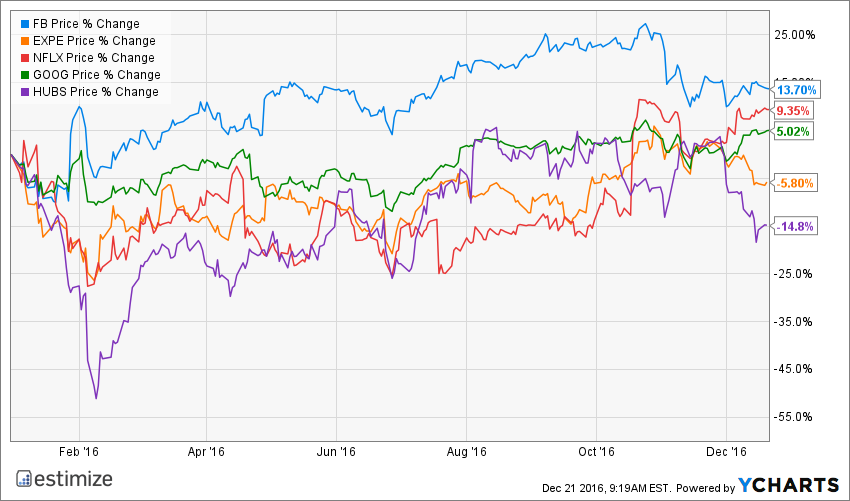

Earnings season can be a difficult time to play the market. Today’s companies are not only expected to consistently top analyst’s estimates, but also issue strong forward guidance. Only then will the stock edge higher and even that’s not guaranteed. For this reason, many investors chose to avoid playing the market during peak reporting weeks. But that doesn’t mean it’s impossible to beat the proverbial earnings game. According to the Estimize data, 5 stocks standout as the most likely to pop following their fourth-quarter reports; Facebook, Expedia, Netflix, Google and Hubspot. These stocks have both short-term catalysts and long-term potential that have propelled share prices in recent quarters.

Facebook | Information Technology | Internet Software & Services

Facebook (NASDAQ:FB) remains an earnings-season favorite as key metrics continue to grow at a rapid clip. In the second quarter, the social network posted 1.8 billion monthly active users of which 1.18 billion visited on a daily basis. To put this in perspective, Twitter's (NYSE:TWTR) monthly user metrics came in just above 300 million. With its user base growing somewhat organically at this point, Facebook can focus its attention on monetizing Instagram, Whatsapp, Facebook Messenger and Oculus Rift. The former three currently boast a robust user base that should easily attract a huge chunk of advertising revenue. Oculus, on the other hand, hit store shelves earlier this year but should start making waves in a rapidly growing VR market. Historically, the stock breaks out during earnings season, rising about 4% immediately through an earnings report. Unfortunately Facebook was front and center of two huge scandals this quarter; disseminating fake news and miscalculating video metrics. The impact of each event remains to be seen but it wouldn’t be surprising if ad revenue comes in a bit light this quarter.

Expedia | Consumer Discretionary | Internet & Catalog Retail

After a volatile first half of the year, Expedia (NASDAQ:EXPE) surprised investors with an impressive third quarter. The online travel agency posted a 16% increase on the bottom line and 33% on the top, with sales exceeding analysts expectations. Travel trends improved throughout the quarter largely thanks to ongoing promotional and discounting activity. Additionally Expedia’s efforts to consolidate the travel market through acquisitions helped support strong traffic trends. The purchase of Homeaway earlier this year provides Expedia with an entry into the fast growing sharing economy. Meanwhile, financial performance is less prone to currency headwinds as the company operates largely in North American markets. Given the improvements in the travel industry, Expedia looks poised to put on a repeat performance in the fourth quarter. Historically the stock rises by 4% after the print and up to 2% in the month following.

Netflix | Consumer Discretionary | Internet & Catalog Retail

If not for NVIDIA (NASDAQ:NVDA), analysts would be touting Netflix (NASDAQ:NFLX) as one of the best Q3 earnings plays. The video-streaming service pulled out quite the surprise in the third quarter, beating analysts expectations on both the top and bottom line. Most of the gains came from a blowout subscription number, which gained 370,000 net members in the U.S. and 3.2 million internationally, handily beating the 2.3 million management forecasted. Netflix’s steady stream of original content and new initiatives like an offline option will continue to provide support to the top line. But the cost of rolling out new content will put pressure on the bottom line. Revisions activity following the report unsurprisingly edged higher for the fourth quarter. The Estimize community is now looking for earnings of 14 cents per share on $2.47 billion in revenue, reflecting a 74% increase on the bottom line and 34% on the top. Historically the stock drives higher by 3% immediately after the print and about 6% in the 30 days following.

Google | Consumer Discretionary | Internet & Catalog Retail

Google (NASDAQ:GOOGL) is still an early favorite to topple fourth-quarter earnings thanks to the ongoing success of its search business but also new initiatives like Google Home, Pixel Smartphone and the Daydream View, its newest virtual reality headset. It now looks like many of its moonshot projects are living up to their lofty expectations. The Google Home and Pixel Smartphone step on the toes of its predecessors like Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL), which offer comparable products. Google is also working on developing a more comprehensive smartwatch and deploying a fleet of driverless cars, both of which will propel earnings potential. Still the stock has failed to keep pace with the broader market this year. Shares are up 5% year to date while the S&P 500 has jumped by nearly 12%. Fortunately for investors, the stock consistently jumps during earnings season. Historically, shares climb 2% immediately through an earnings report but tend to fall in the days and months after.

Hubspot | Information Technology | Software

HubSpot (NYSE:HUBS) continues to astound investors during earnings season, topping expectations in each of its publicly reported quarters. But the combination of decelerating revenue growth and mounting losses has taken its toll on the stock. In the past year, shares plunged by 11% , most of which came outside of earnings season. During the earnings period, shares historically jump by 7% and make a second considerable leap of 15% in the 30 days following a report. Fortunately, Hubspot is still one of the most well-regarded marketing automation tools and a great alternative to Salesforce.com (NYSE:CRM) or Marketo. Its track record for success around its report date can be leveraged into large gains if played correctly.

How do you think these names will report?