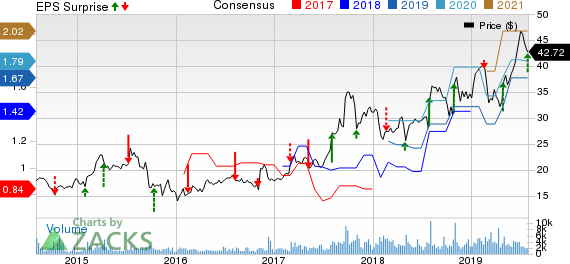

Aerojet Rocketdyne Holdings, Inc. (NYSE:AJRD) reported second-quarter 2019 adjusted earnings of 50 cents per share, which surpassed the Zacks Consensus Estimate of 39 cents by 28.2%. Notably, the bottom line came in line with the figure registered in the year-ago quarter.

Barring one-time adjustments, the company reported GAAP earnings of 54 cents per share, reflecting a solid improvement of 20% from 45 cents recorded in the prior-year quarter. This upside can be attributed to increased sales and operating income in the quarter under review.

Operational Performance

Aerojet Rocketdyne’s second-quarter revenues of $485 million came in 3.8% higher than the year-ago quarter’s figure of $467.2 million. The top line also exceeded the Zacks Consensus Estimate of $474 million by 2.3%.

Total backlog at the end of second-quarter 2019 was $4.6 billion, significantly higher than $3.8 billion registered at the end of the first quarter. Of this, funded backlog amounted to $2.1 billion compared with $1.8 billion at 2018 end.

Total operating expenses increased 3.7% year over year to $413.9 million in the second quarter. Meanwhile, operating income of $71.1 million improved 4.6% from $68 million a year ago.

Segmental Performance

Aerospace & Defense: Revenues at this segment improved 3.8% year over year at $483.1 million. This uptick can be attributed to an increase in defense programs’ net sales primarily driven by the Standard Missile program. However, a decrease in space programs’ net sales affected the segment’s top line.

Meanwhile, the segment’s margin expanded 250 basis points (bps) to 17%.

Real Estate: The segment generated revenues of $1.9 million compared with the year-ago quarter’s figure of $1.6 million.

Financial Update

Aerojet Rocketdyne exited the second quarter with cash and cash equivalents of $744.3 million, up from $735.3 million as of Dec 31, 2018.

Long-term debt amounted to $363.7 million as of Jun 30, 2019, up from $352.3 million as of Dec 31, 2018.

Operating cash outflow from continuing operations summed $31.2 million as of Jun 30, 2019, compared with $24.5 million in the year-ago period.

Free cash flow at the end of the first six months of 2019 was $24.3 million compared with $12.3 million a year ago.

Zacks Rank

Aerojet Rocketdyne has a Zacks Rank #4 (Sell).

Recent Defense Releases

Textron Inc. (NYSE:TXT) reported second-quarter 2019 earnings from continuing operations of 93 cents per share, which surpassed the Zacks Consensus Estimate of 85 cents by 9.4%. The company carries a Zacks Rank #3 (Hold).

Lockheed Martin Corp. (NYSE:LMT) reported second-quarter 2019 earnings of $5 per share, which exceeded the Zacks Consensus Estimate of $4.74 by 5.5%. It carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hexcel Corporation (NYSE:HXL) reported second-quarter 2019 earnings of 94 cents per share, which outpaced the Zacks Consensus Estimate of 88 cents by 6.8%. The company carries a Zacks Rank of 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Hexcel Corporation (HXL): Free Stock Analysis Report

Aerojet Rocketdyne Holdings, Inc. (AJRD): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post