For the last week, market participants have been adding to their stock risk. The activity seems to fly in the face of how markets tend to react to significant uncertainties like the fiscal cliff.

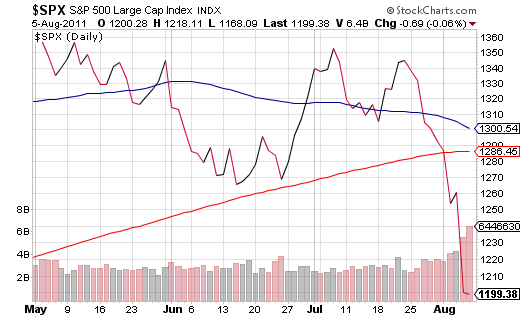

While many expect a financial deal to get done, the market’s collective calm is reminiscent of the debt ceiling stalemate of 2011. Stocks pulled back in May and June of last year, then rallied back in July. Investors expected that cooler heads in the U.S. Congress would prevail. When they didn’t, stocks collapsed in late July-early August.

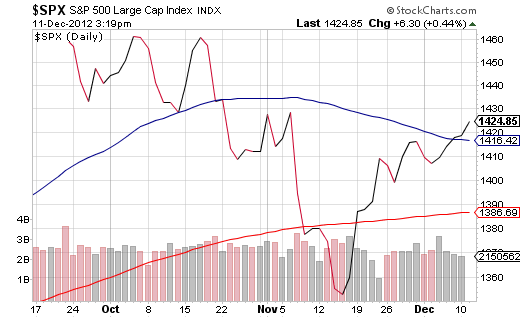

Nearing the end of 2012, the S&P 500 is currently presenting a very similar pattern to the one that we witnessed in 2011. In fact, the only thing missing is the monstrous finale where negotiations fall apart completely.

Could the present equanimity turn ugly on yet another botched political impasse? The prevailing wisdom today is that U.S. leaders learned their lesson from the previous go-around. And to be frank, it is difficult to imagine any other scenario than one where Republicans acquiesce on taxes and Democrats allow for a small amount of spending cuts.

However, the wisdom of commentators as well as the markets themselves may be tested in the days ahead. For one thing, Boehner and Reid are publicly stating that an agreement is unlikely to come by Christmas. This means that investors will need to rely on the proverbial 11th-hour arrangement. Expect some itchy trigger fingers to pursue additional tax-related trading.

What’s more, these are the same leaders that faltered in the 2011 negotiations. As days continue to pass without tangible progress, will the “risk-on” crowd find itself changing its collective heart? Once bitten (2011), twice shy (2012)?

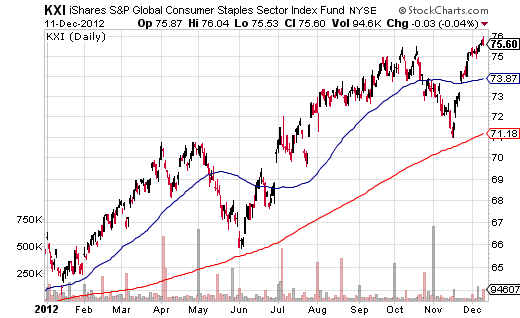

My guidance is to remain relatively defensive. This doesn’t mean abandoning the markets when key indices are above 50-day and 200-day moving averages. What it means is, profit from sectors that hold individual companies with competitive leverage.

For instance, consumer staple stalwarts — Procter & Gamble (PG), Heinz (HNZ), Hershey (HSY), General Mills (GIS) — are individually thriving. Consider a non-cyclical sector ETF like PowerShares Dynamic Consumer Staples (PSL) or iShares S&P Global Consumer Staples (KXI). Both exhibit strong technical uptrends and both are less sensitive to recessionary pressure in the global economy.

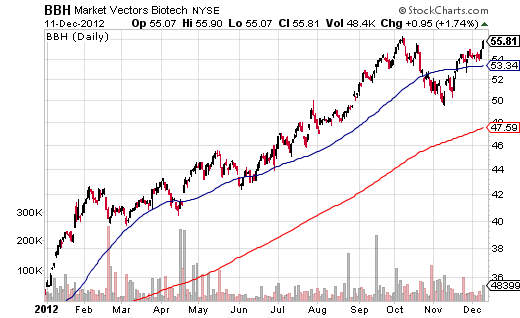

If you’re willing to take on a bit more beta risk, biotechnology stocks continue to show enormous staying power. Amgen (AMGN), Celgene (CELG) and Gilead (GILD) individually hit new 52-week highs on Tuesday, 12/11. Meanwhile, the exchange-traded funds that hold these brand-name biggies — Market Vectors Biotech (BBH) and iShares NASDAQ Biotech (IBB) — are benefiting from the biotech share price surge.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2 ETF Sectors Profiting From Individual Stock Trends

Published 12/12/2012, 05:20 AM

Updated 03/09/2019, 08:30 AM

2 ETF Sectors Profiting From Individual Stock Trends

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.