1Spatial's (LON:SPA) agreed €7m acquisition of Geomap-Imagis (GI) provides further evidence that it is executing on its transition plan. Aside from enhancing its capability, market presence and scale, it also addresses the challenges it faces in France and Belgium. Combining its Elyx product with GI’s Esri platform here should stabilise performance and enable greater focus on sector-specific solutions. We will revisit forecasts for the combined entity more thoroughly after results next week but expect the deal to be significantly earnings accretive.

Acquisition of Geomap-Imagis for €7m

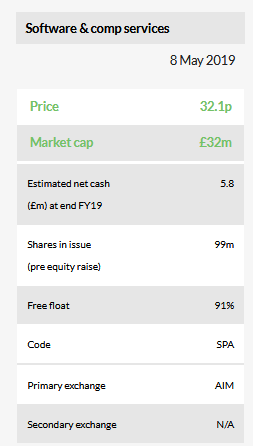

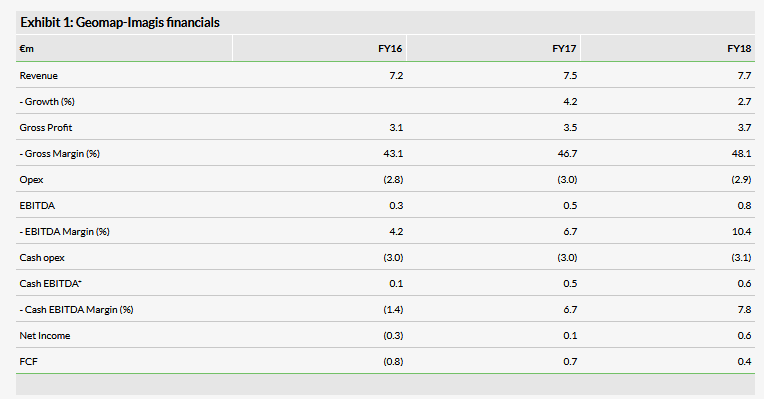

Based in Nimes, France, GI provides geospatial solutions in four verticals (transportation, government, utilities and facilities) primarily based on Esri’s ArcGIS platform. In 2018 it reported €7.7m revenue (up 3% y-o-y) and an adjusted EBITDA margin of 10%. 1Spatial is paying €7m to acquire the business, €5.8m in cash and €1.2m in shares. Adjusting for GI’s €1.9m in net cash, the EV of €5.1m (£4.3m) implies a 0.7x sales and 6.4x EBITDA multiple. 1Spatial’s existing customers in France and Belgium, which currently use its proprietary Elyx GIS (Geographic Information System), will have the option to migrate onto the ArcGIS platform.

Strategic significance: Fixing France

Aside from enhancing its technical capability, market presence and scale, this deal aims to address the challenges 1Spatial faces in France and Belgium. Elyx struggled to compete with ArcGIS and, after the decision was taken in FY17 to shift to focus on GIS-agnostic, sector-specific solutions, the business was no longer strategically aligned with the wider group. Careful integration should ensure 1Spatial stabilises its customer base.

