Rank #1.

SJW Corporation’s 2017 Zacks Consensus Estimate moved up 15.4% to $2.47 in the last 30 days. The company reported positive earnings surprises in three out of last four quarters resulting in average surprise of 23.9%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Connecticut Water Service, Inc. (CTWS): Free Stock Analysis Report

American Water Works (AWK): Free Stock Analysis Report

SJW Corporation (SJW): Free Stock Analysis Report

Aqua America, Inc. (WTR): Free Stock Analysis Report

Original post

Zacks Investment Research