Have you been eager to see how Affiliated Managers Group Inc. (NYSE:AMG) performed in Q4 in comparison with the market expectations? Let’s quickly scan through the key facts from this Massachusetts-based global asset management company’s earnings release this morning:

An Earnings Beat

Affiliated Managers came out with economic earnings of $4.68 per share, which beat the Zacks Consensus Estimate of $4.55.

Higher revenues supported earnings.

How Was the Estimate Revision Trend?

You should note that the earnings estimate revisions for Affiliated Managers depicted optimistic stance prior to the earnings release. The Zacks Consensus Estimate has moved marginally upward over the last seven days.

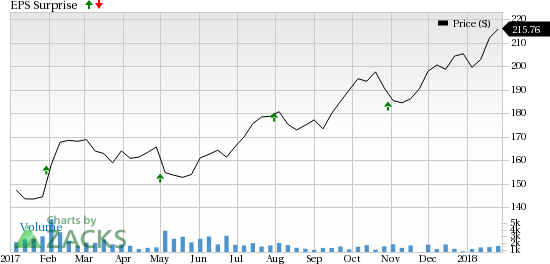

Also, Affiliated Managers has a decent earnings surprise history. Before posting the earnings beat in Q4 the company delivered positive surprises in all four trailing quarters.

Overall, the company surpassed the Zacks Consensus Estimate by an average of 2.1% in the trailing four quarters.

Revenue Came In Lower Than Expected

Affiliated Managers posted revenues of $604.1 million, which lagged the Zacks Consensus Estimate of $607.5 million. The figure was up 9.8% year over year.

Key Statistics

- Recorded $194.1 million charge related recent changes in U.S. tax law

- Net client cash inflows during the reported quarter were $1 billion.

- Assets under management were nearly $836.3 billion as of Dec 31, 2017.

What Zacks Rank Says

The estimate revisions that we discussed earlier have driven a Zacks Rank #2 (Buy) for Affiliated Managers. However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Check back later for our full write up on this Affiliated Managers earnings report!

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Affiliated Managers Group, Inc. (AMG): Free Stock Analysis Report

Original post