Talking Points:

- Classic "Buy the Dip" Set-up

- End of a 5-Wave Elliott Pattern for GBP/NZD

- A Viable Entry Opportunity Happening Right Now

The AUD/CHF trade we highlighted yesterday worked out very quickly, and now today, we’ll look for a similar result from a GBPNZD set-up, although this trade goes in the opposite direction as the AUDCHF one did.

The daily chart is very straightforward, as price is in an uptrend and is pulling back towards support for a possible bounce.

GBP/NZD Uptrend " title="Pullback in GBP/NZD Uptrend " align="bottom" border="0" height="363" width="680">

GBP/NZD Uptrend " title="Pullback in GBP/NZD Uptrend " align="bottom" border="0" height="363" width="680">

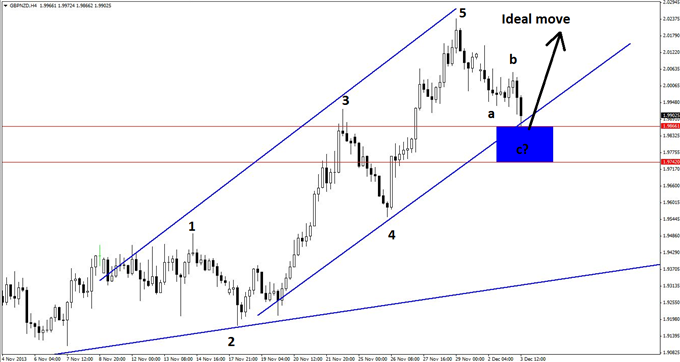

On the four-hour chart below, we see a potential completion of an Elliott wave pattern. The five waves up are clearly marked, and the pullback has been two-legged, with the support zone marking potential end points for the c wave.

GBP/NZD " title="End of a 5-Wave Elliott Cycle for GBP/NZD " align="bottom" border="0" height="362" width="680">

GBP/NZD " title="End of a 5-Wave Elliott Cycle for GBP/NZD " align="bottom" border="0" height="362" width="680">

In this case, a reasonable support area has been derived from previous resistance levels visible on the four-hour chart. Together, the final support zone is 1.9742-1.9866.

As traders will note, price has already begun to flirt with the support area and may be prepping for a move already.

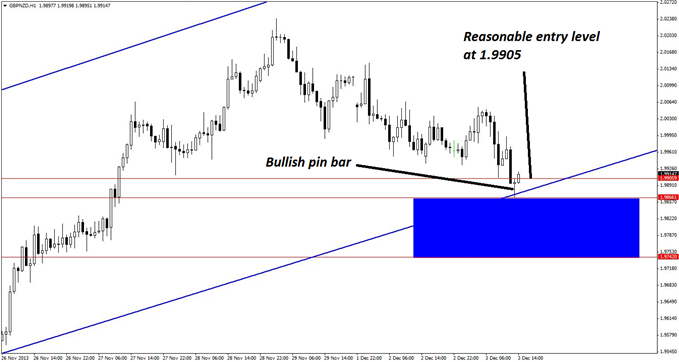

The trigger would be a bullish pin bar, a bullish engulfing pattern, or a bullish reversal divergence on the hourly chart (see below). At the time of writing, the first bullish pin has already formed, as shown.

GBP/NZD Entry Opportunity Happening Now" title="GBP/NZD Entry Opportunity Happening Now" align="bottom" border="0" height="362" width="679">

GBP/NZD Entry Opportunity Happening Now" title="GBP/NZD Entry Opportunity Happening Now" align="bottom" border="0" height="362" width="679">

The first entry would have been near the 1.9905 level, and those who are able to hop on at this level on a price pullback can probably still get on this move. If not, the other option would be to wait and see if price pulls back to the support zone for another swipe before heading upwards.

This is trend trade, so the set-up should be traded at full (but controlled) risk. Those who are unable to get in on the first entry should take solace in the fact that many of these trades do give a second entry opportunity. Of course, what happens next is entirely in the market's hands.

By Kaye Lee, private fund trader and head trader consultant, StraightTalkTrading.com