Westlake Chemical (NYSE:WLK) stock looks promising at the moment. The chemical maker has seen its shares rise roughly 10% year to date. We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

What’s Working in Favor of Westlake Chemical?

Upbeat Q1 & Outlook: Westlake Chemical’s profits rose around 12% year over year to $138.2 million or $1.06 per share in the first quarter of 2017. The bottom line was supported by increased selling prices for key products and contributions of Axiall acquisition. Adjusted earnings for the reported quarter were $1.26 per share, comfortably beating the Zacks Consensus Estimate of 80 cents.

Westlake Chemical raked in revenues of $1,942.6 million, up around 99% year over year. Sales were driven by higher sales volumes for major products and increased selling prices for caustic and North American polyvinyl chloride (“PVC”) resin. Revenues also surpassed the Zacks Consensus Estimate of $1,765 million.

Westlake Chemical said that it is seeing strong global demand for its key products. It expects favorable demand trends for all of its major products, including chlor-alkali, to continue through the balance of 2017. Moreover, the company benefited from higher prices in the first quarter and expects to see full benefit of price increases in the second quarter.

The company is also making a good progress in integrating the acquired Axiall business and is working towards achieving the expected synergies in 2017. The acquisition has created a leading player in Vinyls and Olefins in North America. Westlake Chemical expects to achieve synergies and cost savings of roughly $120 million this year.

Solid Rank & VGM Score: Westlake Chemical currently has a Zacks Rank #2 (Buy) and a Value Growth Momentum Score (VGM Score) of ‘B’. Our research shows that stocks with a VGM Score of ‘A’ or ‘B’ combined with a Zacks Rank #1 (Strong Buy) or #2, offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

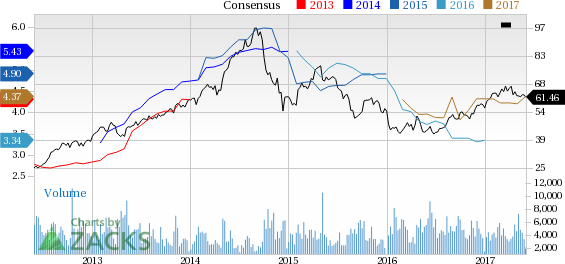

An Outperformer: Westlake Chemical has outperformed the Zacks categorized Chemicals-Plastics industry over a year. The company’s shares have rallied around 36.4% over this period, compared with roughly 7.9% gain recorded by the industry. The company is benefiting from healthy demand for olefins and vinyls products.

Estimates Northbound: Annual estimates for Westlake Chemical have moved north over the past 60 days, reflecting analysts’ confidence on the stock. Over this period, the Zacks Consensus Estimate for 2017 has increased by around 3.6% to $4.37 per share. The Zacks Consensus Estimate for 2018 has also moved up 0.4% over the same timeframe to $4.60.

Positive Earnings Surprise History: Westlake Chemical has an impressive earnings surprise history. The company has outpaced the Zacks Consensus Estimate in three of the trailing four quarters, delivering a positive average earnings surprise of 24.11%.

Healthy Growth Prospects: The Zacks Consensus Estimate for earnings for 2017 is currently pegged at $4.37, reflecting an expected year-over-year growth of 12.8%. The stock also has a long-term (3 to 5 years) expected earnings per share growth rate of around 7.2%.

Other Stocks to Consider

Other top-ranked stocks in the chemical space include Huntsman Corporation (NYSE:HUN) , BASF SE (OTC:BASFY) and The Chemours Company (NYSE:CC) , all sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Huntsman has an expected long-term earnings growth of 7%.

BASF has an expected long-term earnings growth of 8.6%.

Chemours has an expected long-term earnings growth of 15.5%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >>

BASF SE (BASFY): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Original post

Zacks Investment Research