Impact on forecasts: significantly earnings accretive

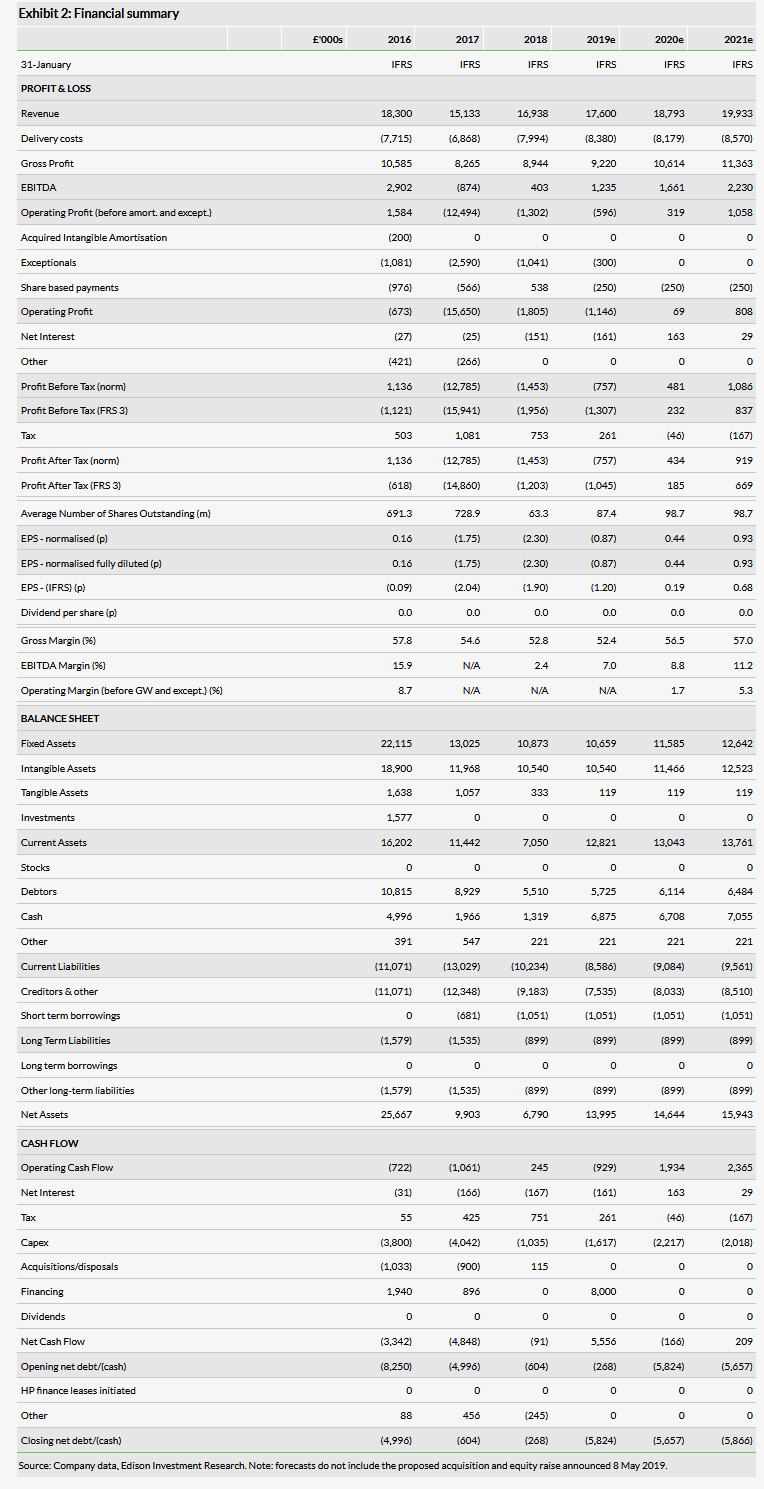

We update FY19 numbers to reflect disclosed headlines but ahead of results next week (14-May), our forecasts are unchanged. GI should increase revenues by over 30% and be significantly earnings accretive even without any large cost savings.

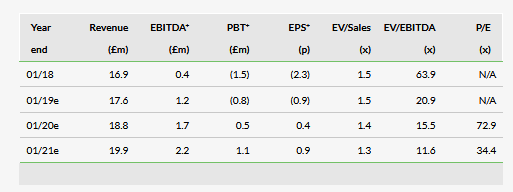

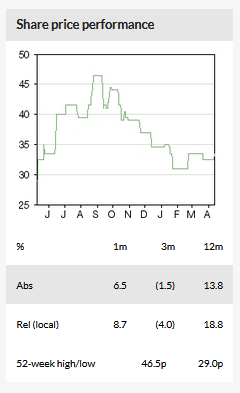

Valuation: Rating yet to reflect execution

We believe this transaction streamlines 1Spatial’s strategic focus and tackles a big drag on its growth. Currently, at 1.3x FY21e EV/sales, the rating is yet to reflect growing evidence of execution in our view. If it can deliver a sector average margin, we believe a share price of 50p, a 56% premium to the current price, is achievable.

