The highlight of the OECD’s fresh-out-of-the-oven report on the Turkish economy is, IMHO, the difference in productivity between large and small firms in Turkey. In fact, as they show in the report, their ratio is one of the highest in the world. So how do these small firms survive? By going informal: Not paying taxes, social security premiums, etc. This explains the skills/education differences between workers in large and small firms as well.

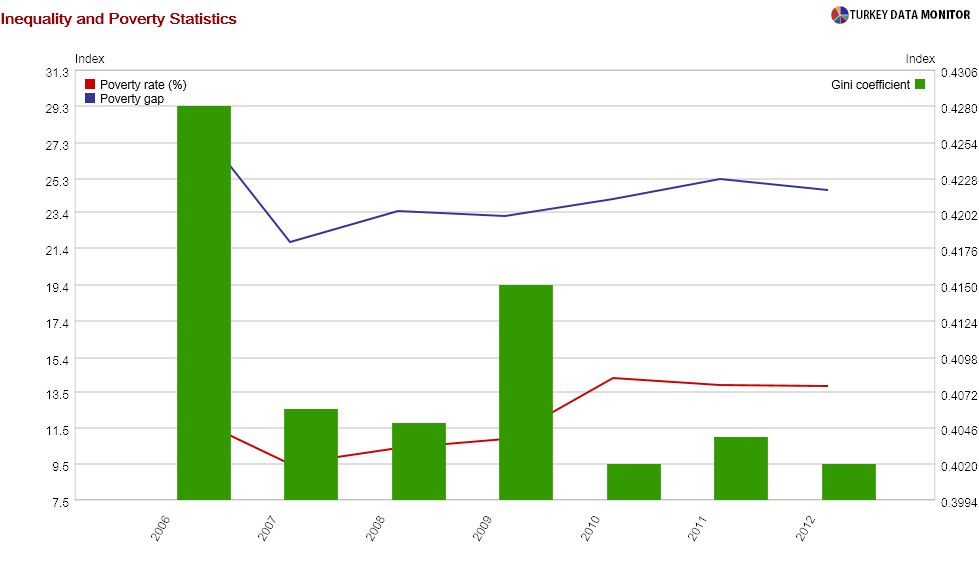

Last but not the least, the OECD report notes the decline in poverty and inequality in Turkey during the last decade, especially in a time when they were rising across the world. This is good news, even notwithstanding the fact that the fall in poverty and inequality has come to a halt in the last few years. But more importantly, as I discussed in a recent column, two out of three of Turkey’s children are under sever material deprivation:(

Changing gears, I also wanted to clarify a couple of things in the column: First, with regards to growth, all emerging markets benefited from the global liquidity flush, which was the main driver of Turkey’s “growth miracle”. Second, I mentioned the low interest rate as the factor that caused private debt to surge, but to be fair, it wasn’t the only factor: The macroeconomic stability and rising incomes in dollar terms because of the appreciating lira also caused debt to increase during the first few years of the AKP’s rule. More recently, the Central Bank’s de facto fixing of the exchange rate caused companies to increase their FX borrowing.