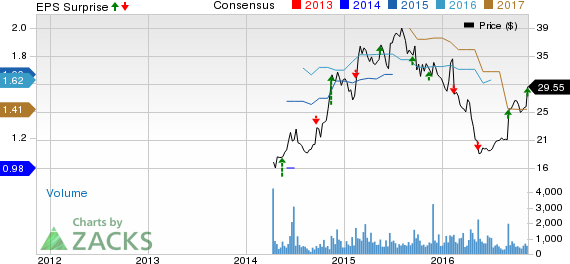

Phibro Animal Health Corporation (NASDAQ:PAHC) reported adjusted earnings per share (EPS) of 36 cents in the first quarter of fiscal 2017, up 5.8% year over year. Adjusted EPS also beat the Zacks Consensus Estimate by a penny.

Per management, sales growth and an improved gross profit ratio, partially offset by SG&A growth and a higher effective income tax rate, were the main contributors to the bottom-line improvement.

Including one-time items, the company reported EPS of 31 cents, reflecting a decline of 34% from the year-ago quarter’s 47 cents.

Net Sales

In the reported quarter, Phibro’s net sales improved 0.4% year over year to $188.0 million.

The improvement was driven by volume growth at the Animal Health segment, which was partially offset by declines in Mineral Nutrition sales.

Sales by Segments

Net sales at the Animal Health segment increased 4% to $124.5 million in the reported quarter on the back of volume increases in the nutritional specialty and vaccine product groups within the segment. Sales from vaccines increased 21%, principally on volume growth, including products acquired from MVP Laboratories, Inc. in Jan 2016. Nutritional specialty products sales rose 18%, owing to volume growth in the U.S. for Phibro’s dairy and poultry products.

On the other hand, sales at Medicated feed additives (MFAs) and Other (the biggest section of this segment) declined 2% primarily due to domestic volume declines resulting from adverse views regarding medically important antibacterials, partially offset by domestic growth in other products. International net sales declined slightly due to volatile macroeconomic conditions in Brazil, partially offset by growth in other regions.

Net sales at the Mineral Nutrition segment declined 5% to $51.6 million. Stable volumes from demand for trace mineral products were offset by lower average selling prices due to underlying raw material commodity price declines.

Net sales at the Performance Products segment declined 5% to $11.9 million on lower volumes of copper-based and chemical catalyst products and decreased average selling prices of personal care ingredients. However, higher average selling prices of copper-based products partially offset the declines.

Operational Update

Phibro’s first-quarter adjusted gross profit increased 3.4% year over year (excluding acquisition-related cost of goods sold and acquisition-related amortization) to $62.3 million. The adjusted gross margin also expanded 102 basis points (bps) to 33.1%.

Adjusted selling, general and administrative expenses increased 1.6% to $37.2 million. Adjusted operating margin expanded 80 bps year over year to 13.3% in the quarter.

Financial Update

Phibro generated $21.5 million in cash flow from operations during the first quarter compared with $2.4 million in the year-ago quarter. Capital expenditure amounted to $5.9 million in the quarter, reflecting a reduction from $8.1 million in the first quarter of fiscal 2016.

FY17 Outlook

Phibro reaffirmed its fiscal 2017 guidance. The company currently expects to generate net sales of $750–$770 million, reflecting 2% annualized growth for fiscal 2017. The current Zacks Consensus Estimate of $759.0 million for fiscal 2017 falls within the guided range.

On the bottom-line front, Phibro expects to deliver adjusted EPS in the range of $1.38–$1.45 in fiscal 2017, displaying an annualized decline of 3% to growth of 1%. The current Zacks Consensus Estimate of $1.41 for fiscal 2017 lies above the company's guided range.

Our Take

Phibro started fiscal 2017 on a promising note, with its first-quarter bottom line exceeding the Zacks Consensus Estimate and revenues expanding in low single digits on a year-over-year basis. Nonetheless, Animal Health remained the key contributing business, delivering positive growth on a year-over-year basis. The company’s strong margins are encouraging.

However, management’s reiterated guidance is quite a dampener. Segment-wise, a persistent decline in Mineral Nutrition segment sales is also likely to prove a drag.

Zacks Rank & Key Picks

Phibro currently carries a Zacks Rank #3 (Hold). Better-ranked medical stocks are GW Pharmaceuticals plc (NASDAQ:GWPH) , Baxter International Inc. (NYSE:BAX) and Bovie Medical Corporation (NYSE:BVX) . GW Pharmaceuticals and Baxter sport a Zacks Rank #1 (Strong Buy) while Bovie Medical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GW Pharmaceuticals surged 87.1% year to date compared to the S&P 500’s 6.0% over the same period. The company has a four-quarter positive average earnings surprise of 41.6%.

Baxter international rallied 27.7% in the past one year, comparing favorably with the S&P 500’s 5.9%. It has a trailing four-quarter average positive earnings surprise of 27%.

Bovie Medical recorded a 101.1% gain in the past one year, way better than the S&P 500’s 5.9%. The company has a trailing four-quarter positive average earnings surprise of 28.7%.

Zacks' Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

PHIBRO ANIMAL (PAHC): Free Stock Analysis Report

BAXTER INTL (BAX): Free Stock Analysis Report

GW PHARMA-ADR (GWPH): Free Stock Analysis Report

BOVIE MEDICAL (BVX): Free Stock Analysis Report

Original post