After failing to grab investors’ attention for quite some time, Lululemon Athletica Inc. (NASDAQ:LULU) seems to have gained traction. The stock, which slipped to a 52-week low in May, posted upbeat performances in the past two quarters on strategies like ivivva’s remodeling and focus on e-commerce among others. Notably, this yoga-apparel company has surged 22.4% in the past six months, surpassing the industry’s 9.9% growth.

Let’s take a detailed look at the factors that are likely to keep driving this Zacks Rank #2 (Buy) stock’s momentum.

Progress on Ivivva’s Remodeling Bodes Well

Lululemon is on track with the remodeling of its iviva business into an online brand, as announced in June. As part of the plan, Lululemon is likely to develop ivivva, its activewear brand, into an e-commerce focused business, with only eight iviva stores operating across North America. Notably, this strategy will enable the company to continue offering the brand to young patrons globally. While the company expects to incur restructuring costs for this move throughout fiscal 2017, it anticipates the strategy to be accretive to the company’s productivity, comps and earnings.

E-commerce & Supply Chain Initiatives Drive Results

Lululemon is strongly focused on enhancing the e-commerce retailing channel and investing in the innovation of new product categories and bringing improvements to its website. Driven by these efforts, the company witnessed a 30% surge in constant dollar e-commerce comps in second-quarter fiscal 2017. The company further stated that it envisions tremendous potential in this business going forward. Also, Lululemon’s supply chain initiatives are on track, which also aided the company’s product margins over a year.

International Growth Resonates With Strategy for 2020

Lululemon has been progressing well with its goals for 2020, by which the company aims to double its revenues to about $4 billion and more than double its earnings. To achieve these targets, management outlined four distinct growth strategies, including product innovation, building store fleet in North America, expanding digital business and international expansion. While the aforementioned strategies resonate well with Lululemon’s 2020 targets, the company is firing on all cylinders with regard to international expansion as well.

Incidentally, Lululemon remains committed toward expanding operations outside the United States and Canada, particularly in the underpenetrated European and Asian markets. Notably, the company’s brand momentum grew manifold in the Asian market in the second quarter, primarily backed by spectacular Chinese performance. In Europe too, the company envisions significant growth opportunity driven by solid market growth in the second quarter. Backed by this optimism, the company plans to expand international base with the opening of 15 new stores in fiscal 2017. Further, it expects to generate $1 billion revenues from international locations in the next few years.

Back-to-Back Positive Surprises, Outlook Boosts Estimates

The impact of these endeavors is visible in Lululemon’s recent performance, and encouraging outlook. Incidentally, the company delivered robust numbers in second-quarter fiscal 2017, wherein both sales and earnings topped estimates and improved year over year. While the bottom line marked its second consecutive beat, the top line recorded its seventh straight quarter of positive surprise. Results were driven by consumers’ favorable response to Lululemon’s product innovations, superb e-commerce performance, international growth and strength in the men’s category.

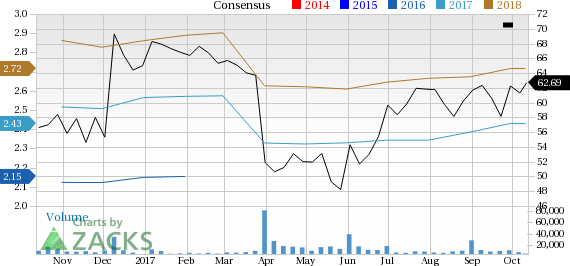

The solid second quarter and favorable third-quarter trends make management confident of generating revenues of $4 billion by 2020. These factors also encouraged Lululemon to raise fiscal 2017 outlook. Analysts were also not far behind in raising the estimates. Over the past 60 days, the Zacks Consensus Estimate for fiscal 2017 and 2018 increased to $2.43 and $2.72 from $2.34 to $2.67, respectively. Given these splendid strategies and an impressive outlook, we believe that there is no looking back for Lululemon.

Looking for Similar Bets? Check These 3 Stocks From Lululemon’s Space

Crocs, Inc. (NASDAQ:CROX) , with a long-term earnings per share growth rate of 15%, sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

G-III Apparel Group, Ltd. (NASDAQ:GIII) flaunts the same Zacks Rank and long-term growth rate as Crocs.

Guess', Inc. (NYSE:GES) with long-term growth rate of 17.5%, also flaunts a Zacks Rank #1.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

lululemon athletica inc. (LULU): Free Stock Analysis Report

Guess?, Inc. (GES): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post

Zacks Investment Research