Internet companies are delivering innovative solutions to address evolving consumer preference, which is driven by the need for convenience and easy accessibility. This boosts the business prospects of Internet companies. Also, improving Internet speed, rapid adoption of 4G Volte technology and accelerated deployment of 5G technology — the next-generation of wireless connectivity — are tailwinds.

Moreover, growth in digital advertising, rapid adoption of online payment methods, cloud computing and cloud-based gaming and expanding online delivery modes are some major catalysts.

The optimism surrounding Internet stocks is reflected in the robust year-to-date performance of Invesco NASDAQ Internet ETF (PNQI), which has rallied 23.6% compared with the S&P 500’s growth of 19.3%.

Promising Initiatives to Expand User Base

Internet-based companies have seamless access to a wealth of information provided by users. This helps them to integrate AI, ML and deep learning into their solutions. Moreover, real-time analysis of user data supported by AI tools is helping advertisers target the right audience, which is boosting their return on investment.

Additionally, focus on video streaming has been driving user engagement that is attracting advertising dollars.

Moreover, transition to SaaS-based (or Software as a Service) applications boosts growth prospects of Internet-based companies. Notably, demand for cloud infrastructure monitoring, web-based application performance management, human capital management (HCM) and cyber security software has been on the rise.

Furthermore, social media platforms are coming up with e-commerce verticals. This is enabling Internet-based companies like Facebook (NASDAQ:FB) to tap new opportunities and expand their total addressable market.

These initiatives are enabling Internet companies to expand their user base and realize business goals.

Winning Criteria

With the help of our Zacks Stock Screener, we have picked five Internet-based stocks that possess strong fundamentals. Each of these stocks has a market cap of more than $5 billion, which makes them less vulnerable to economic slowdown.

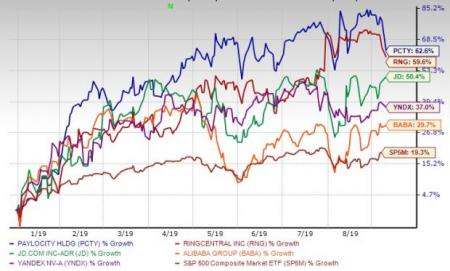

Moreover, each of the stocks has outperformed the S&P 500 year to date and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Year-to-Date Price Performance

5 Top Picks

China’s e-commerce giant, Alibaba Group (NYSE:BABA) is benefiting from steady improvement in core commerce and cloud businesses. The company has a market cap of $452.34 billion.

The company delivered average positive earnings surprise of 19.4% in the trailing four quarters. The Zacks Consensus Estimate for fiscal 2020 earnings has been revised 7.2% upward in the past 60 days to $7.19, indicating growth of 25.7% from the year-ago reported figure.

Another China-based e-commerce player, JD.com (NASDAQ:JD) is benefiting from robust e-commerce business, improving logistics services and supply chain management system. The company has a market cap of $37.9 billion.

Notably, JD.com pulled off an average positive earnings surprise of a whopping 186.4% in the trailing four quarters. Moreover, the consensus estimate for current-year earnings has been revised 27.9% upward in the past 60 days to 87 cents. The figure suggests year-over-year growth of 155.9%.

Yandex (NASDAQ:YNDX) is based in Schiphol, the Netherlands. The company’s core search business and increasing online advertising revenues are key catalysts. Also, solid momentum across Taxi, Classifieds, Media Services and Experiments segments is expected to aid growth. The company has a market cap of $12.17 billion.

The consensus estimate for current-year earnings has remained stable in the past 30 days at $1.38. The figure implies year-over-year growth of 45.3%.

Belmont, CA-headquartered RingCentral (NYSE:RNG) is benefiting from robust adoption of its cloud-based unified communications solutions among digitally transforming enterprises. The company’s strength in delivering services with integrated video, voice, team messaging, in a unified experience holds promise. The company has a market cap of $10.92 billion.

RingCentral pulled off an average positive earnings surprise of 22.8% in the trailing four quarters. Moreover, the current-year earnings estimate has been revised 6.8% upward in the past 60 days to 78 cents. The figure indicates increase of 1.3% on a year-over-year basis.

Schaumburg, IL-based Paylocity (NASDAQ:PCTY) is riding on higher uptake of its HCM products among clients with less than 50 employees.

The company has a market cap of $5.2 billion and delivered average four-quarter positive earnings surprise of 9.4%. The company’s long-term earnings growth rate is currently pegged at 20%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Yandex N.V. (YNDX): Free Stock Analysis Report

Paylocity Holding Corporation (PCTY): Free Stock Analysis Report

Ringcentral, Inc. (RNG): Free Stock Analysis Report

Original post

Zacks Investment Research