As I wrote on Monday as US markets were plunging I believed the intraday price action that was unfolding looked suspicious when considering the volume associated with the move, and this is how I ended the post prior to the close.

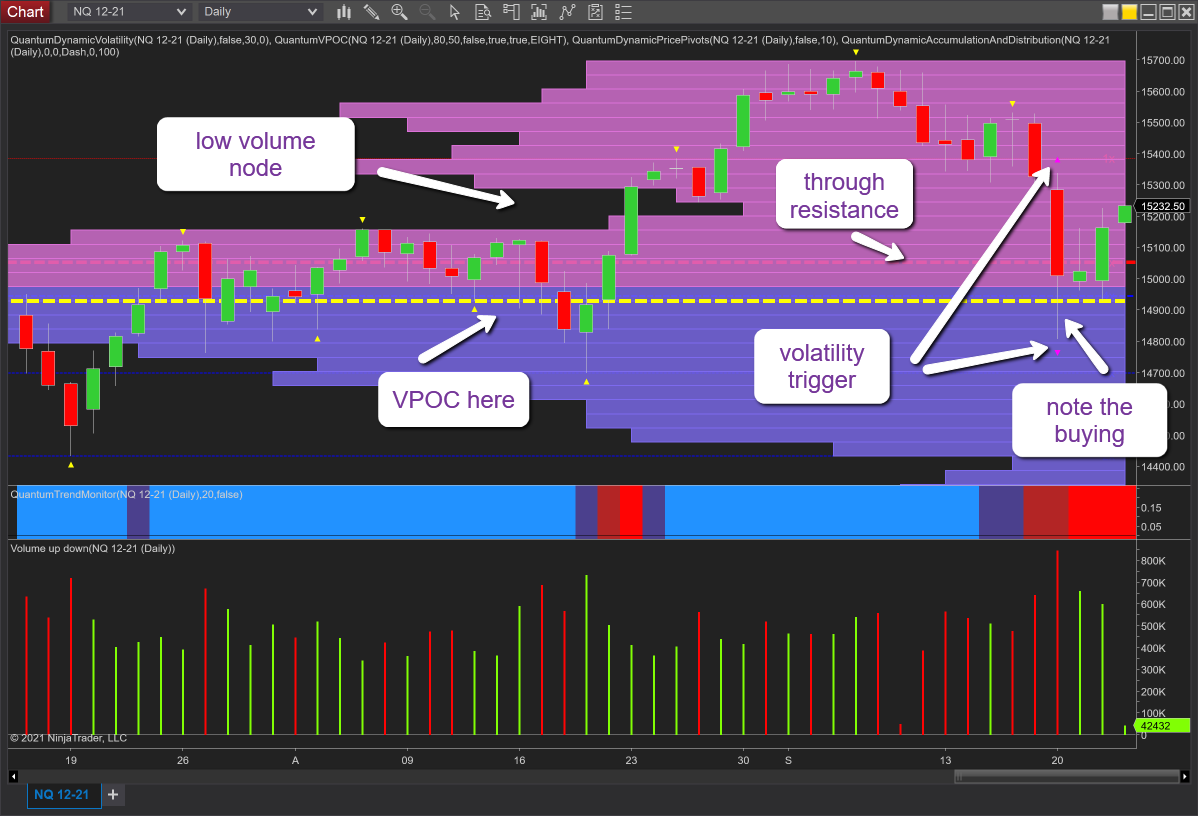

“Second, we are testing the VPOC (the volume point of control) shown with the yellow dashed line at 14,925 where we can expect to find support and see congestion building in the short to medium term as the market settles after this latest washout. Note too how the price has plunged through the low volume node of the VPOC histogram in the 15,200 area which is what we would expect to see. Volume on the Y-axis acts as support and resistance in the same way as price-based s&r does. Hence when we approach low volume areas such as this, or high volume areas at the VPOC itself, this gives us an insight into what to expect next. And in this case, it’s likely to be a period of congestion around the 14,900 area.

Finally, as I mentioned on my Facebook page today’s market gyrations could be seen as a shot across the FED’s bows ahead of the FOMC on Wednesday. We shall see.”

And so it proved to be and since writing the above the session closed with two confirming signals. First, the strength of the buying which appeared late in the session, as evidenced by the depth of the lower wick. Second, the volatility trigger which confirmed the price action had moved outside of the Average True Range (ATR), and when this is coupled with high volume, it confirms the presence of the market makers and big operators and we can therefore expect one of two things to happen. Either congestion within the spread of the candle itself, or a reversal. Furthermore, as I explained in Monday’s analysis, the VPOC was waiting below as denoted with the yellow dashed line and further reason to expect this reaction to be no more than a shakeout as opposed to the start of the big short.

Now with the FOMC out of the way, markets are waking to sunny uplands with the yen complex in a bullish mood. Of these the CAD/JPY is leading the way helped by oil and whilst this analysis has been centered on the NQ E-mini, the same thoughts can be applied equally to the ES E-Mini and also the YM, with all three moving firmly higher and looking set to recover Monday’s losses in double-quick time. And with a low volume node ahead and a breach of the price-based resistance in the 15,000 region, the outlook looks positive once again but it is one that needs to be validated by volume.