Halliburton Company (NYSE:HAL) is set to report second-quarter 2016 results on Jul 20, before the opening bell.

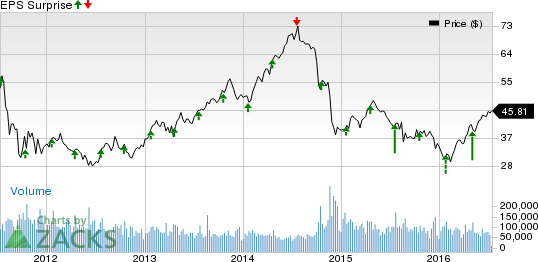

Last quarter, the company posted a positive earnings surprise of 75.00%. The trailing four-quarter average beat for the company is 42.68%. Let's see what is in store for this quarter.

HALLIBURTON CO Price and EPS Surprise

Crude Recovery May Back Q2

Houston, TX-based Halliburton is a global oilfield services provider, offering a variety of equipment, maintenance, and engineering and construction services to the energy, industrial, and government sectors. Oil field services players primarily support upstream companies that include drilling firms setting up their oil and gas wells.

Through the quarter, oil price improved significantly from mid-February when West Texas Intermediate (WTI) crude fell to a 12-year low mark of $26.05 per barrel. Moreover, last month, oil prices settled above the psychologically important $50 per barrel level for the first time in more than 10 months.

Since, the overall operation of Halliburton is positively correlated with crude prices we can say that the second quarter might come up as a blessing for the company.

However, weak oilfield service activities following lower U.S. drilling rigs are expected to hurt Halliburton.

Earnings Whispers

Our proven model does not conclusively show that Halliburton Company is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1, 2 or 3 for this to happen. That is not the case here as you will see below.

Zacks ESP: Earnings ESP represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate. This leads to an ESP of -16.67% for Halliburton as the Most Accurate estimate stands at a loss of 21 cents while the Zacks Consensus Estimate is pegged narrower at a loss of 18 cents.

Zacks Rank: Halliburton has a Zacks Rank #3 (Hold). We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing a negative estimate revisions.

Stocks to Consider

Here are some companies in the energy sector that investors may consider, as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Anadarko Petroleum Corporation (NYSE:APC) has an Earnings ESP of +11.25% and a Zacks Rank #2. The company is likely to release earnings results on Jul 26.

Legacy Reserves LP (NASDAQ:LGCY) has an Earnings ESP of +15.79% and a Zacks Rank #1. The partnership is expected to release earnings results on Aug 3.

Ring Energy, Inc. (NYSE:REI) has an Earnings ESP of +33.33% and a Zacks Rank #1. The company is anticipated to release earnings results on Aug 8.

HALLIBURTON CO (HAL): Free Stock Analysis Report

ANADARKO PETROL (APC): Free Stock Analysis Report

LEGACY RESERVES (LGCY): Free Stock Analysis Report

RING ENERGY INC (REI): Free Stock Analysis Report

Original post

Zacks Investment Research