Watching the evening news is becoming more and more like watching a horror film each and every night. With wars, terrorism, shoot-outs in US city streets, and the ever present threat of another pandemic virus; you cannot get through 5 minutes of the news without hearing one of these topics.

While the 24 hour news cycle has certainly hyped many stories, these issues still exist, and remain a detriment to society and the world as a whole. But sadly, these issues highlight the need for protective products and services in this day and age.

Appropriately, there are companies out there that specialize in some sort of personal protection, or personal services during emergencies. Typically, these services are targeted to individual consumers, and or government agencies. Currently, the Protection/Safety segment holds a Zacks Industry Rank of 39 out of 258 (top 15% of all industries). If you watch the news you will easily understand why this industry is ranked so highly.

Stocks To Consider

Lakeland Industries Inc (NASDAQ:LAKE) which carries a Zacks Rank #1 (Strong Buy) manufactures and sells a large range of safety garments and accessories for the industrial and public protective clothing market in the United States and Internationally. The companies produces a wide array of items including; lab coats, high-end chemical protective suits, fire-fighting and heat protective apparel, electrostatic dissipative apparel used in pharma and automotive industries, clean room apparel, and extrication suits for emergency responders to name a few protective items.

Lakeland recently reported Q1 16 earnings results, which revealed that their core business grew by 8% in the quarter, and sales increased 14% year over year. The MERS outbreak in South Korea and the Avian Flu in the Midwest United States drove demand for the company’s ChemMax protective suits.

Further, the exceptional effectiveness of their Ebola related suits has generated new business in the pharma and medical segments. These organic sales enabled Lakeland to beat the Zacks Consensus Estimate with a +11.11% positive earnings surprise.

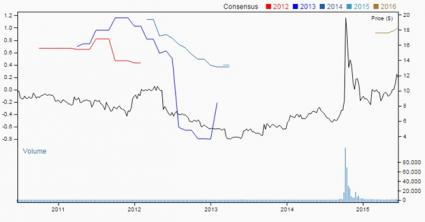

As you can see from the chart below, expectations for Lakeland have significantly increased in the last quarter.

TASER International Inc (NASDAQ:TASR) which carries a Zacks Rank #2 (Buy) develops, markets, and assembles less-lethal conducted energy weapons primarily used in the law enforcement and corrections markets. The company has two segments, TASER Weapons and AXON.

The AXON segment consists of the camera system that utilizes advanced audio-video to record and capture devises worn by first responders, also known as the AXON body camera. Further the AXON segment also contains EVIDENCE.COM, a cloud-based digital evidence management system and warehouse, which offers digital evidence management, sharing analysis, and storage.

In their most recent earnings report (Q1 15), Taser saw net sales increase 23% y/y, the TASER Weapons segment saw revenues increase 18% y/y, the AXON segment saw revenues rise 73% y/y, and total AXON and EVIDENCE.com bookings jumped up 288% y/y. These are stunning growth numbers!

With the recent focus on law enforcement body cameras, Taser is uniquely positioned to take advantage of the trend. Rick Smith, Taser CEO stated, “Taser International is off to an outstanding start in fiscal 2015 thanks to strength in the Taser Weapons segment, as well as continued growth and new wins in the AXON business. New programs such as the Standard Issue Grant Program are examples of how we are partnering with law enforcement agencies for the long term, and we are enthusiastic thus far about the results of our investment.”

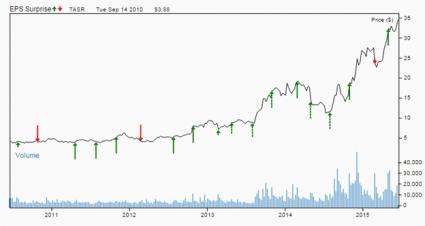

As you can see in the graph below, Tasar’s EPS surprises have the stock price rising rapidly.

Pointer Telocation Ltd (NASDAQ:PNTR) which carries a Zacks Rank #1 (Strong Buy) provides mobile resource management products and services for the automotive, insurance industries, and other mobile tracking markets worldwide. The company operates in three segments, MRM, RSA, and Cellocator.

The MRM segment offers asset tracking, fleet management, stolen vehicle retrieval, and car sharing services. The RSA segment provides towing services, and other mobile auto repair services. The Cellocator segment designs, develops, and produces MRM products, and communication infrastructure products.

In their most recent earnings report (Q1 15), Pointer saw that Net Income increased 28% y/y, and Non-GAAP net income rose 9% y/y. Further, during the earnings announcement CEO David Mahlab stated, “… in most of the regions in which we operate, we grew out MRM service business and we are particularly pleased with the performance of our recently acquired operations in South Africa. We continue to look for additional acquisition opportunities, and our improving cash position is further enabling us to capitalize on this strategy.”

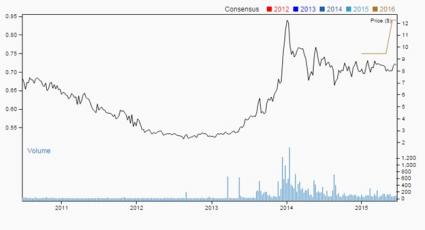

As you can see in the graph below, Pointer has some high expectations going forward.

Bottom Line

It is a dangerous world out there, and there are things we need in which to protect ourselves and our loved ones. If it is a pandemic bird flu, a carjacking, or quelling a riot, these Protection and Safety companies have you covered now, and into 2016.