Business description

1Spatial’s core technology validates, rectifies and enhances customers’ geospatial data. The combination of its software and advisory services reduces the need for costly manual checking and correcting of data.

Geomap-Imagis (GI): Profitable and an aligned sector focus

GI is a geospatial solutions provider based in based in Nimes, France with around 125 employees more-or-less split evenly between France and Tunisia. Its solutions include proprietary software licences, services and consultancy but are often based on Esri’s ArcGIS platform. It is an Esri Gold Partner and has significant expertise delivering tailored solutions based on this platform. It has over 500 customers spread across four verticals: government (38%), transportation (28%), utilities (20%) and facilities management (14%). As Exhibit 1 highlights, the business has been profitable and cash generative since FY17 (GI’s financial year end is 31 December), and delivered 3% y-o-y revenue growth and a 10% EBITDA margin in FY18.

Terms of the deal

1Spatial is paying €7m to acquire GI, being €5.8m in cash and €1.2m in shares. This is in phases – a total of €5.4m is payable immediately (of which €0.7m is in shares). Further payments will be phased: €0.4m cash held in escrow until the first anniversary of completion; €0.7m cash no later than 13 months after completion; and €0.4m in shares in 2023. To fund the acquisition, the group is raising £3.1m (€3.6m) through a placing of 9.9m shares at 31.5p, with an additional 1.9m issued direct to the seller (11.8m additional shares in total). Excluding the €1.9m in net cash on GI’s balance sheet, the EV of €5.1m (£4.3m) implies acquisition multiples of 0.7x sales and 6.4x EBITDA.

The integration plan

1Spatial plans to integrate GI with its existing business based in France and Belgium. This will give its existing customers on its proprietary Elyx GIS product the option to migrate to the Esri ArcGIS platform over time. Any migration will take place gradually and will be supported by Esri providing training to 1Spatial’s existing staff. Aside from GI’s CFO and CTO, who plan to retire after a six-month handover is complete, no explicit cost saving measures or targets have been announced at this point.

Significant cross-selling opportunities between the two entities should be deliverable over time. Aside from the technical expertise in ArcGIS, GI enhances 1Spatial’s capability in new sectors like facilities management and telecoms, and the Tunisia presence expands development resources. 1Spatial also has the opportunity to sell its 1Integrate and emerging location master data management (LMDM) solutions to the GI customer base.

The financial impact: significantly earnings accretive

1Spatial has also updated the commentary provided in its March trading update (see our note, Transition on track, EBITDA ‘at least in line’, published on 7 March). Ahead of the release of FY19 results on 14 May, we adjust FY19 numbers to reflect these stated figures. Revenue of £17.6m was £0.2m below our forecast, reflecting a £0.2m adjustment for IFRS 15, but EBITDA of £1.2m was marginally ahead of our £1.0m. We leave our underlying forecasts unchanged for the moment. Adding GI could boost FY21 revenue (the first full year of consolidation) by over 30% and substantially increase EBITDA even before considering the impact of cost synergies. We expect the deal to be significantly earnings accretive.

Further evidence of execution

We see this transaction as a significant step forward for 1Spatial as it executes on its three-phase transition plan. Aside from broadening its technical capability and market presence, it has acquired a profit stream at a substantial discount to its current multiple (even without large cost savings). More significantly, it sharpens its strategic focus and tackles a big drag on its recent financial performance. Based on our existing forecasts, 1Spatial trades at 1.3x FY21e EV/sales, a substantial discount to both its small-cap UK software peers and international GIS providers. In our view, the rating is yet to reflect growing evidence of execution and improving strategic focus. Assuming the company can deliver a sector average margin, we believe a share price of 50p (based on a sector average 2.2x EV/Sales multiple) is justifiable. We will revisit our forecasts on release of final results on 14 May 2019.