American Public Education, Inc. (NASDAQ:APEI) reported first-quarter adjusted earnings per share of 28 cents, which missed the Zacks Consensus Estimate of 29 cents by 3.5%. Adjusted earnings also declined 56.3% year over year due to declining revenues.

Revenues and Enrollment

Total revenue of $75.7 million surpassed the Zacks Consensus Estimate of $74.5 million by 1.6%. Revenues however decreased 9.9% year over year owing to declining revenues at both American Public University System and Hondros College of Nursing.

The company operates in two segments – American Public Education Segment (APEI) and Hondros College, Nursing Programs (HCN).

APEI primarily includes operations of American Military University and American Public University, together referred to as American Public University System, Inc. (APUS).

Revenues dropped 10.7% to $68.1 million from $76.3 million in the prior-year quarter due to a 9% decrease in net course registrations.

Net course registrations declined due to a 26% decrease in net course registrations by new students using Federal Student Aid (FSA) and an 18% decrease in military tuition assistance (TA).

The downside at FSA may be attributed to the company’s efforts to improve its quality mix of students, adjustments to its marketing efforts and increasing competition for online students. The decline in Net course registrations using TA is largely due to changes in the TA program by the Department of Defense.

Completion rates of undergraduate students using FSA at APUS increased approximately 19% year over year.

New student enrollments using veteran benefits slipped 13%, while enrollment of students using cash and other sources increased 8%, both on a year-over-year basis.

Hondros College of Nursing revenues fell 1.8% to $7.6 million from the prior-year quarter owing to lower enrollments.

Total enrollment at the Hondros College Nursing Programs declined 8% year over year to 1,710 students, while new student enrollment increased 22% year over year.

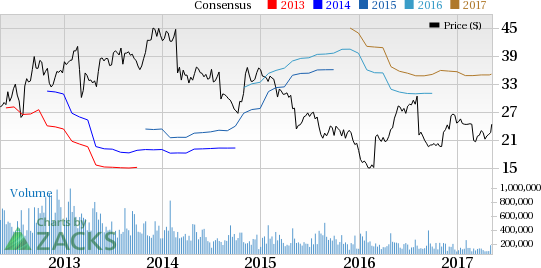

American Public Education, Inc. Price, Consensus and EPS Surprise

Inside the Headline Numbers

Income from operations before interest income and income taxes was $8.3 million, compared with $16.0 million in the prior-year quarter.

Costs and expenses decreased 0.9% year over year to $67.4 million in the quarter.

Selling and promotional or S&P expenses, as a percentage of revenues, rose to 20.4% from 19.6% in the prior-year quarter.

Financials

As on Mar 31, 2017, total cash and cash equivalents were approximately $147.8 million, compared with $120.0 million as of Mar 31, 2016. Capital expenditures were approximately $1.7 million as of Mar 31, 2017, compared with $3.1 million in the prior-year period.

Second-Quarter 2017 Outlook

American Public Education anticipates consolidated revenues to decline approximately 10%–7% year over year.

The company expects earnings in the range of 19 cents to 24 cents per share.

At APUS, net course registrations by new students are expected to decrease between 11% and 7% on a year-over-year basis. Net course registrations are likely to decline between 9% and 6%.

Zacks Rank & Stocks to Consider

American Public Education currently carries a Zacks Rank #3 (Hold).

Better-ranked companies in the same space include Bright Horizons Family Solutions Inc. (NYSE:BFAM) , Bridgepoint Education, Inc. (NYSE:BPI) and Grand Canyon Education, Inc. (NASDAQ:LOPE) .

Bridgepoint Education sports a Zacks Rank #1 (Strong Buy). You can the complete list of today’s Zacks #1 Rank stocks here.

Bridgepoint Education’s 2017 earnings are expected to increase 263.9%.

Bright Horizons’, a Zacks Rank #2 (Buy) stock, full-year 2017 earnings are expected to increase 20.4%.

Grand Canyon, a Zacks Rank #2 stock, is expected to witness 15.1% growth in earnings in 2017.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information >>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Bridgepoint Education, Inc. (BPI): Free Stock Analysis Report

Bright Horizons Family Solutions Inc. (BFAM): Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE): Free Stock Analysis Report

Original post