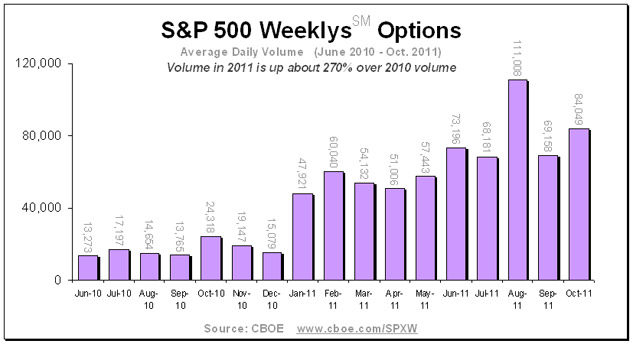

In addition to the variety of monthly contracts available, many underlying stocks are beginning to offer weekly options. These weekly options can be employed in various trading strategies to manage both the theta and delta risk associated with options expiration. Overall, the growth in weekly options can provide a richer strategy platform that should not be overlooked.

Differences Between Weekly & Monthly Options

Before discussing the various trading strategies that can be build with weekly options, it is important to go back and review some of the more important trading terms. Remember that weekly options are different in that they have a much shorter lifespan. Most of these weekly options start trading on Thursday and expire the following Friday. This provides uniformity and also allows traders to easily “roll” weekly options from one expiration to another.

Four Strategies You Can Use

1) An investor can use weeklies as a pure play. Because they do not remain open as long, the may involve somewhat less risk, but it is important to consider liquidity constraints, as many weeklies have smaller markets. The lower risk of a shorter holding period is lost if the instrument is illiquid and the investor cannot trade the position when needed.

2) Offsetting positions can be taken at certain times during the month between weeklies and monthlies. When the options expiration of the monthly contract is nearly identical to the expiration of the weekly option, there may be a price difference that can be captured between the two.

3) You could take a position in the monthly contract and take rolling positions in the weekly contract in the opposite direction. The idea is to establish a consistent hedge against short term market volatility but make sure that you factor in the higher transaction costs for getting in and out of the market more often.

4) The last approach to using weekly options is to use them to supplement income from an underlying position. This is often called a call writing strategy because the investor who owns the underlying instrument writes calls on that position and collects the premium. If the underlying remains static or falls, the investors makes a profit or mitigates losses. If the underlying rises, he or she may miss some of the profit, but the downside protection is used to justify this risk.

What About Trading Daily Options?

Rumors have been floating around the web about the possibility of daily options as the next logical product for traders. We already had monthly options and weekly option popularity is growing fast. Add your comments below and let me know if you would ever trade a daily option that started trading in the morning and expired that same afternoon.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

4 Ways You Can Trade Weekly Options In Your Portfolio

Published 01/12/2012, 01:33 AM

Updated 07/09/2023, 06:31 AM

4 Ways You Can Trade Weekly Options In Your Portfolio

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.